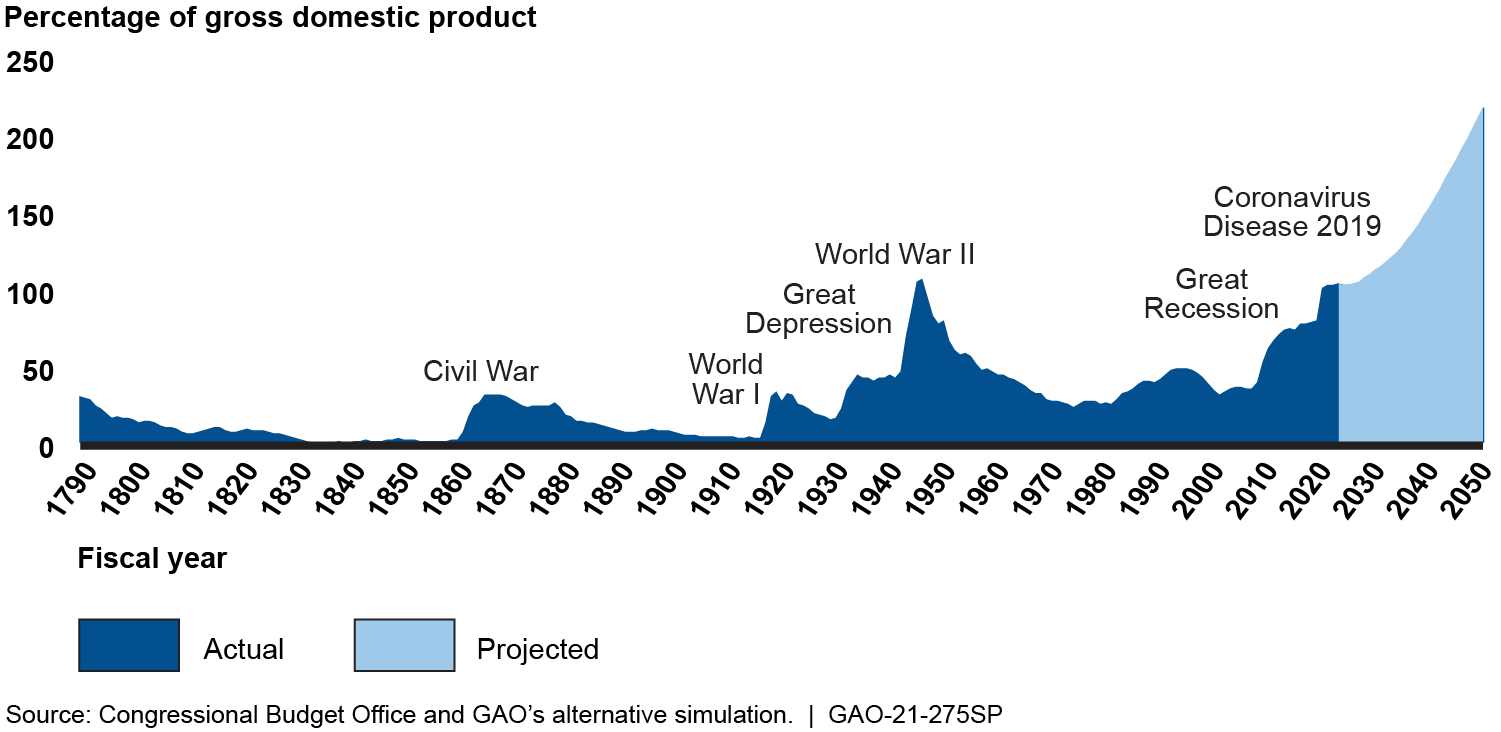

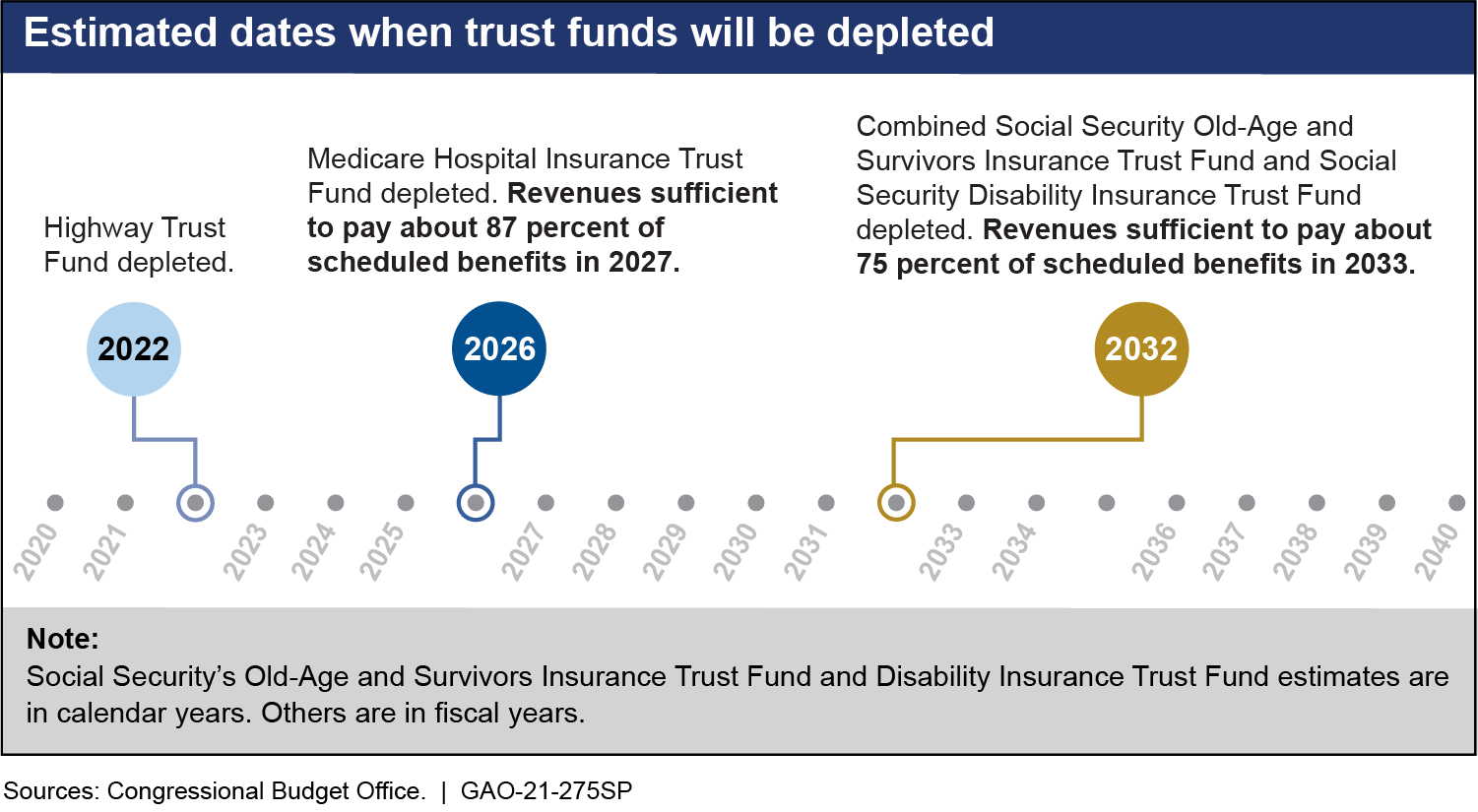

Government-driven solutions for America’s economic maladies are doing nothing to provide long-term solutions. In fact, they appear to be driving America deeper and deeper into the hole….

………………………………………………..

CBS: With moratorium ending, more than 8 million households face foreclosure or eviction

By Khristopher J. Brooks

June 19, 2021 / MoneyWatch / https://www.cbsnews.com/news/eviction-foreclosure-moratorium-ending-8-million-households/

Excerpts:

Even as the nation rebounds from the coronavirus pandemic, more than 2 million homeowners are behind on their mortgages and risk being forced out of their homes in a matter of weeks, a new Harvard University housing report warns.

Most of the homeowners at risk of foreclosure are either low-income or families of color, said researchers who published the 2021 State of the Nation’s Housing report. Congress has dedicated $10 billion to help homeowners get caught up on payments, but it’s unclear if that funding will make it to families before mortgage companies begin sending out foreclosure notices, researchers say.

Separately, millions more renters are “on the brink of eviction,” the Harvard researchers found. Census data show that 6 million households are still behind on rent and could face eviction at the end of June, when federal eviction protections expire.

The Center for Disease Control order halting some evictions, and federal limitations on foreclosures for federally-backed housing, both expire on June 30. Housing advocates have pushed for the Biden administration to extend both, but there is no indication an extension will happen.

“With so many renters in financial distress, there are concerns about an impending wave of evictions,” the Harvard report said.

More than 7 million homeowners took advantage of the foreclosure moratorium passed as part of the Coronavirus Aid, Relief and Economic Security Act last spring. The provision was later extended by the Biden White House. As of March 2021, most of those homeowners have started repaying lenders and some are even up to date with their lenders. But that leaves about 2.1 million still behind on their mortgages, researchers said. Of that number, about 325,000 homeowners have a Federal Housing Administration loan and are behind at least 60 days. They are most likely people of color, the U.S. Department of Housing and Urban Development said Wednesday.

____________________________________________

Solution: A Federal Reserve Citizen’s Credit Facility – to power American families up out of poverty and eliminate dependence upon government social welfare programs.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2022 (3782 downloads)