Today’s Treasury auction of 20Y paper wrapped up with some “disastrous metrics.”

Higher interest payment obligations on America’s already ‘out of control’ federal borrowing means that the currently rip-roaring “interest expense” item in the annual budget deficits just got hotter…

The good news: There is a solution to this monumental fiscal quagmire…

………………………………………………………

Yields Surge After Terrible 20Y Auction With Biggest Tail o Record

ZeroHedge, Feb 21, 2024 – Excerpts:

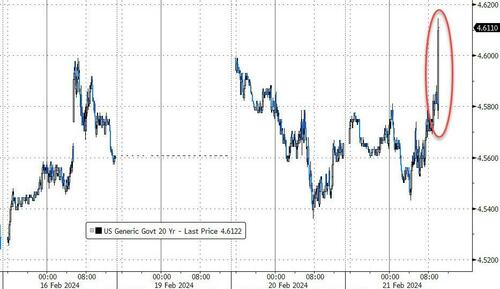

Despite some optimistic expectations (most notably from Bloomberg’s Markets Live blog) that today’s 20Y auction would “stop through with long list of positives”, moments ago the Treasury sold 20Y paper with disastrous metrics which sent yields sharply higher across the board.

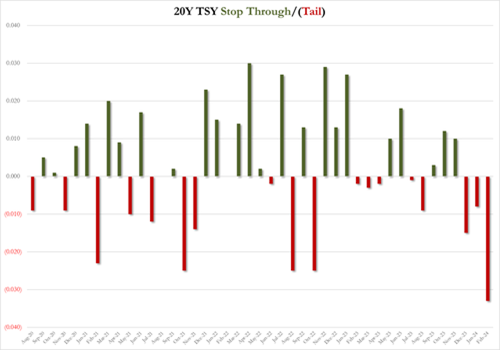

The high yield of 4.595% was well above last month’s 4.423% but worse, it tailed the When Issued 4.562% by a whopping 3.30bps, which was the biggest tail on record for the tenor since the 20Y auction was introduced in May 2020.

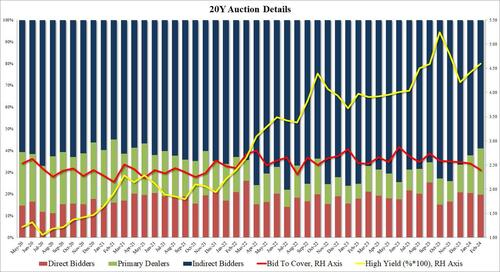

The bid to cover tumbled to 2.39, down from 2.53, well below the 2.59 six-auction average, and was the lowest since August 2022.

The internals were even uglier, with Indirects awarded just 59.08%, lower than last month’s 62.16%, sharply lower than recent average of 68.2% and the lowest since May 2021. And with Directs taking down 19.7%, Dealers were left holding 21.2%, the most since May 2021.

Overall this was a very ugly auction, despite the substantial concession thanks to the ongoing selling in rates (perhaps due to the $13.5BN in debt issuance just announced by Cisco to fund its Splunk purchase), and while it is unclear why demand was so terrible perhaps one can attribute it to nerves from today’s FOMC Minutes which however should be a non-event as they are already rather dated and do not reflect the latest reflationary spike.

In any case, yields promptly spiked with the 10Y rising as high as 4.325% before retracing some of the move, which also sent stocks sliding briefly before recovering.

_______________________________________

The Leviticus 25 Plan will generate $112.6 billion budget surpluses annually during each of the first five years of activation (2025-2029).

Which means – NO TREASURY AUCTIONS. No “disastrous metrics.” Falling interest rates. U.S. Dollar strength and stability. Long-term economic growth.

Summary Details:

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2025 (11654 downloads )