The Biden administration has announced that it will “forgive up to $20,000 in federal student loan debt for tens of millions of Americans, a move that will provide unprecedented relief for borrowers:..” – The Wall Street Journal, Aug 24, 2022.

Continuing – “The Penn Wharton Budget Model estimates that canceling $10,000 for borrowers earning up to $125,000 will cost about $300 billion. The Pell grant addition could increase this by as much as $270 billion. The four-month freeze on payments will cost $20 billion on top of the roughly $115 billion it already has.”

That’s a cool $590 billion.

“Worse than the cost is the moral hazard and awful precedent this sets. Those who will pay for this write-off are the tens of millions of Americans who didn’t go to college, or repaid their debt, or skimped and saved to pay for college, or chose lower-cost schools to avoid a debt trap. This is a college graduate bailout paid for by plumbers and FedEx drivers.”

Meanwhile, “The combined actions could render up to 20 million borrowers free of student debt, according to the White House.

“It’s hard to wrap your head around how life changing this is going to be for so many people. It is almost cosmic in scale,” said the Debt Collective, an activist group that has pushed for broad cancellation.”

__________________________________

It is hard to overstate how important and beneficial this type of debt relief is for millions of recent college graduates, who are now dealing skyrocketing rents and higher food and fuel costs – and how it will be viewed, politically, by the nearly 20 million beneficiaries.

And what was the Republican response? Did the Washington Republicans have a better plan for America?

Answer: No.

“GOP lawmakers quickly criticized the idea, with the Republican National Committee calling the plan ‘Biden’s bailout for the wealthy.’” –The Wall Street Journal, Aug 25, 2022.

Republicans in Washington, by the way, do not have any type of broadly-defined ‘Vision for Restoring the American Dream,’ and never have a superior alternative to offer the American people when Biden and the Washington Democrats push to expand big-government’s budget-blowing powers benefiting politically-malleable special interest groups.

What the Washington Republican response should have been:

“We Republicans offer to the American people a comprehensive economic plan that is far superior to the Biden Administration’s $10,000 college loan forgiveness plan.

Our plan will provided direct access to liquidity and a path to massive debt relief for all U.S. citizens – which includes millions of past college graduates who have worked hard and repaid their loans, and the millions of tax-paying Americans who did not go to college (but are now subsidizing Biden’s college loan forgiveness plan).

Our plan will not strap taxpayers with a $590 billion addition to the national debt. Our plan will instead generate $583 billion budget surpluses each of the first five years of activation (2023-2027).

Our plan will not continue to make citizens ever more dependent on federal government programs. It will instead will allow citizens to become less dependent and less controlled by government. It will rebuild the foundations of freedom in America.

Our plan will re-vitalize free market dynamics in America, lower inflation, usher in a grand new long-term economic growth cycle, and ‘raise all boats’ with enhanced financial security for all Americans.

Our plan:

The Leviticus 25 Plan provides a $90,000 credit extension, direct from the Federal Reserve, to every participating U.S. citizen: $60,000 into a Family Account (FA) and $30,000 into a Medical Savings Account (MSA).

Example: Qualifying family of four would receive $240,000 in their FA, and $120,000 in their MSA.

Primary goal: Massive debt elimination at family level: mortgage debt, consumer debt, student loan debt

Eligibility: U.S. Citizen. Job history, credit history requirement (similar to traditional credit checks for bank loans). Clean recent drug history. Clean crime history.

Requirements: Forego all federal and state tax refunds for 5-year period.

Forego all means-tested welfare benefits – for minimum 5-year period.

Forego all income security program benefits – for minimum 5-year period.

Forego new federally-subsidized ‘Family Medical Leave’ benefits – for minimum 5 year period.

Forego Child Tax Credit benefits – for minimum 5-year period.

Forego enhanced unemployment benefits – for minimum 5-year period.

Forego enhanced rental forbearance/assistance – for minimum 5-year period.

Forego SSI and SSDI for minimum 5-year period.

New $6,000 deductible on primary care access to: Medicare, Medicaid, VA, TRICARE, FEHB – for minimum 5-year period.

The Plan assumes that the elite-wealthy will not participate, because their refunds are too valuable to give up over the requisite 5-year period.

The Plan also assumes that many who heavily depend on social welfare benefits will also choose not to participate, because the overriding value of those benefits, vs foregoing them, over the 5-year period.

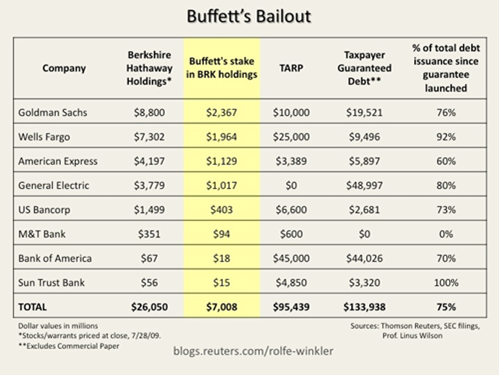

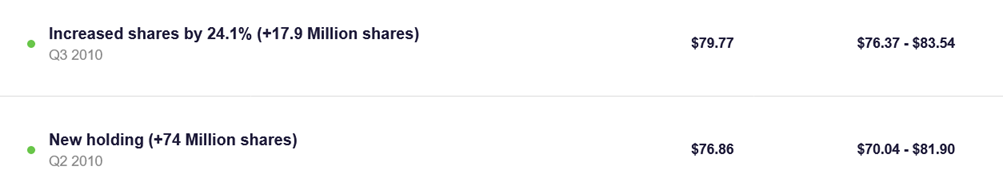

The Leviticus 25 Plan grants the same direct access to liquidity, through a Fed-based Citizens Credit Facility, similar to the credit facilities that were created by the Fed to transfuse trillions of dollars in direct transfers and credit extensions to Wall Street’s major banks, credit agencies and insurers during the great financial crisis.

The following facilities were created and activated by the Fed for this massive Wall Street bail out operation: Term Auction Facility (TAF), Primary Dealer Credit Facility (PDCF), Term Securities Lending Facility (TSLF), currency swap agreements with several foreign central banks, Commercial Paper Funding Facility (CPFF), Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility (AMLF), Money Market Investor Funding Facility (MMIFF), and the Term Asset-Backed Securities Loan Facility (TALF), and access to the Fed’s Discount Window.

Additional perspective: SIGTARP, the oversight agency of the Troubled Asset Relief Program (TARP), in its July 2009 report, vetted by Treasury, noted that the U.S. Government’s “Total Potential Support Related to Crisis” (page 138) amounted to $23.7 trillion. While this figure represents a backstop commitment, not a measure of total potential loss, it is nonetheless an astounding degree of support, in the form of liquidity infusions, credit extensions and guarantees, various other forms of assistance for financial institutions and other business entities affected by the financial crisis.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2023 (4161 downloads)