America’s government entities have a gargantuan debt problem.

The Leviticus 25 Plan has the solution.

Federal debt: $32.9 trillion

State debt: $1.27 trillion

Local debt: $2.38 trillion

Source: https://www.usdebtclock.org/

The U.S. Governmental Accountability Office

The Nation’s Unsustainable Fiscal Path

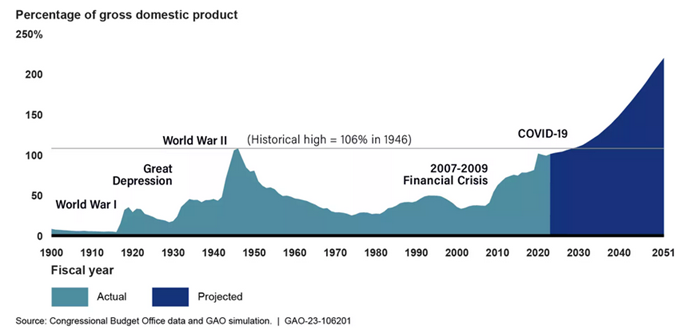

How much federal debt is held by the public — past, present, and future?

Debt held by the public is the total amount of money that the federal government owes to its investors. We compare projections of the debt (what is owed) to gross domestic product, or GDP (what is earned), to show the debt in relation to the size of the economy supporting it. Our annual report on the nation’s fiscal health, released May 2023, provides our latest projections.

At the end of fiscal year (FY) 2022, federal debt held by the public was about 97% of the GDP.

The federal deficit in FY 2022 decreased 50% from FY 2021 to $1.4 trillion—but it was still the fourth largest deficit in U.S. history. The decline is attributable to higher tax revenue and lower federal spending due to the COVID-19 pandemic. You can learn more about the current financial condition here.

_____________________________

The Leviticus 25 Plan would eliminate federal deficits and generate $619.5 billion surpluses each of the first five years of activation:

2023 Economic Scoring Update:

The Leviticus 25 Plan would reignite a powerful long-term economic growth cycle with stronger revenue growth, and it would dramatically reduce participation in state and local government entitlement programs – thereby eliminating massive amounts of state and local debt.

In many of the well-managed state and local government entities, the balance sheet gains would be sufficiently large and sustainable to allow for broad-based tax cuts.

The Leviticus 25 Plan would generate dynamic new tax revenue flows and reduce dependence on government by U.S. citizens.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2023 (7161 downloads)