Washington-based Democrats and Republicans have a long-standing record of growing government, creating greater dependence on government among the citizenry, dreaming up new spending programs riddled with inefficiencies, waste and outright fraud.

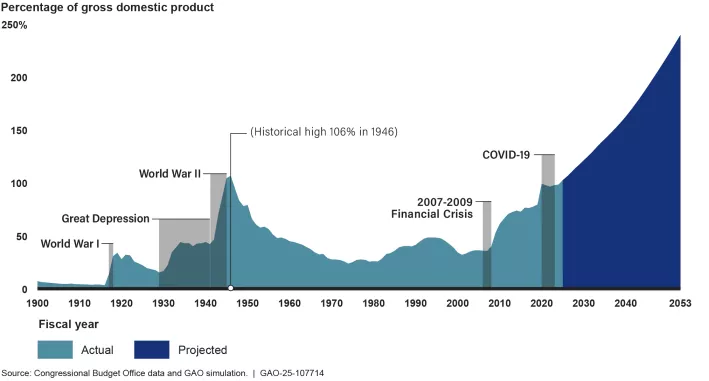

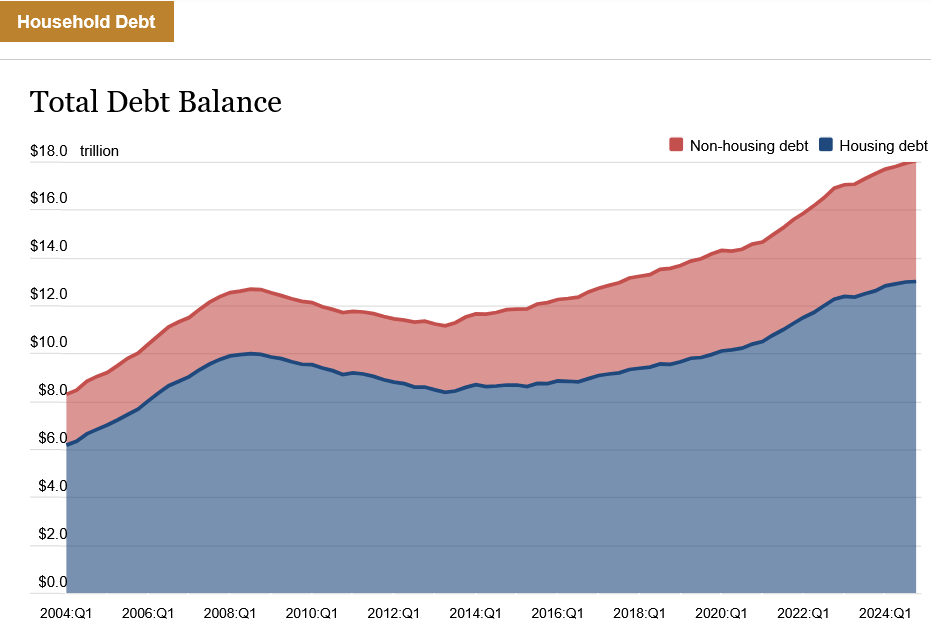

Washington political policy initiatives over the past two decades have impoverished millions of Americans, created record Household Debt burdens, stymied economic growth, and generated soaring, nightmarish federal budget deficits, massive enough to now constitute a national security issue.

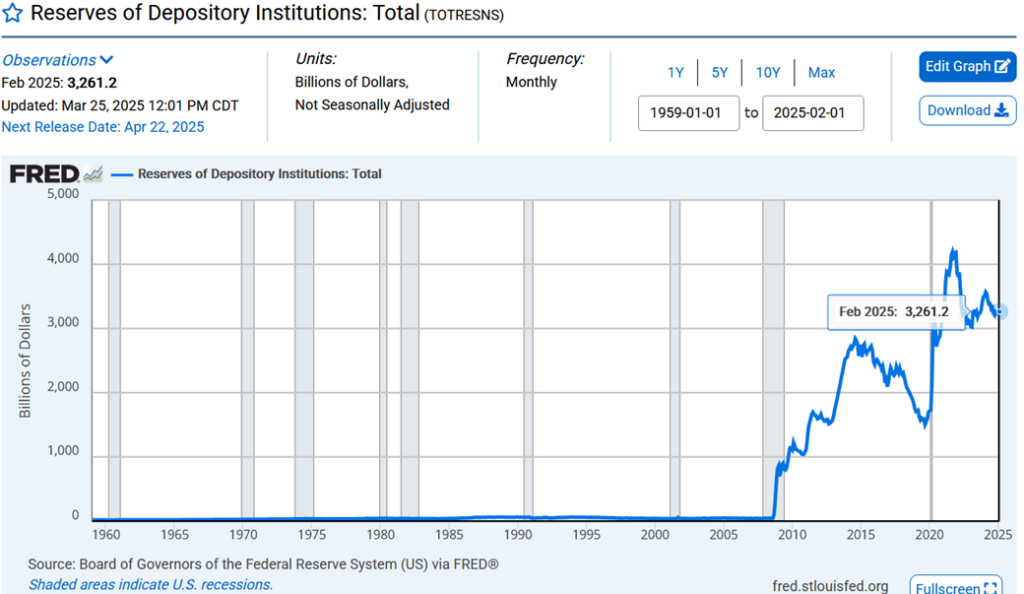

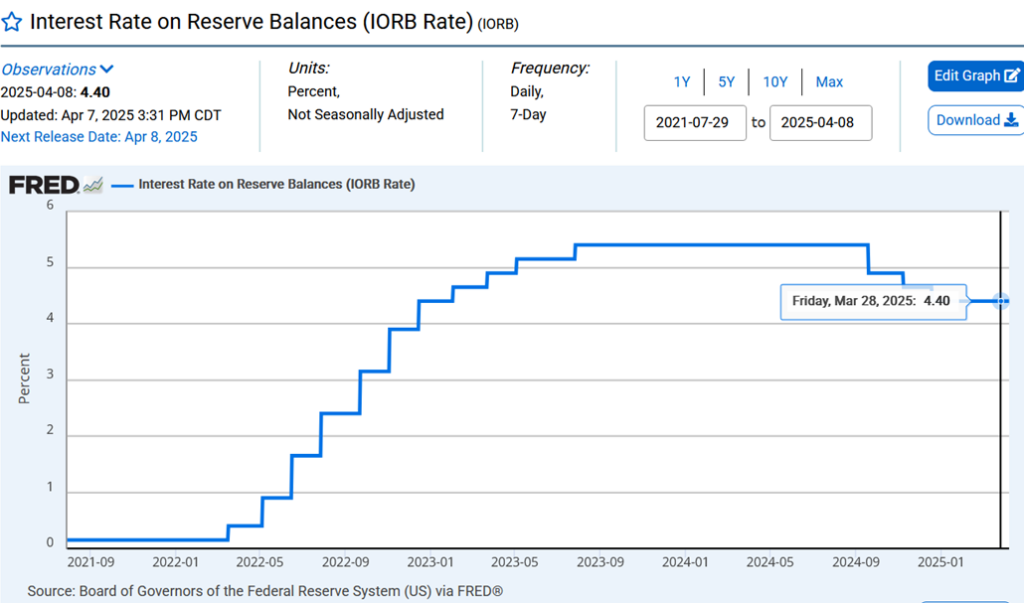

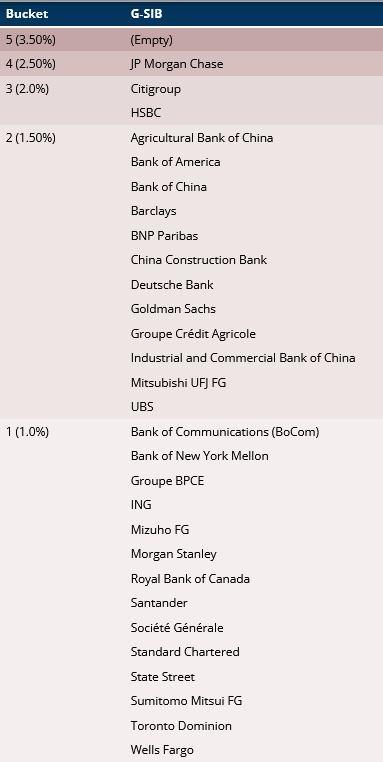

Now imagine a future America where millions of U.S. citizens were to be granted equal access to direct liquidity extensions to those which were so generously provided to major Wall Street financial institutions during the great financial crisis (2007-2010) and the Covid economic crisis (2020-2022), including: Morgan Stanley, Citigroup, Bank of America, State Street Corp, Goldman Sachs, Merrill Lynch, JPMorgan Chase, Wachovia, Lehman Brothers, Wells Fargo, Bear Stearns) and major foreign financial institutions (Royal Bank of Scotland, UBS AG, Deutsche Bank AG, Barclays, Credit Suisse. Dexia, BNP Paribas).

Imagine a future America where millions of hard-working, tax-paying U.S. citizens have eliminated massive sums of mortgage debt, paid off auto loans and installment debt, paid off student loans (or were fully reimbursed for previously paid off student loans), and are able to improve their current quality of life and save considerable sums of money toward future plans and dreams.

Imagine a future America where millions of ‘below-the-poverty-line’ families did not need ongoing government support to cover life’s basic necessities (food, housing, and primary health care expenditures).

Imagine a future where families did not need two incomes, or additional government assistance to barely cover family-specific expenses like child-care, private education, and federal, state, and local tax burdens.

And now visualize a future America where government spending has dropped precipitously, tax revenues have risen dramatically (without raising taxes), federal (and state) budget surpluses have become an ongoing reality.

America’s economy – surging into a new, long-term, revitalized, free market growth cycle.

And citizen-centered healthcare largely replacing the current big government / big corporation market-dominating partnerships.

That future is here.

The Leviticus 25 Plan – loaded up and ready to launch.

…………………..

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2026 (27484 downloads )