Credit Markets Are Creaking, Creating Economic Uncertainty

Excerpts:

Moody’s Investors Service has estimated that defaults on risky debt will peak at 5.1 percent globally early next year, up from relatively low levels currently.

But in a sign of the uncertainty over the severity of debt distress on the horizon, the Moody’s forecast also suggested that in a “severely pessimistic” scenario defaults on risky debt could jump to 13.7 percent in a year, higher than the 13.4 peak reached during the 2008 financial crisis.

“You don’t know when it’s going to happen, or to what degree,” Mr. Zandi said, explaining that while financial risk may not be the Fed’s top concern today, “it’s one of those things that goes immediately to the top of the list when something breaks, when that gasket blows.”

The post Credit Markets Are Creaking, Creating Economic Uncertainty appeared first on New York Times

…………………………………………………….

US Corporate Debt Defaults In 2023 Surpass Last Year’s Total: Moody’s

ZeroHedge, Jul 21, 2023 – Excerpts:

Authored by Bryan Jung via The Epoch Times,

The total amount of corporate debt defaults in the United States this year have already exceeded the amount seen in 2022.

Experts have been warning of a wave of defaults to hit the economy for some time due to higher borrowing rates.

At least fifty-five American-based companies defaulted on their loans in the first half of 2023, according to data from Moody’s Investors Services.

That is a 53 percent increase from the total number of defaults last year, when just 36 companies said they would fail to repay their debt obligations to lenders.

Moody’s blamed higher borrowing costs and tight lending standards for adding pressure on companies reliant on credit. In May alone, there were 16 corporate debt defaults worldwide, up from 12 in April.

Economic uncertainty and higher interest rates have made it more difficult for borrowers to refinance existing loans or mature their debt, and has them with few options because they lack the cash to repay their creditors.

The aggressive monetary-tightening policies of the Federal Reserve have been a major factor in pushing many companies into default by making it harder to pay back their loans.

The spike in interest rates and the growing number of banks unwilling to issue new loans in the wake of the regional bank crisis this spring has exacerbated the situation.

Firms unable to repay their creditors are prevented from restructuring and forced to file for bankruptcy.

“Banks are battening down the hatches, hogging their bailout money instead of lending it out,” said Pete St. Onge, a Heritage Foundation economist, in a recent podcast.

“That credit crunch means not only do we get bankruptcies like in any recession, on top of that, we get a lending wall that cuts off even the healthy businesses. Of course, their jobs go down with them.”

…..

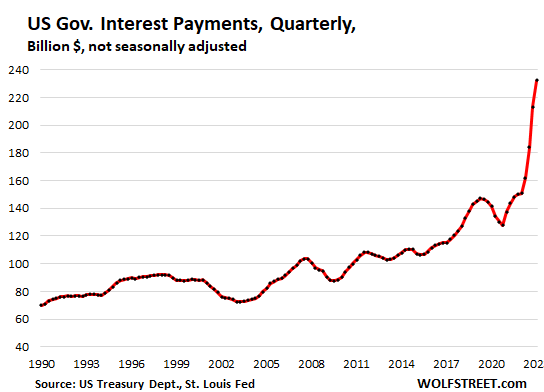

“Capital is much more expensive now,” Mohsin Meghji, chairman of the restructuring advisory firm M3 Partners, told CNBC on June 24.

“Look at the cost of debt. You could reasonably get debt financing for 4 percent to 6 percent at any point on average over the last 15 years. Now that cost of debt has gone up to 9 percent to 13 percent,” he said.

…….

Meanwhile, Bank of America warned in May that a tougher credit environment combined with a full-blown recession could result in nearly a $1 trillion in corporate debt defaults.

Total loan defaults in the United States could rise to 11.3 percent in a credit crunch, just below the all-time-high of 12 percent seen during the Great Recession, according to Deutsche Bank.

…….

Moody’s analysts noted that the five sectors with the most defaults in 2023 were business services, health care and pharmaceuticals, retail, telecommunications, and the hospitality sector.

U.S. corporate debt defaults account for the most of the total defaults worldwide this year, with 81 firms in total failing to make payments on their debts in the first half of 2023.

…….

There were 340 bankruptcy filings by July of this year, not far behind the total of 374 in 2022, according to S&P Global Market Intelligence.

Standard & Poor’s reported more than 230 bankruptcy filings through April of this year, the highest rate for that period since 2010.

_________________________________

Question: Does the Federal Reserve or the Department of the Treasury have a plan to clean this mess up and get America back on track:

Answer: No

Question: Do Washington-based Democrats and Republicans have a plan.

Answer: No. Both parties are clueless.

Main Street America Republicans do have a plan:

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. Citizen – Leviticus 25 Plan 2023 (6717 downloads)