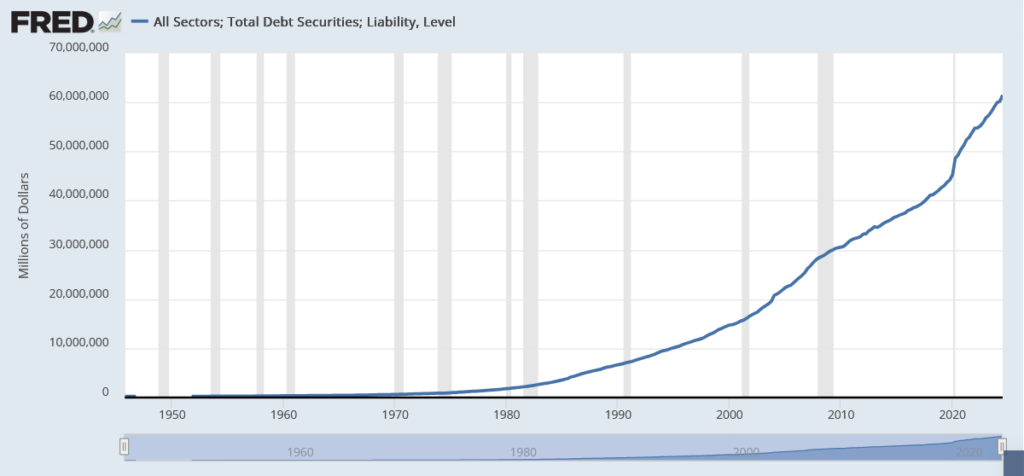

The U.S. could lead the world’s economies out of this massive debt quagmire – with the right powerful, new ‘targeted liquidity’ economic acceleration strategy: The Leviticus 25 Plan.

“He who will not apply new remedies must expect new evils.” – Sir Francis Bacon

………………………………………………………………………..

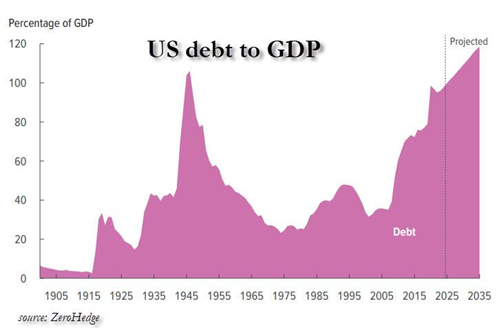

Visualizing $102 Trillion Of Global Debt In 2024– | ZeroHedge, Dec 22, 2024

In 2024, global public debt is forecast to reach $102 trillion, with the U.S. and China largely contributing to rising levels of debt.

This marks a $5 trillion increase since 2023 alone. Looking ahead, debt levels are projected to increase faster than previously expected as government policies fail to address debt risks amid aging populations and increasing healthcare costs. Going further, rising geopolitical tensions could lead to higher spending on defense, adding strain to government budgets.

This graphic, via Visual Capitalist’s Dorothy Neufeld, shows government debt by country in 2024, based on data from the IMF’s October 2024 World Economic Outlook.

Ranked: Government Debt by Country

As the world’s largest economy, the U.S. debt pile continues to balloon, accounting for 34.6% of the world’s total government debt.

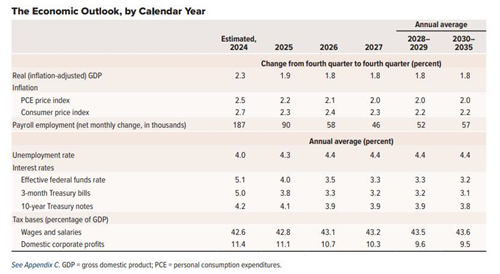

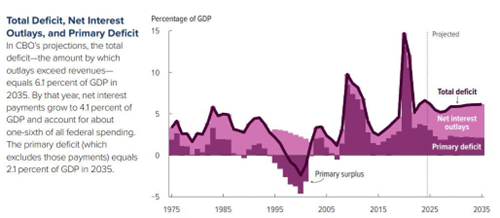

Overall, net interest payments on the national debt soared to $892 billion in the 2024 fiscal year. By 2034, these costs are forecast to reach $1.7 trillion, with total net interest costs amounting to $12.9 trillion over the next decade. A rising mountain of debt and higher interest rates are among the primary factors driving up net interest costs.

[Here] we show the gross government debt of 186 countries worldwide in 2024.

*The above table uses IMF data from October 2024, however, the most current up-to-date number for U.S. government debt is $36.1 trillion based on data from the U.S. Treasury for December 12, 2024.

China, ranking second globally, holds 16.1% of the world’s government debt.

Over the next five years, China’s debt to GDP ratio is projected to hit 111.1% of GDP, up from 90.1% in 2024. Going further, Chinese officials recently stated they are prepared to deploy stimulus measures to support the economy if Trump imposes sweeping tariffs on goods imported from China. As a result, China’s debt to GDP could rise even faster than current projections.

India, ranked seventh globally, has amassed $3.2 trillion in debt, an increase of 74% since 2019. However, thanks to its strong economic growth and fiscal policies that are increasing government revenues, debt as a percentage of GDP is projected to fall gradually from 83.1% in 2024 to 80.5% by 2028.

In Europe, the UK has amassed the most debt, about $3.65 trillion, equal to 101.8% of GDP. This is far higher than the regional average, standing at 77.4% of GDP in 2024. Europe has a lower debt to GDP than North America and the Asia-Pacific, but European budgets likely face increasing pressures looking ahead, due to sluggish economic growth, trade wars, and aging populations.

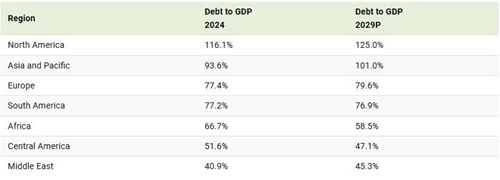

A Regional Outlook for Global Debt

Below, we show how government debt by region is projected to change over the next five years:

As we can see, average debt by country in North America is set to swell to 125% of GDP, the highest across global regions.

With governments increasingly using stimulus measures to boost the economy, it poses a greater threat to fiscal sustainability. In order to stabilize debts, the IMF stated that major spending cuts and tax hikes are needed over the next five to seven years.

Like North America, debt to GDP ratios are set to increase across Asia, Europe, and the Middle East.

Overall, world government debt is projected to exceed 100% of global output by 2029, driven by several large countries including the U.S., China, Brazil, and France, among others.

To learn more about this topic from a forward-looking perspective, check out this graphic on G7 government debt projections over the next five years.

____________________________________________

The world’s one and only government and private sector ‘debt-slaying colossus:’

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2026 (24647 downloads )