The Fed may ‘talk’ about tapering and rate normalization, but there can be very little question that there will be a long succession of geopolitical ‘events,’ liquidity crises, and stagflationary pressures of various sorts which will require Fed ‘intervention’ – in the form of ‘new money creation’ and balance sheet expansion.

The Fed, along with the European Central Band, Bank of Japan, Bank of England, Swiss National Bank, and the People’s Bank of China, are feeding the flames of septic ‘disorder’ in the Foreign Exchange (FOREX) markets – in the form of wild valuation fluctuations among the world’s major fiat currencies.

Thankfully, there is a way out of this toxic mess….

…………………………………………………………………………….

Another Fed Balance Sheet Record; Where’s The Exit Door?

ZeroHedge, Jul 28, 2021 – Excerpts:

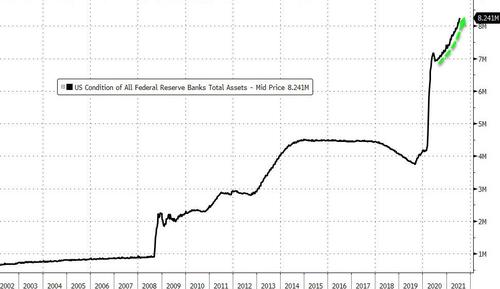

As of July 21, the Fed balance sheet stood at a record $8.24 trillion. In the previous week, the central bank expanded the balance sheet by $39 billion. In July alone, the Fed has added $162 billion to its balance sheet. The Fed can talk about tapering all it wants. The markets can expect the Fed to give up its “transitory inflation” narrative and turn to tightening all they want. But the reality is extraordinary monetary policy continues unabated.

And there’s no sign it will stop any time soon.

The Fed balance sheet has nearly doubled in just a little over one year. It stood at a mere $4.159 trillion on Feb 24, the cusp of the COVID-19 pandemic. The New York Fed projects the balance sheet will top $9 trillion before all is said and done. And I would call that projection very conservative.

In a note, Wells Fargo Institute head of global fixed income strategy Brian Rehling said even when tapering begins, it will take a long time for asset purchases to end.

While Fed tapering whispers may have started, we expect it to be long and drawn out. Once the Fed begins the tapering process, we anticipate it will be about one year before the Fed stops increasing the size of its balance sheet.”

And Rehling said he expects that even after the Fed finishes QE, the balance sheet will remain at its ending level – however high that may end up being – until at least 2025.

What happens when you pull out props? Things fall down. The moment the Fed announces substantive monetary tightening, the stock market will tank and corporate earnings will sag. We’ve seen this song and dance before.

The Fed balance grew from $898.6 billion in August 2008 to a peak of just over $4.5 trillion in Jan. 2015. The Fed didn’t get around to significantly shrinking the balance sheet until 2018. The central bankers claimed balance sheet reduction was on autopilot, but that didn’t last long. The balance sheet dipped to $3.76 trillion in late August of 2019. From there it took an upward trajectory. Although they didn’t call it quantitative easing, the Fed had already pivoted back to QE in 2019, long before coronavirus reared its ugly head. In the fall of that year, the stock market tanked. The over-indebted economy couldn’t even handle a modest move toward monetary policy normalization. Once the stock market threw its taper-tantrum, the Fed pivoted back toward loose monetary policy.

Since the onset of the pandemic, the Federal Reserve balance sheet has grown nearly twice as large as it was at its peak in the wake of the Great Recession. Debt has skyrocketed. The US government alone added more than $4 trillion to its debt-load over the last year and a half.

If history provides any indication, the notion of a serious pivot to monetary policy normalization is nothing but a fantasy.

____________________________________________

“Fantasy” becomes reality with the most powerful economic acceleration plan in the world.

The Leviticus 25 Plan will eliminate massive amounts of ‘ground level’ debt – which is the pivotal factor in getting America back on track for long-term economic growth and financial stability.

The Leviticus 25 Plan will reduce dependence on government and sharply reverse the growth of America’s socialist entitlement programs.

The Leviticus 25 Plan will generate massive tax revenue growth and produce $383 billion government surpluses in each of its first five years of activation.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2022 (3809 downloads)