Rogoff Says Biden, Trump Favor ‘Blowing Up’ US Debt – Bloomberg

Christopher Anstey | Mar 13, 2024 – Excerpts:

(Bloomberg) — Harvard University economics professor Kenneth Rogoff said both President Joe Biden and his predecessor and challenger Donald Trump risk sending US debt levels into dangerous territory as Washington fails to grasp that the era of ultra-low interest rates won’t come back.

“Washington in general has a very relaxed attitude towards debt that I think they’re going to be sorry about,” Rogoff said on Bloomberg Television’s Wall Street Week with David Westin. “It’s just not the free lunch that Congress and perhaps the two presidential candidates have gotten used to.”

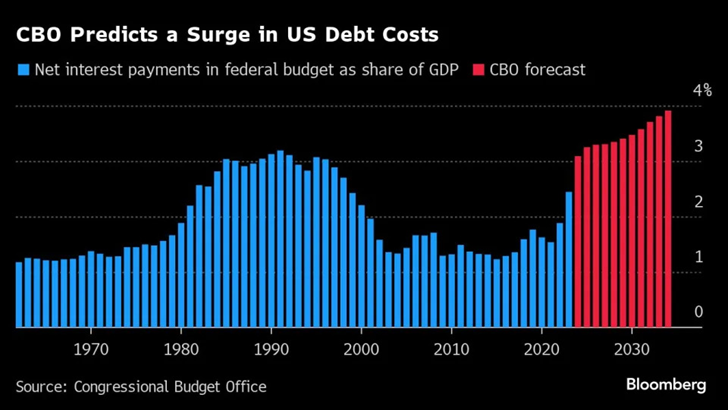

While an exact “upper limit” for the federal debt cannot be known — it’s estimated by the Congressional Budget Office to climb to 116% of US gross domestic product by 2034 from 99% today — Rogoff warned that there will be challenges as the level increases.

The former International Monetary Fund chief economist said the escalating borrowing load will create volatility in inflation and interest rates, and encourage political pressures on the Federal Reserve. Current CBO projections also leave “a lot of room for accidents” that drive debt even higher.

“You’re taking bigger and bigger risks,” Rogoff said. “We will feel that.”

Both candidates may favor policies that will drive borrowing higher, he said. “Biden’s speech suggested blowing up the debt,” he said — even after the president in his State of the Union address last week proposed tax hikes to help to pay for spending priorities.

“We have really no idea what Donald Trump will do, but that’s what he did last time he was president — good guess he will do it again,” Rogoff said, referring to widening fiscal deficits when Trump was president 2017-21.

In the post-global financial crisis era, ultra-low interest rates helped to limit the impact of US deficits. But the post-pandemic period is different, Rogoff said. The real benchmark interest rate is more likely to be 1.5% to 2% rather than 0%, he said. Fed policymakers’ most recent projections imply a real, or inflation-adjusted, policy rate of 0.5%.

______________________________________

The Leviticus 25 Plan has the raw power to eliminate America’s projected gargantuan $1.7-$2.0 trillion federal budget deficits and generate $112.6 billion annual budget surpluses.

If Mr. Trump or Mr. Biden have a better plan, or if Washington Republicans have a better plan, America is eager to see it…

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2025 (12188 downloads )

Summary Details: