The Federal Reserve and U.S. Treasury Department have us on the fast-track to complete disorder in the credit markets and eventual monetary chaos.

…………………………………………………………………..

The Money Boom Is Already Here – WSJ

by John Greenwood and Steve H. Hanke

WSJ Feb 21, 2021 — Excerpts:

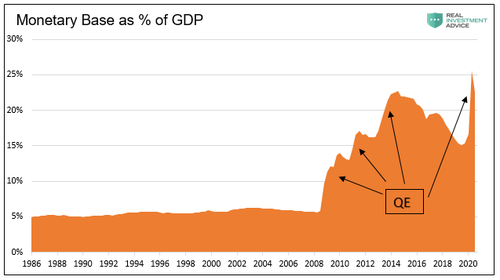

Speculative manias are in the air, as evidenced by the recent price surges for bitcoin, a digital asset with a fundamental value of zero, and GameStop, a declining retailer. Along with the other economic trends—a strong recovery, surging commodity prices and an uptick in inflation—those asset bubbles have a clear cause: the massive expansion of money and credit.

….. Fast-forward to February 2020. Since then, the quantity of money in the U.S. economy, measured by M2, has increased by an astonishing $4 trillion. That’s a one-year increase of 26%—the largest annual percentage increase since 1943.

The looming danger for the economy isn’t only that the monetary printing presses have been in overdrive since the pandemic began, but also that they are already set for the same in 2021. A monetary surge for this year is locked in.

… March 2020, the Fed’s holdings of Treasurys and mortgage-backed securities have increased by almost $3 trillion. M2 has increased by roughly the same amount.

The second largest source of M2 growth has been commercial bank purchases of short-term Treasurys and other debt securities, including mortgage-backed ones. These transactions create deposits in the same way as new loans do, with the deposit account of the seller or borrower being credited. Since the start of the pandemic last year, the increase in banks’ holdings of these assets has added almost $1 trillion to deposits and, therefore, to M2.

A third source of the increase in M2 was the sudden drawdown of $800 billion in credit lines by U.S. companies from February through April 2020. These funds were immediately credited to corporate deposit accounts. But corporate bank borrowing has turned downward, so that total bank loans have declined from their May peak, leaving a net $300 billion increase.

The $4 trillion increase in M2 tracks closely with the $3 trillion of Fed quantitative easing, plus $1 trillion of bank purchases of securities and the net $300 billion in new corporate borrowing. The reason for the apparent $300 billion discrepancy is that the Fed purchases some of its securities from banks—transactions that do not create new deposits. When the Fed buys securities from a bank, the bank’s reserve account at the Fed is credited. The Fed’s balance sheet has expanded, but for the bank the transaction is merely an asset swap. Its securities holdings drop, and its Fed reserves rise, but there is no addition to customer deposits, so M2 remains unchanged.

The U.S. money explosion isn’t over. Bank reserves, currently $3.2 trillion, will increase by about $1.4 trillion this year simply from Fed purchases of Treasurys and mortgage-backed securities at a promised $120 billion a month. In addition, the Treasury indicated in its February Refunding Statement that it will run down its Treasury General Account at the Fed by about $820 billion this year. This money will be spent through federal fiscal programs. These expenditures will further boost deposits counted in M2.

So we already know that the money supply will likely increase by at least another $2.3 trillion over the current year. In other words, even without any new lending or further purchases of securities by banks, the M2 money supply will grow by nearly 12% this year. That’s twice as fast as its average growth rate from 2000-19. It’s a rate that spells trouble—inflation trouble.

_________________________________________

The Leviticus 25 Plan has the raw power to clean this wreckage up.

It all starts with massive debt elimination at ‘ground level’ and a wide-ranging reduction in dependence on government.social welfare and income security programs, and dynamic adjustments in entitlement spending.

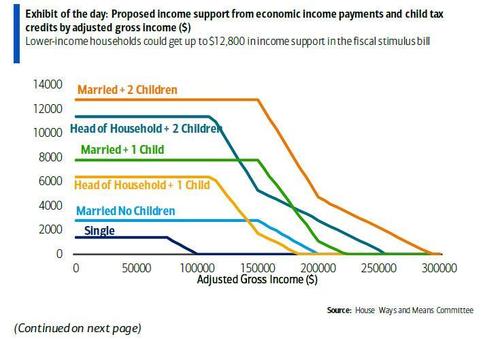

The resulting government outlay reductions and expansive tax revenue growth will generate $383 billion government surpluses for each of the first five years of activation (2022-2026), as well as powerful budget balancing effects for state and local government entities.

“He who will not apply new remedies must expect new evils.” – Sir Francis Bacon

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2022 (3682 downloads)