June 18, 2020 – Excerpts:

When Congress passed the $2.2 trillion dollar Coronavirus Aid, Relief, and Economic Security Act (CARES) in late March, lawmakers were quick to tout its egalitarian guardrails.

Unlike the 2008 bailout packages, which funneled hundreds of billions to Wall Street and padded executives already-cushy pay packages, the CARES Act was shot through with provisions that lawmakers said would ensure that federal funds actually went to those in need. Any money loaned through the new $500 billion Federal Reserve program, for example, came with oversight measures, limits on stock buybacks and caps on executive compensation.

But nearly three months after the CARES Act’s passage, none of those guardrails appear to have made much of a difference. The disbursement of the money so far has been riddled with complaints and analyses showing it has disproportionately gone to the wealthiest corporations and individuals.

“No lessons have been learned [from the 2008 bailout]—it certainly seems that way,” says Neil Barofsky, who oversaw the Troubled Asset Relief Program as Inspector General under the Obama administration. Those much-talked-about guardrails that lawmakers imposed on the $500 billion Federal Reserve program, for example, have been mostly irrelevant so far. By June 17, the Treasury had committed to spending just $222 billion, less than half of the funds it was allocated. The rest of the roughly $1.7 trillion allotted through the CARES Act was not, for the most part, subject to the same restrictions.

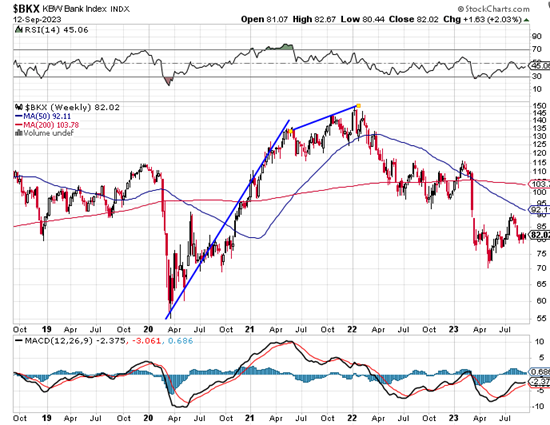

A prime example of the market sector that benefited handsomely: The KBW Bank Index showed an astounding 300% gain dating from the initial passage of the CARES Act in March 2020 through the end of 2022.

……………..

The KBW Index is slumping again in 2023, and the Fed is once again providing emergency funding.

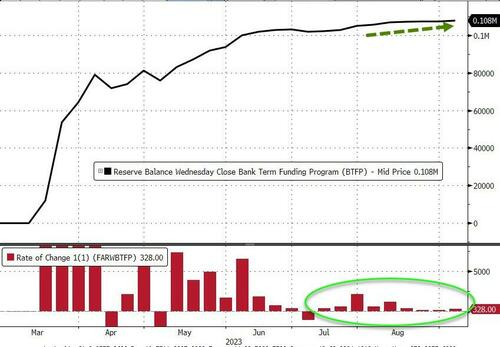

Bloomberg Sep 7, 2023 – Usage of The Fed’s emergency bank funding facility jumped by $328 Million last week to a new high of $108BN…

……………………….

The banking sector remains unsettled – Fitch “mulling over sweeping rating downgrades for dozens of banks, including ones as big as JPMorgan Chase.”

Fitch Warns Big Banks Face Downgrades

ZeroHedge, Aug 15, 2023 – Excerpts:

At the start of August, Fitch Ratings downgraded the US government’s top credit rating. Last week, Moody’s cut the credit ratings of small and midsized US banks because of higher funding costs, potential regulatory capital weaknesses, and rising risks tied to commercial real estate loans. Now, another week, another possible downgrade, this time of major banks.

Fitch analyst Chris Wolfe told CNBC another round of turmoil could be nearing for the banking industry. He said the ratings agency is mulling over sweeping rating downgrades for dozens of banks, including ones as big as JPMorgan Chase.

“Another one-notch downgrade of the industry’s score, to A+ from AA-, would force Fitch to reevaluate ratings on each of the more than 70 US banks it covers,” Wolfe told CNBC at the firm’s New York headquarters.

He continued, “If we were to move it to A+, then that would recalibrate all our financial measures and would probably translate into negative rating actions.”…

This comes one week after a triple whammy of factors of regional banks: Higher funding costs, potential regulatory capital weaknesses, and rising risks tied to CRE loans prompted Moody’s to lower credit ratings for ten small and midsize US banks; and noted in a slew of notes that it may downgrade major banks.

“Collectively, these three developments have lowered the credit profile of a number of US banks, though not all banks equally,” the ratings agency wrote in some of the assessments….

……………………..

S&P and Moody’s warn of “more pain ahead” for banks.

S&P Joins Downgrade Party Of US Banks Due To “Tough” Climate

ZeroHedge, Aug 22, 2023 – Excerpts:

Two weeks after Moody’s slashed ratings of regional banks on a ‘triple whammy of factors’, now S&P Global Ratings is joining the downgrade party. S&P is painting a grim picture for even more lenders due to higher interest rates and deposit outflows, according to Bloomberg.

S&P wrote in a research note that a “tough” lending environment forced them to downgrade five banks – KeyCorp, Comerica Inc., Valley National Bancorp, UMB Financial Corp., and Associated Banc-Corp, one notch citing negative outlooks for River City Bank and S&T Bank. The rating agency said the review of Zions Bancorp remains negative.

The reason for the downgrades is because depositors have “shifted their funds into higher-interest-bearing accounts, increasing banks’ funding costs,” S&P said, adding, “The decline in deposits has squeezed liquidity for many banks while the value of their securities – which make up a large part of their liquidity – has fallen.”

S&P’s downgrades come two weeks after Moody’s slashed the ratings on ten small and midsize banks. It cited higher funding costs, potential regulatory capital weaknesses, and rising risks tied to commercial real estate loans as the reasons for the downgrade.

“US banks continue to contend with interest rate and asset-liability management risks with implications for liquidity and capital, as the wind-down of unconventional monetary policy drains system-wide deposits and higher interest rates depress the value of fixed-rate assets,” Moody’s analysts Jill Cetina and Ana Arsov said in the accompanying research note.

Moody’s also warned there is more pain ahead: “We continue to expect a mild recession in early 2024, and given the funding strains on the US banking sector, there will likely be a tightening of credit conditions and rising loan losses for US banks.”

…………………..

Main Street America Republicans have the solution.

The Leviticus 25 Plan re-targets Fed liquidity flows in a way that will eliminate vast amounts of the ‘ground level’ debt that is strangling the U.S. economy.

It will shore up the balance banks of virtually every bank in America, large and small, by shifting troubled loans and delinquent credit card accounts back into a state of ‘currency.’

It will mitigate the ‘squeezed liquidity” and “rising loan losses” currently plaguing US banks.

It will set America back on course for a long-term economic growth cycle.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2023 (7151 downloads)