“Democracy extends the sphere of individual freedom, socialism restricts it. Democracy attaches all possible value to each man; socialism makes each man a mere agent, a mere number. Democracy and socialism have nothing in common but one word: equality. But notice the difference: while democracy seeks equality in liberty, socialism seeks equality in restraint and servitude.” ― Alexis de Tocqueville

Monthly Archives: April 2025

WSJ: ObamaCare Subsidies Explode from $55 Billion to $470 Billion.

Behind the ObamaCare Boom – WSJ

Sweetened subsidies are attracting more takers, at taxpayer expense.

By The Editorial Board | Jan. 28, 2024 5:30 pm ET

Excerpts:

Government entitlements and subsidies invariably cost more than politicians advertise. Take the ObamaCare premium tax credits, which Democrats during the pandemic turned into a de facto public option for health insurance.

President Biden took a victory lap last week after the Health and Human Services Department reported that a record 21.3 million Americans had signed up for coverage on the ObamaCare exchanges. That’s nearly five million more than last year and nearly double as many as in 2020. “It’s no accident,” the President tooted. He’s right, but not in a good way.

The March 2021 American Rescue Plan Act sweetened the premium tax credits to make insurance on the exchanges free or nearly free for many middle-class Americans for two years. The Inflation Reduction Act extended the bigger subsidies through 2025, while his Administration rewrote ObamaCare rules to enable more families to qualify.

Because the enhanced subsidies make the plans cheaper than employer coverage, many more Americans are signing up on the ObamaCare exchanges. The pandemic Medicaid expansion also ended last spring, enabling states to remove people who no longer qualify. HHS says many who left Medicaid signed up for ObamaCare plans.

Recall that Democrats claimed that extending the sweetened subsidies for three years would cost a mere $64 billion. But a conservative back-of-the-envelope calculation based on enrollment and the average tax credit indicates that the subsidy boost this year alone will cost some $70 billion—meaning it could end up costing three times what the politicians claimed.

When the government creates an open-ended subsidy, more people than predicted always show up to the buffet. The pandemic Medicaid expansion cost more than six times the original $50 billion estimate. The Covid-era Employee Retention Credit was initially estimated to cost $55 billion, but the final price tag may be upward of $470 billion as tens of thousands of businesses continue to claim it.

The truth is that you can’t trust Congress’s budget estimates. The bipartisan tax deal now moving through the House to boost the child tax credit and renew some business tax breaks is estimated to cost $78 billion. The smart money will take the over.

______________________________________

And on we go… more people dependent on government programs, more price distortion in private markets, ongoing ‘projected cost’ blowouts, ballooning federal budget deficits.

Washington Democrats (and Republicans) have America on track for credit market chaos.

There is currently one plan (and only one plan) on the table with the power to: 1) Revive free-market efficiencies and economic viability in the U.S. healthcare system; 2) Restore order and stability to credit markets, and; 3) Get America back on track for federal budget surpluses, sound money, and financial security for millions of hard-working, tax-paying U.S. citizens.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2026 (27486 downloads )

The Impossible Dream: Federal Budget Surpluses, Citizen-Centered Healthcare, Financial Security for Millions of American Families. The Leviticus 25 Plan.

Washington-based Democrats and Republicans have a long-standing record of growing government, creating greater dependence on government among the citizenry, dreaming up new spending programs riddled with inefficiencies, waste and outright fraud.

Washington political policy initiatives over the past two decades have impoverished millions of Americans, created record Household Debt burdens, stymied economic growth, and generated soaring, nightmarish federal budget deficits, massive enough to now constitute a national security issue.

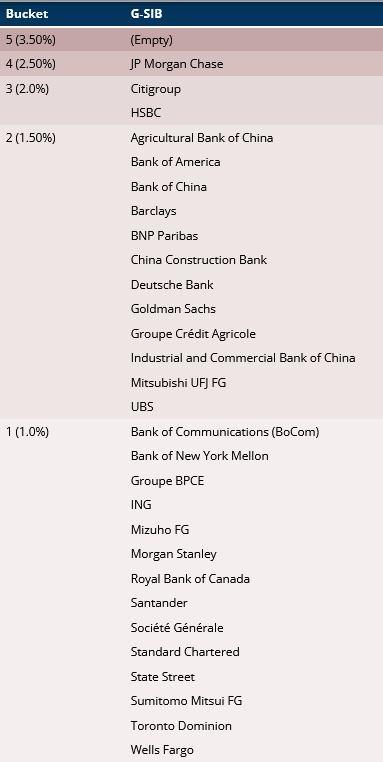

Now imagine a future America where millions of U.S. citizens were to be granted equal access to direct liquidity extensions to those which were so generously provided to major Wall Street financial institutions during the great financial crisis (2007-2010) and the Covid economic crisis (2020-2022), including: Morgan Stanley, Citigroup, Bank of America, State Street Corp, Goldman Sachs, Merrill Lynch, JPMorgan Chase, Wachovia, Lehman Brothers, Wells Fargo, Bear Stearns) and major foreign financial institutions (Royal Bank of Scotland, UBS AG, Deutsche Bank AG, Barclays, Credit Suisse. Dexia, BNP Paribas).

Imagine a future America where millions of hard-working, tax-paying U.S. citizens have eliminated massive sums of mortgage debt, paid off auto loans and installment debt, paid off student loans (or were fully reimbursed for previously paid off student loans), and are able to improve their current quality of life and save considerable sums of money toward future plans and dreams.

Imagine a future America where millions of ‘below-the-poverty-line’ families did not need ongoing government support to cover life’s basic necessities (food, housing, and primary health care expenditures).

Imagine a future where families did not need two incomes, or additional government assistance to barely cover family-specific expenses like child-care, private education, and federal, state, and local tax burdens.

And now visualize a future America where government spending has dropped precipitously, tax revenues have risen dramatically (without raising taxes), federal (and state) budget surpluses have become an ongoing reality.

America’s economy – surging into a new, long-term, revitalized, free market growth cycle.

And citizen-centered healthcare largely replacing the current big government / big corporation market-dominating partnerships.

That future is here.

The Leviticus 25 Plan – loaded up and ready to launch.

…………………..

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2026 (27484 downloads )

GAO: America’s “Unsustainable Fiscal Path”

THE NATION’S UNSUSTAINABLE FISCAL PATH – Government Accountability Office

Excerpt:

The federal government faces an unsustainable fiscal future. In February 2025, we released our annual report on the nation’s fiscal health, highlighting both short-term and long-term risks.

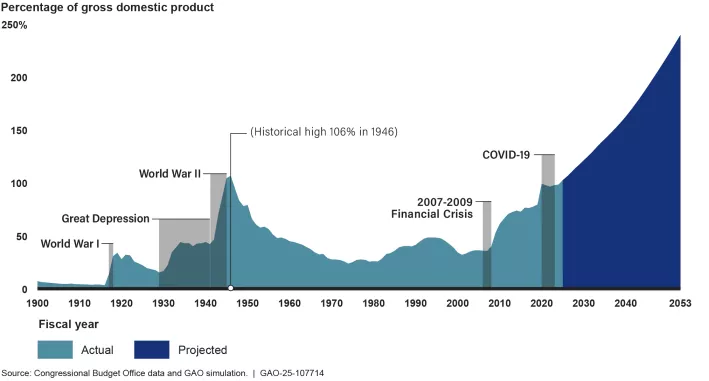

Federal debt held by the public (that is, the total amount of money that the federal government owes to its investors) will continue to grow faster than the economy, which is unsustainable.

Federal debt held by the public—past, present, and future

Historically, debt has decreased during peacetime and economic expansions. But this pattern has changed in recent decades. Unless current revenue and spending policies change, by 2027 debt will reach its historical high of 106 percent of GDP, according to our simulation. If unaddressed, it will grow more than twice as fast as the economy and reach 200 percent of GDP by 2047.

…………………………………………..

The U.S. Congress’ latest response to resolving the fiscal crisis:

A little or a lot? Conflicting targets for cuts leave budget in limbo

The House of Representatives this week narrowly approved a budget resolution after the Senate did so previously.

By Ben Whedon | JusttheNews | Apr 11, 2025

While President Donald Trump has suggested he may sign a balanced budget plan during his term, competing estimates and promises on cuts from interested parties appear to signal the government could either come close to achieving its goal or largely fail to make meaningful cuts, with little room for a moderate option.

The House of Representatives this week narrowly approved a budget resolution after the Senate did so previously. Both chambers committed to the basic framework of “one big, beautiful bill” favored by Trump to address both his tax cuts and his border proposals in the same legislation. The reconciliation process, however, will see competing parties quibble over the depth of cuts and what to target.

The Congressional Budget Office projected that the federal government would run a $1.9 trillion budget deficit in Fiscal Year 2025 and the Elon Musk-led Department of Government Efficiency (DOGE) had previously vowed to cut $2 trillion in spending to balance the budget. But Musk’s projections have dwindled of late and budget hawks in the House aim to hold Speaker Mike Johnson to his promises of major cuts, setting up a potential leadership change should he fail.

_____________________________________

The most powerful economic acceleration plan in the world is loaded up and ready to launch – and solve America’s debt crisis, once and for all.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2026 (26881 downloads )

Treasury Secretary Bessent: “It’s Main Street’s Turn to Restore The American Dream.”

“It’s Main Street’s Turn To Restore The American Dream” – US Treasury Secretary Warns Wall Street

ZeroHedge, Apr 09, 2025 | Via American Greatness, – Excerpts:

U.S. Secretary of the Treasury Scott Bessent laid out President Trump’s financial policy priorities for the American Bankers Association (ABA) on Wednesday, saying that Main Street America will now take priority.

Bessent speaking at the ABA’s Washington Summit, said, “For too long, financial policy has served large financial institutions at the expense of smaller ones— no more.”

The Treasury Secretary stated that, “It’s Main Street’s turn to hire workers, it’s Main Street’s turn to drive investment and it’s Main Street’s turn to restore the American dream.”

Bessent announced the Trump administration’s shift to focusing on helping Main Street businesses and consumers thrive by giving all institutions a chance to succeed, adding, “For the last four decades, basically since I began my career in Wall Street, Wall Street has grown wealthier than ever before, and it can continue to grow and do well.”

Addressing fears of a looming recession, Bessent defended Trump’s agenda of tax cuts, deregulation and trade rebalancing and noting that,

“We want to de-leverage the government sector, re-leverage the private sector …. we can’t do it all at once, or that will cause a recession.”

Bessent added,

“What will keep us from having a recession is making sure that the tax bill doesn’t expire, adding back 100% depreciation and then adding some of President Trump’s agenda — no tax on tips, no tax on Social Security, no tax on overtime.”

___________________________________

There is one more step that America needs to take to “re-leverage” the debt-logged private sector and activate the powerful reset that millions of American families and small businesses need – a massive, public and private sector debt elimination plan.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2026 (26840 downloads )

Federal Reserve Interest on Excess Reserves (IOER) vs The Leviticus 25 Plan

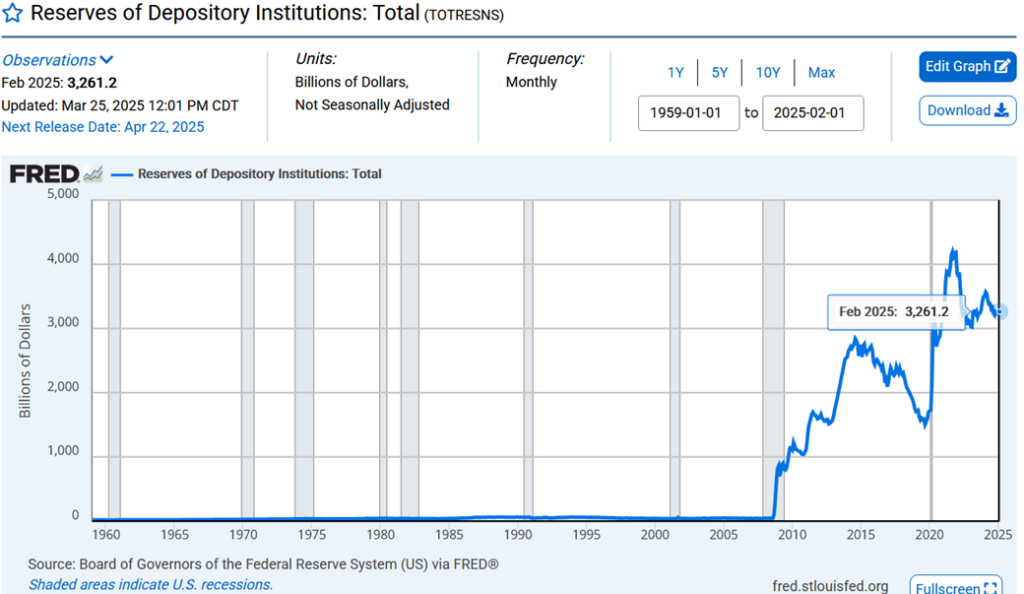

The U.S. Federal Reserve pays banks on the required and excess reserves they hold on deposit. The Fed is currently holding $3.262 trillion in the cash reserves.

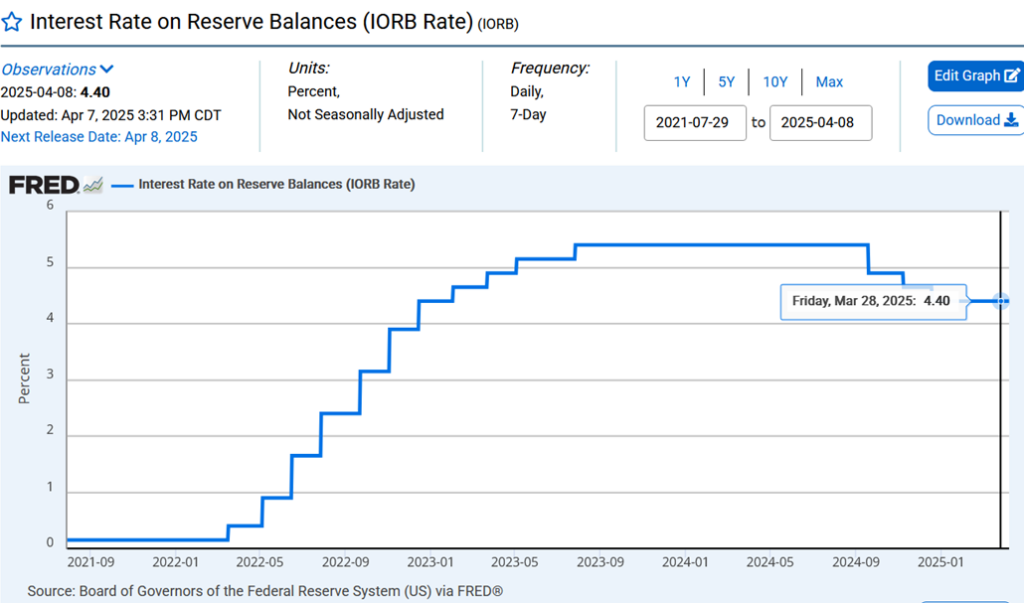

And it is currently paying 4.40% in interest on that $3.261 trillion…

The current total annual interest payments to banks, therefore, come in at a cool $81.525 billion. And, it would be safe to assume that many or all of the ‘Systemically Important Banks’ listed below (foreign and domestic) are partakers of those generous Fed IOER payments:

_______________________________

Fed IOER payments were initiated in October 2008, “primarily to maintain control over the federal funds rate and facilitate credit market interventions during the financial crisis.”

This monetary tool does nothing, however, to reduce the soaring annual Federal budget deficits, nor does it do anything to insulate hard-working, tax-paying U.S. citizens from the catastrophic effects of future ‘financial crises’ – which are all but inevitable with with America’s snowballing public and private debt burdens.

The Leviticus 25 Plan corrects these imbalances – generating federal budget surpluses and financial security for millions of American families.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2026 (26809 downloads )