Highlights:

“A whopping 40 percent of enrollees in fully subsidized plans had no claims in 2024. In 2024 alone, taxpayers sent at least $35 billion to insurers for people who paid no premiums and never used their plan”…

“COVID opened the door for massive waste, fraud, and abuse of government programs, like the billions in fraud and abuse allowed by the ‘temporary COVID’ enhanced Obamacare subsidies“…

_________________________________________________

The Obamacare Sweeteners Poisoning Budget Negotiations

ZeroHedge, Friday, Sep 26, 2025 – Authored by James Varney via RealClearInvestigations,

Halloween could come early this year. The Democrats have named their price to avoid a government shutdown come October – an additional $350 billion for healthcare over the next decade. Critics say a big chunk of that money may go to ghosts.

At issue are the generous subsidies the Biden administration created for Affordable Care Act policies, sweeteners that are slated to expire in December. Making healthcare essentially free for millions of Americans, those policies have skyrocketed enrollment in Obamacare plans. But a recent study found they have also sparked a curious phenomenon: an estimated 12 million enrollees “without a single claim – no doctor visit, lab test, or prescription filled” in 2024.

The Paragon Health Institute study reports that this is triple the number of no-claim policyholders before the Biden sweeteners were put in place. “Among those now eligible for zero-premium plans with low or no deductible,” the study found, “that number increased nearly sevenfold. … A whopping 40 percent of enrollees in fully subsidized plans had no claims in 2024. In 2024 alone, taxpayers sent at least $35 billion to insurers for people who paid no premiums and never used their plan,” the report said.

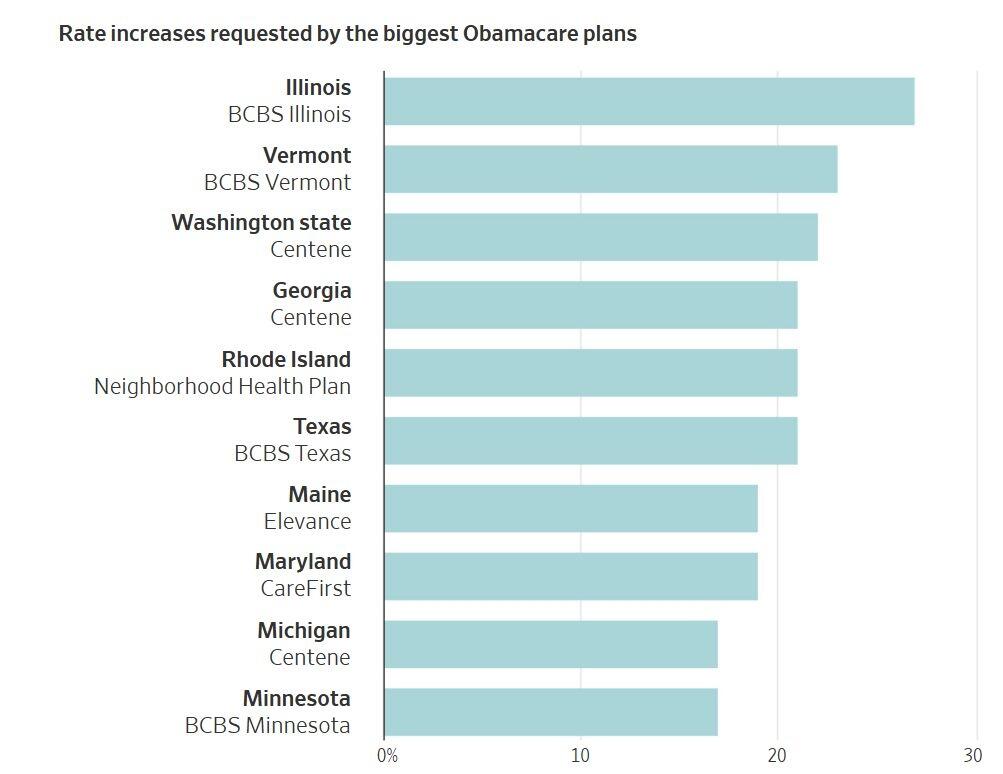

Although many analysts suspect that these numbers suggest widespread fraud, Democrats and the insurance industry argue that they reflect consumers taking advantage of affordable coverage. They warn that the expiration of Biden-era reforms will make policies far more expensive for more than 20 million Americans. “If Congress fails to extend the health care tax credits, millions of Americans will face immediate and severe premium increases, leading many to forgo coverage altogether,” said Chris Bond, a spokesman for AHIP, the lobbying arm of the health insurance industry. “Congress must act as quickly as possible to protect Americans from this affordability crisis.”

As Democrats have made healthcare their line in the sand to avert a partial government shutdown on Oct. 1, Biden-era expansions of Obamacare are receiving new attention as a symbol of both expanding access to healthcare and of spending run amok.

Critics say they underscore the findings of the Department of Government Efficiency (DOGE), which has highlighted a lack of accountability in massive government spending programs at a time when the federal government is struggling to corral massive deficits and debt. They say the Biden sweeteners also illustrate how and why government spending keeps increasing: Once a subsidy is put in place, it is hard to take it away from voters.

Swollen Rolls

The Obamacare expansion at issue came about through legislation and regulations during Biden’s term and was often cast as a response to the COVID pandemic.

First, the scope of who was eligible for subsidies was broadened, making it available to households with incomes above 400% of the federal poverty line – making a family of four earning up to $160,000 eligible for subsidized plans. Also, increased subsidies made Obamacare free for those with incomes between 100% and 150% of the poverty line, and longer enrollment periods were created.

The cost for this, on the other hand, is borne by taxpayers.

“Biden’s COVID credits didn’t reduce health care costs – they just shifted them to taxpayers while padding insurer and enrollment intermediary profits,” Paragon President Brian Blase said.

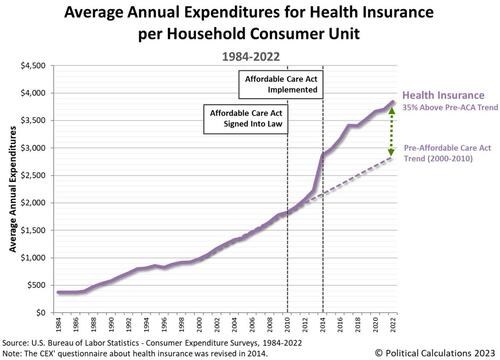

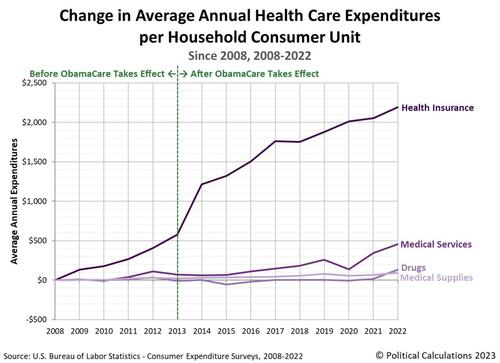

Like all gigantic markets and massive government programs, the Affordable Care Act and what people pay each month have become a very complicated thing, varying by age, state, level of plan, and other factors. But the figures for the Obamacare “reference plan” (silver level) reveal what has happened since the COVID pandemic.

In 2021, when Biden was inaugurated, that basic plan cost an individual $27 a month if they reported income along the federal poverty line, which stood around $14,500 a year. For those making 50% more, the “reference plan” cost $75 a month, and so on up to $152 a month for someone making more than $30,000. Those monthly payment figures were constant regardless of what the insurers charged, with taxpayers making up the difference.

Through legislation Biden pushed through by narrow majorities or via reconciliation, the amount someone would pay each month in the first two categories dropped to zero. And as Obamacare became essentially free, millions signed up – enrolling at rates the plan had never seen since its inception in 2013.

The overall figures reflect this explosion. Between 2016 and 2020, an average of 8.5 million people signed up for a subsidized Obamacare policy each year, and in none of those years did the figure equal 9 million, according to the Center for Medicare and Medicaid Services (CMS).

In 2021, however, the subsidized total topped 10 million, and by 2024 it had nearly doubled to 19.5 million, CMS figures show.

“It’s all counter-intuitive, that when enrollment isn’t being publicized, no one is out beating the bushes to get people enrolled like we had in the early years of Obamacare,” said Ed Haislmaier, a healthcare expert at the conservative Heritage Foundation. “Amazing, that a product’s sales would go through the roof when nobody was talking about it.”

Some analysts believe the numbers indicate rampant fraud. Blase claimed in a letter to the Wall Street Journal that the expansion has created an explosion of phantom patients – including 6.4 million of them so far in 2025. “The problem isn’t real people with coverage they don’t use – it’s fraudulent sign-ups who never should have been subsidized.”

Haislmaier agreed, “We don’t have an exact number for how many people might be fake, I don’t think anyone does,” said Ed Haislmaier, “What we do have is a lot of circumstantial evidence, a lot of data points, and a lot of information about how the markets have always operated to suggest there is massive fraud here.”

Feds Smell a Rat

Paragon is not the only group voicing concerns. It often seems like fraud is endemic in federal programs, and government healthcare appears to offer a rich vein for such activity.

In fact, CMS itself has warned of potentially rampant fraud and abuse sapping taxpayers through the revamped Obamacare exchanges. CMS focused on people unwittingly signed up for more than one plan, possibilities that multiplied when the Biden administration relaxed reviews of applicants and extended open enrollment periods.

CMS found in July that 2.8 million Americans were potentially enrolled “concurrently” in Medicaid and the Children’s Health Insurance Plan (CHIP) in more than one state, or on one of those federal programs plus the Obamacare exchange, resulting in inexplicable overlaps that could cost taxpayers $14 billion a year.

CMS insists its analysis is helping identify such problems, and that it is working with states and exchanges to strengthen eligibility verification processes and clean up enrollment data. The Trump administration has instituted some safeguards, such as sending state Medicaid agencies and state-based exchanges a list of individuals with possible concurrent enrollments so they can cross-check appropriate eligibility.

Opponents of expanded subsidies note that when the government makes a deep pool of money available, as has happened with the ACA, fraud is sure to follow. In June, Bloomberg did a deep dive on the phenomenon, describing a rat’s nest of unscrupulous call centers, primarily based in Florida, that have lured people in with various gimmicks and then signed them up for subsidized plans.

What’s more, those licensed to sell plans had access to Obamacare exchange databases, which allowed them to change both the “agent of record” (thereby making themselves recipient of whatever bonus insurers paid for new signups), or the plan a person was enrolled in (thereby increasing their commission and the taxpayers’ bill), according to Gabrielle Kalisz, one of the authors of Paragon’s report.

Consequently, millions of Americans may be unaware that they own a subsidized Obamacare policy, and horror stories abound of unsuspecting people hit with tax bills seeking to recoup the subsidies.

“Nobody seems to have an incentive to be a good actor in the process,” Kalisz said. “The insurance companies are perfectly happy to keep getting the rising premiums, the navigators or agents are happy to keep getting the commissions, and Obamacare supporters are happy to act as if all this reflects people getting coverage.”

Nor are the so-called “phantom enrollees” the only issue. For example, the numbers don’t add up when percentages of state populations according to census data are measured against the Obamacare subsidies. Fourteen states have more people enrolled at up to 150% of the federal poverty line than they do residents who fit that category, and Florida’s total is five times what census data shows it could be.

“The enrollment fraud has become a massive problem,” said Michael Cannon, a healthcare expert at the libertarian Cato Institute. “The program has become like a great big ATM spitting out checks, and there’s very little policing going on because the government doesn’t care as much as it should about other people’s money.”

The new figures also diverge from what has been fairly consistent behavior in healthcare markets – another red flag, Haislmaier said. In 2019 and 2020, less than a quarter of policyholders never filed a claim. And the huge increase in so-called “phantom enrollees” doesn’t appear in market segments other than the now highly subsidized Obamacare plans.

Such figures make no sense if they reflected genuine people aware of what coverage they were enrolled in, and bogus enrollment activity offers a clear explanation.

“This whole situation has been ideal for the fraudster,” he said. “Now you’ve got more enrolled than are eligible, subsidized plans spiking and non-subsidized plans flat. These are just all indicators that there is something whacky going on here.”

Subsidies or Shutdown?

All of this is informing the partisan debate over healthcare and efforts to fund the government after the current fiscal year ends on Sept. 30.

Republicans, including some who got fabulously wealthy through the healthcare system, like Florida’s Sen. Rick Scott, have said extending the subsidies is ruinously expensive and foolhardy, given what has happened since they were introduced.

“COVID opened the door for massive waste, fraud, and abuse of government programs, like the billions in fraud and abuse allowed by the ‘temporary COVID’ enhanced Obamacare subsidies,” Scott posted last week. “Americans don’t want their tax dollars lining the pockets of insurance companies – it’s time to end this clear abuse of YOUR dollars.”

Scott drew attention to a Sept. 15 post by Wisconsin Republican Sen. Ron Johnson that made much the same point: “Extending the ‘temporary COVID’ enhanced Obamacare subsidies would perpetuate fraudulent activity, sending billions of dollars to insurance companies for policies that people are unaware they’re enrolled in and do not use,” he posted.

On the other side are Democrats who make strange political bedfellows of the insurance industry. Some who traditionally oppose big business, such as Massachusetts’ Sen. Elizabeth Warren or Vermont’s socialist Sen. Bernie Sanders, insist these recent subsidies must continue, preferably permanently. For them, the Obamacare rolls more than doubling – from 11.4 million to more than 24 million between 2020 and today – are a success sign of government-run healthcare.

Last week, Warren compared ending the subsidies to taking healthcare away from people.

“Still waiting to find out how Trump and Republicans think cutting health insurance for 15 million Americans makes America healthy again,” she posted on X Sept. 15.

Polls suggest support for government-subsidized healthcare is a partisan issue. Last November, Gallup reported that “ninety percent of Democrats say that the federal government is responsible for American healthcare coverage, while 65% of Independents hold the same view. Although only 32% of Republicans share that opinion.” Another survey found that among those receiving subsidies, people who voted for Democrats outnumber Republicans by more than two to one.

Insurers say the Paragon study was flawed and accused the think tank of misunderstanding how insurance works. It’s not unusual for homeowners or car insurance policy holders to go years without filing a claim, and the same could be true with healthcare, they say. According to the industry and Democrats, the ballooning numbers reflect a thriving market in which many more Americans are enjoying healthcare coverage, as stated in a rebuttal released by AHIP on Aug. 15.

The debate will come to a head in the next week or so. President Trump this week rejected a meeting with congressional Democrats whose spending ideas he derided as fantastical. Republicans want to let the subsidies expire; Democrats want to make them permanent.

Of course, that leaves some wiggle room, such as extending the subsidies for another year or some set period of time, a kicking-the-can option long favored by Congress. There have been some indications in the past several days that, public intransigence notwithstanding, negotiations might be ongoing.

Whatever the outcome, large subsidies that have always been part of Obamacare will continue. For all the hue and cry about rising costs, the elimination of Biden-era sweeteners would simply return the system to the way it was operating before 2021, Kalisz said.

“It’s crony math, a kind of corporate welfare,” she told RealClearInvestigations. “Why are the insurers now making it seem like all the subsidies are going away? It’s a form of scaring and spooking the public.”

_____________________________

The Leviticus 25 Plan will restore citizen-centered healthcare across America by paving forward a system in which millions of qualifying U.S. citizen families receive direct financial allocations to fund their own primary healthcare needs – and pay for insurance coverage that best fits their individual situations.

The Leviticus 25 Plan makes it possible for millions of Americans to pay directly for primary health care services, without government agency and insurance company involvement.

This will massively reduce the Medicaid rolls, massively reduce Medicare outlays, massively reduce the number of people who qualify for Obamacare ‘sweeteners.’

And it will eliminate layers of fraud woven into Medicaid, Medicare, Obamacare, and other entitlement programs like the Earned Income Tax Credit, Housing assistance, and others.

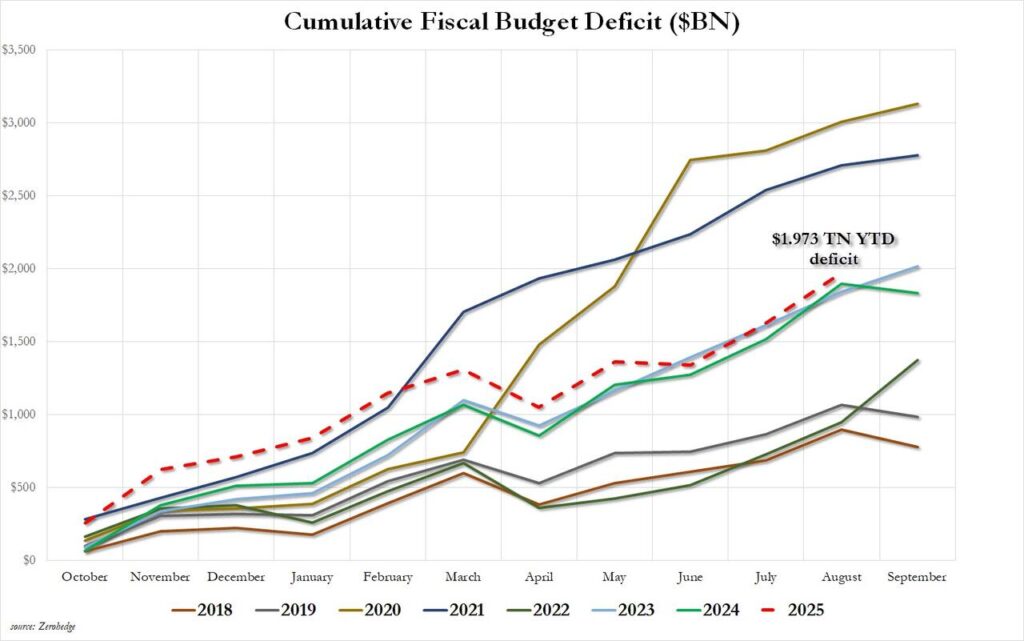

The Leviticus 25 Plan is the world’s most powerful economic rejuvenation plan in the world, It will generate $36.568 billion federal budget surpluses each of its first five years of activation (2026-2030) vs projected $2.1 trillion deficits.

And it will pay for itself entirely over the coming 10-15 years.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$95,000 per U.S. citizen – Leviticus 25 Plan 2026 (37132 downloads )