Without question, one of the principal ulterior motives involved in the Fed’s gang-buster rate hike campaign has been cranking rates up to high enough, attractive enough, levels to create strong demand for government debt at Treasury’s monthly auctions.

The Fed has stopped buying Treasuries (through back door Primary Dealer channels) and is now actually selling Treasuries from their portfolio – to begin shrinking its balance sheet (announced months ago with their QT initiative).

The Fed was well aware that ‘bidders’ would be needing sufficient ‘yield-based enticement,’ and that robust private sector demand would therein be critical for orderly Treasury auction events – perpetuating big government, specifically the Executive branch and its various agencies, and the U.S. Congress, to continue happily digging America ever deeper into debt.

Without adequate demand at the auctions, credit markets will deteriorate quickly.

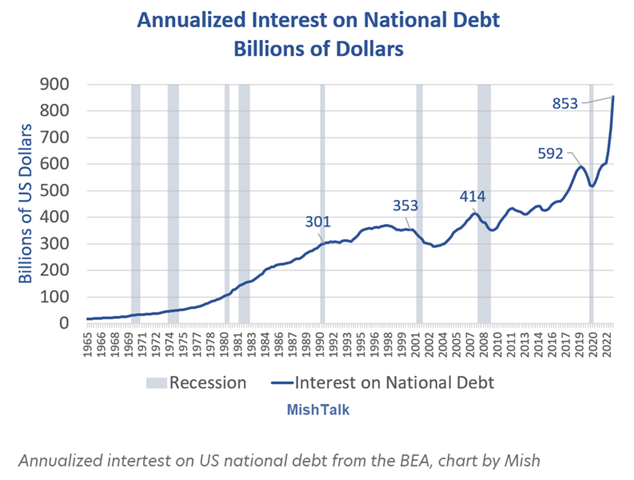

The looming problem: higher net interest costs are now getting ‘baked in’ to our ever-ballooning federal budget deficits, which will inevitably lead into U.S. Dollar instability, chaos in the foreign exchange markets and complete disorder in the credit markets. And America’s hard-working, tax-paying U.S. citizens will pay dearly when this pandemonium hits our shores.

WSJ report: National Debt, as of Jan 19, 2023 – $31.38 trillion. In the first quarter of this 2023 fiscal year, “gross interest on the national debt hit $210 billion—or $144 billion in net interest, excluding interest on Treasury securities held in government trust accounts. That’s $840 billion gross and $576 billion net on an annualized basis, up dramatically from $580 billion gross and $383 billion net in the 12 months before the economic shutdown in March 2020. This escalation doesn’t even reflect the full-year impact of the Fed’s 2022 interest-rate increases. Effective interest rate: 1.836% net; 2.677% gross

There is a true powerhouse economic solution to America’s debt crisis, one that will keep America’s financial affairs in good order. Re-targeting liquidity flows key to a dynamic resolution of this crisis:

Grant U.S. citizens with the same direct access to liquidity extensions that was so generously extended, through various credit facilities, to scores of ‘too big to fail’ financial institutions during the great financial crisis of 2007-2010, including the likes of: Morgan Stanley, JP Morgan, Goldman Sachs, Citigroup, Bank of America, Wells Fargo, State Street, Deutsche Bank, RBS, Barclays, UBS AG, BNP Paribas, and multiple others…

The key dynamic: When U.S. citizens pay down, or eliminate massive amounts of debt, the financial sector will have trillions of dollars on hand – to engage in competitive bidding at Treasury auctions, lowering interest rates, and dramatically lowering net interest projections.

The Leviticus 25 Plan – An Economic Acceleration Plan for America will generate in excess of $619 billion in annual budget surpluses in each of its first five years of activation.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2023 (5862 downloads)