US Treasury Could Default As Soon As August, CBO Warns

ZeroHedge, Mar 26, 2025 – Excerpt:

Earlier this week we pointed out the striking plunge in the Treasury’s cash balance which had averaged around $800 billion for the past 18 months, and which plunged by $480 billion in the past month.

Treasury cash down $480 billion in the past month. pic.twitter.com/uV4GDNGheO

— zerohedge (@zerohedge) March 25, 2025

Regular readers are aware of the reason for this plunge: ever since the US hit the debt ceiling in the last days of the Biden administration, the US Treasury has been unable to issue new debt and so has been forced to draw down its cash to fund day to day operations.

Obviously, there is a limit to how much longer this can continue: after all, once the cash balance hits 0, the Treasury will have to start prioritizing payments, and eventually, it may even have to delay payments of interest or repayments of principal… better known as default.

Which brings us to the latest report from the Congressional Budget Office published this morning which warned that the federal government could run out of enough money to pay all of its bills on time as soon as August if lawmakers fail to raise or suspend the debt limit, to wit:

The Congressional Budget Office estimates that if the debt limit remains unchanged, the government’s ability to borrow using extraordinary measures will probably be exhausted in August or September 2025. The projected exhaustion date is uncertain because the timing and amount of revenue collections and outlays over the intervening months could differ from CBO’s projections. (source)

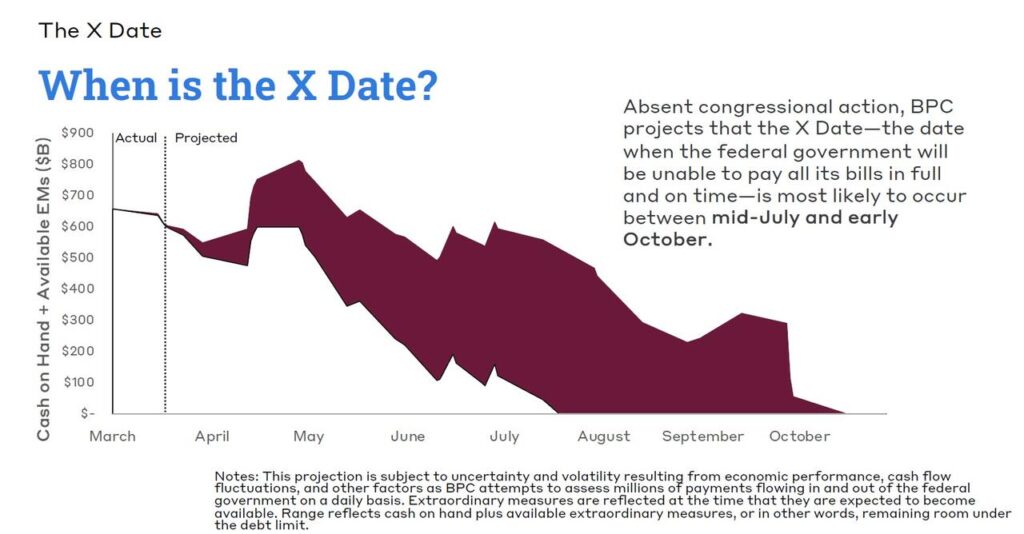

On Monday, the Bipartisan Policy Center said that according to public data the Treasury will be forced to start defaulting on obligations sometime between mid-July and early October.

The CBO also cautioned that if the government’s borrowing needs are “significantly greater than CBO projects, the Treasury’s resources could be exhausted in late May or sometime in June, before tax payments due in mid-June are received or before additional extraordinary measures become available on June 30.”

The date is uncertain because of the unpredictable nature of tax receipts, and Rep. Jason Smith of Missouri, chair of the House Ways and Means Committee, said earlier this month that it could come as early as mid-May.

Henrietta Treyz, director of economic policy at Veda Partners, wrote in a Monday note to clients that an earlier “x date” would be beneficial to House Republicans and those rooting for the Trump tax plan to be initiated in a single piece of legislation as soon as possible.

The Treasury Department has been using special accounting maneuvers since Jan. 21 to avoid breaching the $36.1 trillion debt ceiling, which kicked in at the start of the year. But the department has yet to offer specific guidance on when those measures will be exhausted.

Full article: https://www.zerohedge.com/economics/cbo-warns-us-treasury-could-default-soon-august

___________________________

It is time to enact a massive debt-elimination budget clean-up operation. And there is one comprehensive plan with the raw power to make it happen.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$60,000 per U.S. citizen – Leviticus 25 Plan 2026 (26221 downloads )