America needs a new, outside-the-box plan to deal with this ticking time bomb..

………………………………………………………………….

One Bank Spoils The Party, Reminds Traders We Are This Close To The “Breaking Point”

ZeroHedge, Apr 5, 2021 – Excerpt:

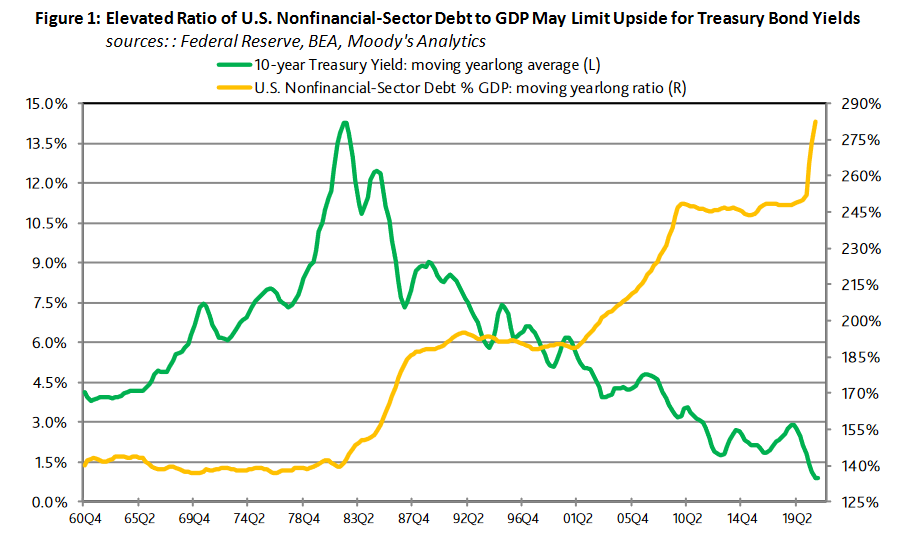

“… the only question is how much longer with this yield stability persist. Because if Deutsche Bank rates strategist Steven Zeng is correct, the next move higher in yields is on its way.

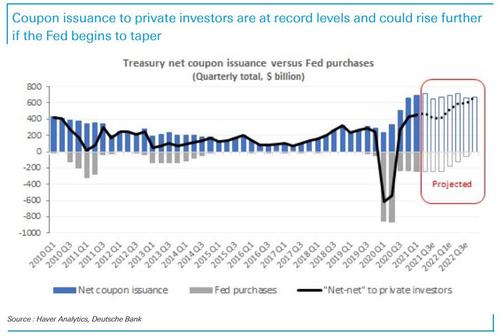

In a note that could sober up some of the stock market Kool-aid drinkers, Zeng reminds us that the amount of outstanding Treasury coupon debt is increasing at a record pace, and “every quarter, the Treasury is adding more than $650bn of new debt to replace the T-bills issued last year and to support new stimulus spending.”

The math is, to put it mildly, startling: even with the Fed buying substantial amounts, the amount of coupon supply left to private investors is staggering, and it will only go up more once the Fed begins to taper its purchases.

“All of that begs the question: who will buy all these Treasuries”, Zeng asks rhetorically (especially since the Fed’s next move is not more QE but an eventual tapering of QE)…..

___________________________________

America’s powerful ‘outside-the-box plan”:

The Leviticus 25 Plan will massively reduce the ‘cost of government’ by trillions of dollars each year. It will reduce the U.S. Treasury Department’s income tax refunds amounts by $261 billion per year during each of its first five years of activation.

It will generate $383 billion budget surpluses during each of those first five years, also, and it will completely pay for itself over a 10-15 year period.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2022 (3751 downloads)