The GDP Number Was Great… There Is Just One Huge Problem

ZeroHedge, Jan 25, 2024

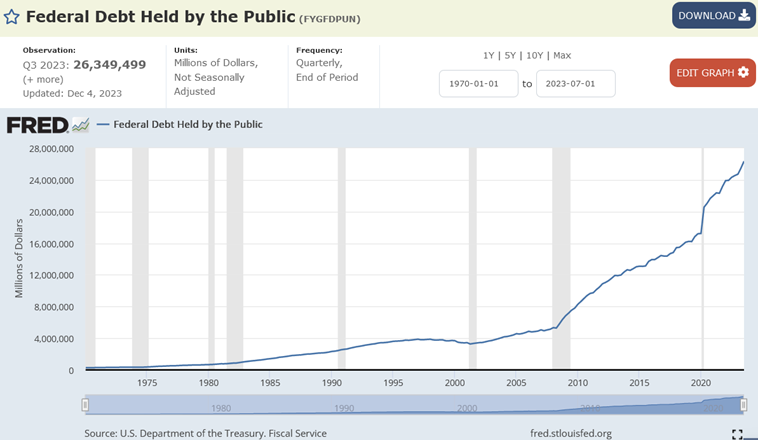

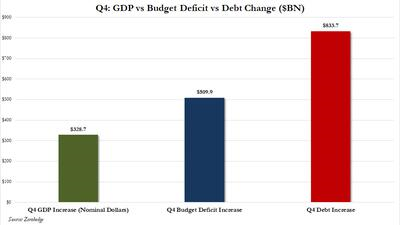

It now takes $1.55 in budget deficit to generate $1 of growth… and it takes over $2.50 in new debt to generate $1 of GDP growth!

……………………………………….

The Great Growth Hoax – ZeroHedge, Jan 28, 2024

Excerpts / Insights – Q4 GDP Report:

Peter St Onge writes it up and it is a doozy: “Fresh GDP numbers came in and it was a blowout. The kind of blowout that only a $2.7 trillion government deficit can buy while the private economy crumbles around it. Another couple blowout GDP reports like this and Americans will be living under an overpass.”

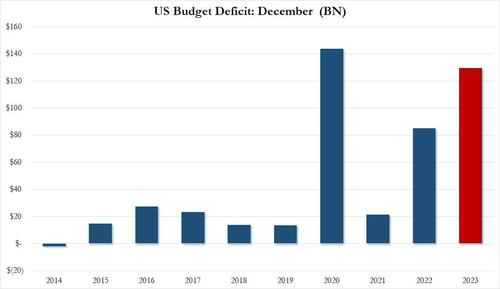

The essential ruse comes down to unfathomable amounts of government spending that is being recorded as productivity and output, and interpreted by media as growth. “In the past 12 months the federal deficit increased by $1.3 trillion. Yet we only got half that in GDP—about $600 billion. In other words, everything else shrank. It’s even worse for that brave and stunning Q4—there we got just $300 billion in extra GDP for—wait for it—$834 billion of new federal debt.”

To put a fine point on it: “Essentially, [GDP is measuring] the pace at which we’re going Soviet, replacing private wealth with government waste.” In his interpretation of the data, we are destroying wealth at the fastest rate since 2008.

An analysis by ZeroHedge echoes the same thought.

“While Q4 GDP rose by $329 billion to $27.939 trillion, a respectable if made up number, what is much more disturbing is that over the same time period, the US budget deficit rose by more than 50 percent, or $510 billion. And the cherry on top: the increase in public US debt in the same three month period was a stunning $834 billion, or 154 percent more than the increase in GDP. In other words, it now takes $1.55 in budget deficit to generate $1 of growth… and it takes over $2.50 in new debt to generate $1 of GDP growth!”

To further the analysis, and doing the math: “[E]very dollar in GDP growth cost $1.69 in new debt, and also means that every new job cost future generations of Americans $957,100.48.”

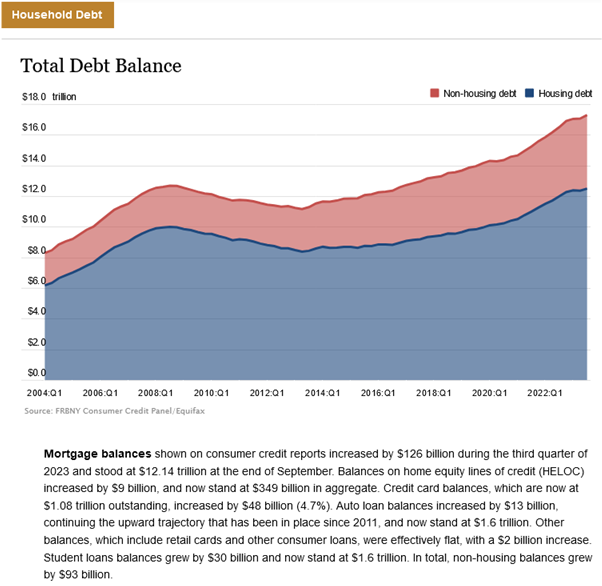

To say this is unsustainable is more than obvious. It is a disaster and this is dragging American prosperity into the pits, if by prosperity you mean quality of life. No matter how many gizmos to which you have access, the resources for living a good life are depleting very fast. The idea of a one-income family is nearly extinct, whereas it was the norm three-quarters of a century ago…

The United States has been the world center of technological innovation during these years, and the historical home for free enterprise and entrepreneurship. We should have had the greatest boom times in our history! Instead, government stole all that energy for itself. It’s a tragedy…

On the good side, we are seeing the evaporation of trust in media, medicine, academia, and government. Large media organizations are laying off workers in droves just to survive, and the woke agenda generally seems on the ropes.

________________________________________

Again: “To say this is unsustainable is more than obvious. It is a disaster and this is dragging American prosperity into the pits, if by prosperity you mean quality of life. No matter how many gizmos to which you have access, the resources for living a good life are depleting very fast. The idea of a one-income family is nearly extinct, whereas it was the norm three-quarters of a century ago.”

Washington Democrats are feeding America’s debt-binged economic decline.

Washington Republicans have no credible counter-plan to get America’s mushrooming debt cycle back under control and get the U.S. economy back on track. This is one of the most shameful episodes in the history of the GOP.

Main Street America Republicans do have a plan…

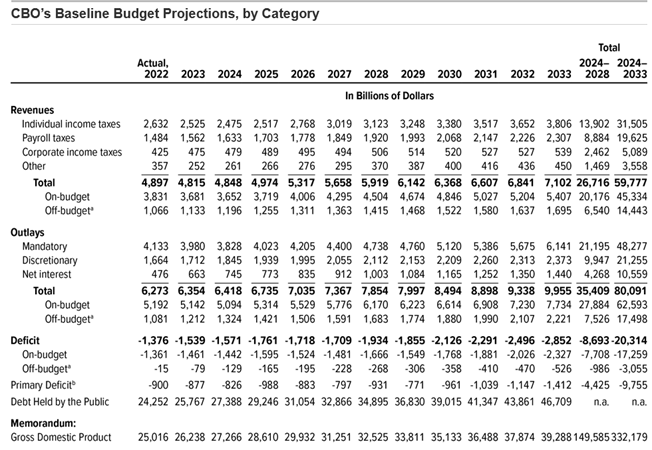

The Leviticus 25 Plan will generate average annual budget surpluses of $112.6 billion in each of its first five years of activation (2025-2029) vs current CBO-projected average annual deficits of $1.795 trillion for the same period.

This represents an astounding $1.9 trillion positive budget gain annually (2025-2029) for the U.S. federal budget.

Summary Details:

______________________________________

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2025 (11474 downloads )