The U.S. Congress and the U.S. Federal Reserve have not formalized a strategy to rejuvenate the U.S. economic system, promote economic liberty, and preserve the strength and stability of the U.S. Dollar.

Why? They literally have no strategy.…

The formalized policies of the U.S. Congress and the various agencies they have empowered include:

- Unmitigated deficit spending;

- Expanding the social welfare system and increasing government control over the daily affairs of U.S. citizens;

- Over-regulating / handicapping the free market system in America;

- Funding and facilitating special interest groups that are openly hostile to American values and the American dream;

The formalized policies of the U.S. Federal Reserve include:

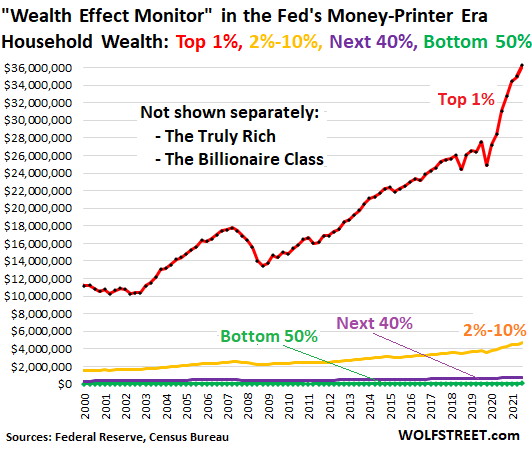

- Expanding its balance sheet to fund (directly and indirectly) the federal government’s voluminous deficit spending proclivities;

- Creating various credit facilities to transfuse Wall Street financial institutions (domestic and foreign) with trillions of dollars in liquidity extensions and credit guarantees to disentangle them from leveraged speculation and failed financial innovation schemes, mothballed risk management protections, credit-rate shopping sprees, counter-party defaults, and doomed predatory lending rackets;

- Rewarding the Fed’s Primary Dealers with ongoing special access to liquidity lines which are minimally beneficial to the economic health of U.S. citizens and main street America.

The Leviticus 25 Plan will correct these glaring distortions in our economic system through:

- Granting U.S. citizens the same direct access to liquidity that was provided by the Federal Reserve to major banking institutions like Morgan Stanley, JP Morgan, Goldman Sachs, Bank of America, Citigroup; AIG, Merrill Lynch, Bear Stearns, State Street, Barclays, RBS, Deutsche Bank, UBS, BNP Paribas, HSBC, and many others during the great financial crisis (2007-2012);

- Facilitating massive debt elimination for American families;

- Generating $583 billion federal budget surpluses for the first five years of activation (2023-2027);

- Paying for itself entirely over a 10-15 year period;

- Revitalizing a citizen-centered health care system in America;

- Reigniting long-term productive economic growth;

- Providing the framework for long-term strength and stability in the U.S. Dollar;

- Restoring economic liberty and free market economics in America;

- Putting America squarely back on track for long-term financial health and prosperity for all U.S. citizens;

- Helping to keep America free of corrupting and dangerous financial entanglements that threaten our national sovereignty.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2023 (4060 downloads)