A look back…

The 2008-2010 great financial crisis was precipitated by major Wall Street financial institutions, both foreign and domestic, that became engrossed with sewage-grade subprime mortgage paper, fell below their capital requirements, and triggered the credit market collapse.

The very same ‘too big to fail banks’ then received trillions of bailout dollars in direct liquidity transfers and credit guarantees through the Fed’s “Secret Liquidity Lifelines” … to magnanimously restore them to a state of ‘financial health.

During this same crisis, precipitated by the likes Morgan Stanley, Goldman Sachs, AIG, Citigroup, Bank of America, Merrill Lynch, JP Morgan, Wells Fargo… and foreign-based RBS, Barclays, UBS AG, Deutsche Bank, BNP Paribas, Dexia SA, 12 million Americans lost jobs.

And then, at the very time they were receiving their massive bailout packages, the big mortgage service institutions turned around and foreclosed on ~8.4 million homes. Small businesses crashed.

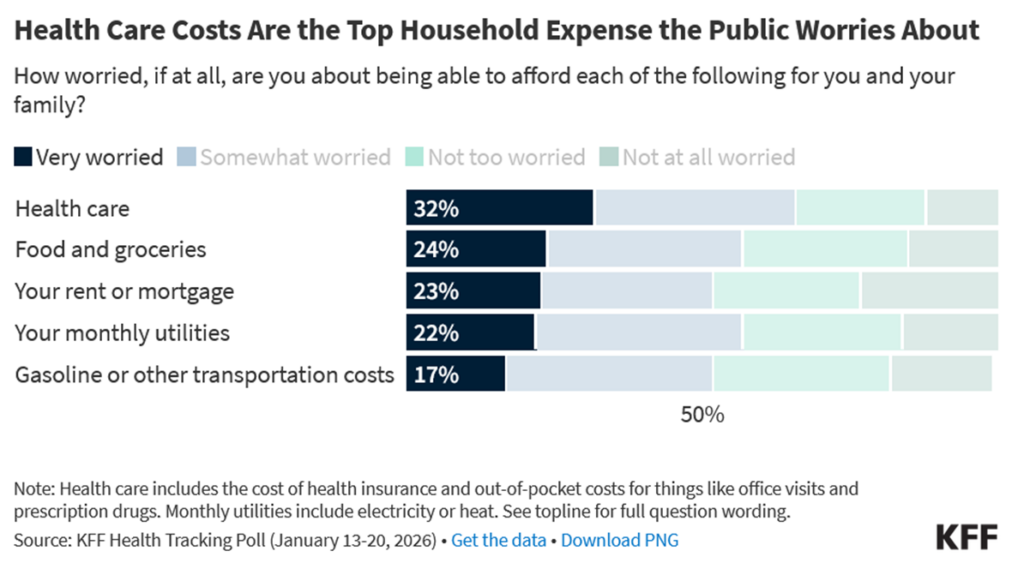

And now, the great American middle class is getting crushed by inflation, the affordability crisis, record high Household Debt, and stagnant economic growth.

The good news is — there is a dynamic economic plan to rebalance the scales and get America back on track… Loaded up and ready to launch.

………………………………….

Grinding The American Middle Class To Dust

ZeroHedge, Feb 21, 2026 – Authored by MN Gordon via EconomicPrism.com,

Excerpts:

The housing market, for much of the 20th century, was the bedrock of the American Dream. Home ownership, and the financial stability it represents, was a sure path to middle-class prosperity.

That dream turned to a nightmare for many American families during the epic real estate bubble and subsequent bust in 2008-09. What’s more, in the near two decades that followed, federal monetary policies coupled with restrictive local development standards have huffed and puffed an even more perilous bubble than the last one….

We’ve reached the point where discretionary income, the money left over after you’ve paid for basic needs, has effectively vanished for much of the population. When 67 percent of Americans are living paycheck to paycheck, saving for a down payment is impossible.

Currently, about 72 percent of Americans are struggling to pay their monthly bills. We aren’t talking about luxury vacations or even unexpected medical expenses. We’re talking about keeping the lights on and the fridge full. When the buffer is gone, the entire economic engine stalls.

The lack of affordable housing has created a generational rift. Young workers find themselves trapped in a permanent renter class. They’re unable to build the equity that once anchored the nation’s middle class.Right now, more than 75 percent of homes across the country are unaffordable for the typical household. Most Americans are effectively priced out of the housing market. And this number is climbing…

Between higher interest rates, relative to four years ago, and artificially inflated valuations, the entry-level home no longer exists….

The middle class, specifically the segment that has historically held the most private property, is under attack. By squeezing the life out of the housing market, wealth is being funneled upward. When families lose their homes to foreclosure, they don’t just lose a roof, they lose their primary vehicle for intergenerational wealth.

The result is a civilization of serfs. We’re rapidly transitioning to a rentership society. If you don’t own property, you don’t have a stake in the future. You’re left out in the cold.

In 2008, the crash was about bad paper and subprime loans. Today, the crisis is about affordability and insolvency. House price inflation in the face of stagnating wages has become too much to overcome.

Moreover, as houses are lost en masse to the banks they aren’t being foreclosed on and put back on the market at a lower price. They’re being sold in bulk to hedge funds, who promptly jack up the rents. What this means is your neighborhood could soon be owned by a corporation that doesn’t have a face, let alone a soul.

The real estate market isn’t just cooling off. It’s being hollowed out. Between the loss of discretionary income, the instability of the job market, and the sheer impossibility of the two-income mortgage, the American middle class is standing on a trap door….

Grinding the American Middle Class to Dust

For decades, the home was a forced savings account that allowed a mechanic or a teacher to retire with dignity. Today, that vehicle has been hijacked by institutional capital.

As the supply of affordable homes dwindles, we see the rise of the build-to-rent trend. This is where entire subdivisions are constructed not for families to buy, but for corporations to lease back to them in perpetuity.

This shift marks the transition from a stakeholder society to a subscription society consistent with the WEF diktat of, “you will own nothing and be happy.” Housing, the most basic of human needs, has become a subscription service.

Thus, the ability to accumulate private wealth through long-term home ownership has disappeared. As a renter, you are no longer building equity and wealth, you are funding a hedge fund’s quarterly dividends.

This exploitive model ensures that the fruits of one’s labor are siphoned away from the community and into the coffers of distant shareholders. As a result, the working class are left with nothing but receipts and a sense of perpetual instability. The economic ladder has been replaced by a treadmill to nowhere.

In addition, a society of renters is a society of transients that lack the long-term community ties that homeownership once encouraged. As the trap door swings open, the fall both destroys people’s finances and shatters the very concept of the neighborhood.

The doors are closing on the era of American middle-class independence. The dream of home ownership is being replaced by the reality of permanent debt, and the bedrock of the American middle class is ground into dust.

________________________________________

The Leviticus 25 Plan will accomplish five of America’s most critical national economic/social priorities:

- Massive debt elimination and the renewed financial security for millions American families;

- Breaking the vicious ‘cycle of dependence’ on federal and state social welfare subsistence programs — restoring hope and strengthening families;

- Federal budget surpluses averaging $37.303 billion annually 2027-2031 … vs $2 trillion annual deficits — generating credit market stability, lower interest rates;

- Citizen-centered, market-driven health care;

- Robust, ‘non-debt driven,’ economic growth.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$95,000 per U.S. citizen – Leviticus 25 Plan 2027 (46465 downloads )