Paying Americans Not to Work – Committee To Unleash Prosperity

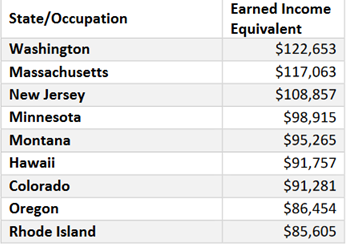

A Family of Four Can Receive over $100,000 Annualized Equivalent in Cash and

Benefits in Three States, and over $80,000 in 14 States, with No One Working

Casey Mulligan is a Professor of Economics at the University of Chicago, who served as Chief Economist at the White House Council of Economic Advisors. EJ Antoni is a Research Fellow for Regional Economics in The Heritage Foundation’s Center for Data Analysis. Both are Senior Fellows at the Committee to Unleash Prosperity.

Executive Summary

In a previous study in 2021 we estimated that with supplemental unemployment benefits of up to $600 a month, food stamp expansions, child tax credit payments, and other special Covid-related benefits to families without anyone working could exceed $120,000 in many states. Those extra benefits had a highly negative effect on employment, particularly in the states with the highest benefits.

Those temporary benefits have expired but this study finds that even with existing unemployment benefits and the dramatic recent expansion of ObamaCare subsidies, a spouse would have to earn more than $80,000 a year from a 40 hour a week job to have the same after-tax income as certain families with two unemployed spouses receiving government benefits. In these states, working 40 hours a week and earning $20 an hour would mean a slight REDUCTION in income compared to two parents receiving unemployment benefits and health care subsidies.

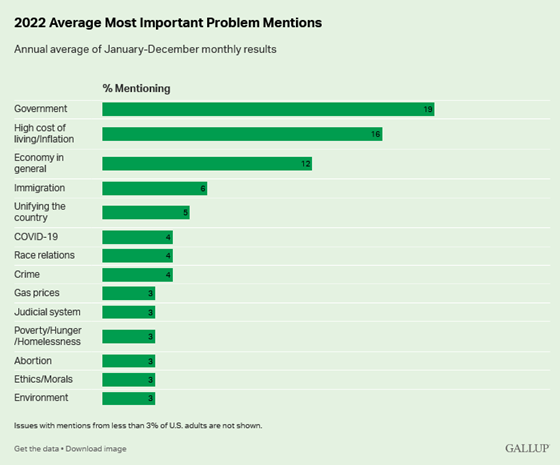

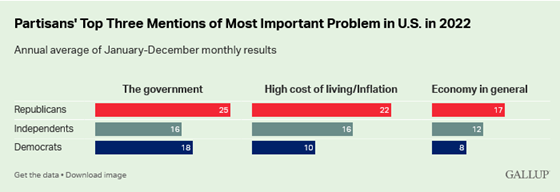

This study also finds:

• In 24 states, unemployment benefits and ACA subsidies for a family of four with both parents not working are the annualized equivalent of at least the national median household income.

• In 5 states, those two programs provide the same family with both parents not working the annualized equivalent of at least the national median household income and benefits.

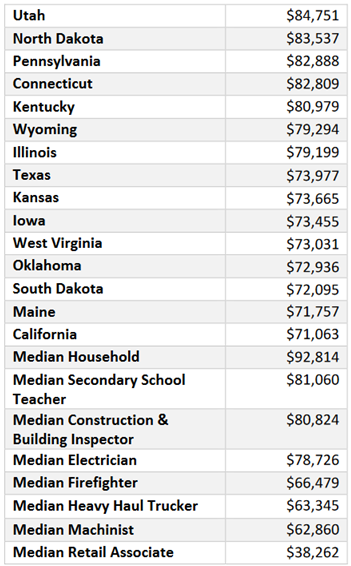

• In 14 states, unemployment benefits and ACA subsidies are the equivalent to a head of household earning $80,000 in salary, plus health insurance benefits.

• This is a higher wage than is earned by the national median secondary school teacher, electrician, trucker, machinist, and many other jobs.

• In more than half the states, unemployment benefits and ACA subsidies exceed the value of the salary and benefits of the average firefighter, truck driver, machinist, or retail associate in those states.

• In a dozen states, unemployment benefits and ACA subsidies exceed the value of the salary and benefits of the average teacher, construction worker, or electrician in those states.

• A family of four with income over $227,000 qualifies for ACA subsidies in all states and families earning over $300,000 a year still qualify for ACA subsidies in 40 states and DC.

Fig. 1: Highest Benefit States for Not Working and National Median Income Plus Benefits for Selected Occupations

Disincentive crisis: Many states pay families unemployment benefits larger than job salaries https://committeetounleashprosperity.com/wp-content/uploads/2022/12/Paying-Americans-Not-to-Work.pdf

________________________________________

America’s Main Street Republicans have a solution to these types of big-government perverse outcomes – one that will deliver a ‘helping hand’ up to a new live of debt elimination and financial security for hard-working, tax-paying U.S. citizens – rather than ongoing government handouts and debt serfdom.

This dynamic plan will generate federal budget surpluses, state budget surpluses, citizen-centered healthcare, and economic liberty for all Americans.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2023 (5516 downloads)