The Council on Foreigh Relations, founded in 1921, is a non-profit American organization, populated with senior government figures and politicians, bankers, lawyers, intelligence officers, and other from the elite class. With offices in New York and Washington, D.C., it is viewed as the nation’s “most influential foreign-policy think tank.”

…………………………………..

Seeking Alpha / Sep 2, 2014 5:55 AM ET – Excerpts

When an article appears in Foreign Affairs, the mouthpiece of the policy-setting Council on Foreign Relations, recommending that the Federal Reserve do a money drop directly on the 99%, you know the central bank must be down to its last bullet.

The September/October issue of Foreign Affairs features an article by Mark Blyth and Eric Lonergan titled “Print Less But Transfer More: Why Central Banks Should Give Money Directly To The People.” It’s the sort of thing normally heard only from money reformers and Social Credit enthusiasts far from the mainstream. What’s going on?

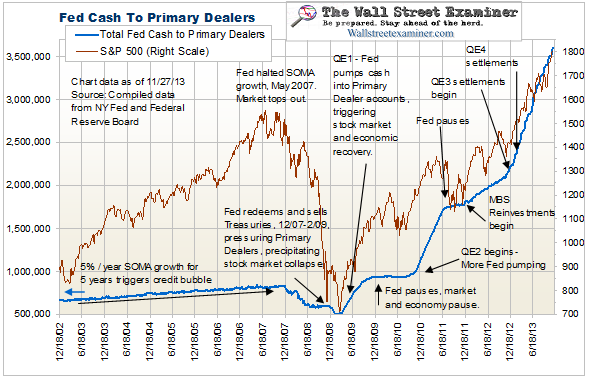

The Fed, it seems, has finally run out of other ammo. It has to taper its quantitative easing program, which is eating up the Treasuries and mortgage-backed securities needed as collateral for the repo market that is the engine of the bankers’ shell game. The Fed’s Zero Interest Rate Policy (ZIRP) has also done serious collateral damage. The banks that get the money just put it in interest-bearing Federal Reserve accounts or buy foreign debt or speculate with it; and the profits go back to the 1%, who park it offshore to avoid taxes. Worse, any increase in the money supply from increased borrowing increases the overall debt burden and compounding finance costs, which are already a major constraint on economic growth.

Meanwhile, the economy continues to teeter on the edge of deflation….

______________________________

The Council on Foreign Relations (CFR) is marginally on the right track. But their proposal does nothing to restore economic liberty in America, and it does nothing to free people from the heavy hand of government in controlling and restricting them in managing their daily affairs.

The Leviticus 25 Plan does restore economic liberty in America, and it frees people from oppressive government programs that actually keep them in poverty and servitude.

The Leviticus 25 Plan would effect wide-scale debt elimination at the family level, thereby helping to insulate millions of Americans from potentially devastating effects of another severe economic contraction.

The Plan would eliminate massive government restrictions and control over healthcare, and replace it with individual control and consumer choice in healthcare access.

The Leviticus 25 Plan would balance the federal budget – immediately in Year One.