A recent study by social scientists from Harvard and the University of Exeter examined the potential benefits of ‘free money’ transfer payments in relation to quality of life outcomes.

The Wall Street Journal, The High Cost of Free Money, July 20, 2022, discussed the results of this study.

Excerpts:

Liberals argue that no-strings-attached handouts encourage better financial decisions and healthier lifestyles. The theory is that low-income folks become more future-oriented if they’re less stressed about making ends meet. The Harvard study put this hypothesis to the test and found the opposite.

During a randomized trial conducted from July 2020 to May 2021, researchers assigned 2,073 low-income participants to receive a one-time unconditional cash transfer of either $500 or $2,000. Another 3,170 people with similar financial, demographic and socioeconomic characteristics served as a control group. The trial was funded by an anonymous nonprofit.

Participants earned an average of about $950 a month and had $530 in unearned income (e.g., food stamps). About 80% had children, and 55% were unemployed. Over 15 weeks they were surveyed about their physical, mental and financial well-being. Forty-three percent also agreed to allow researchers to observe their bank balances and financial transactions.

The top-line result: Handouts increased spending for a few weeks—on average $26 a day in the $500 group and $82 a day in the $2,000 group—but had no observable positive effect on any individual outcome. Bank overdraft fees, late-payment fees and cash advances were as common among cash recipients as in the control group.

Handout recipients fared worse on most survey outcomes. They reported less earned income and liquidity, lower work performance and satisfaction, more financial stress, sleep quality and physical health, and higher levels of loneliness and anxiety than the control group. There was no difference between the two cash groups.

These findings contradicted the predictions of 477 social scientists and policy makers the researchers surveyed. That’s not surprising. Most liberal academics and politicians believe government handouts are the solution to all problems. If transfer payments were a ticket to the middle class, the War on Poverty would have succeeded long ago.

The roots of poverty are complex, but the study isn’t a one-off in documenting a link between transfer payments and worse outcomes. A 2018 study in the Journal of the American Medical Association examined the diet quality of food-stamp beneficiaries from 2003 to 2014, a period in which average benefits increased more than 50%. Similar low-income people who didn’t get food stamps ate more healthily than those who did. The non-food-stamp group consumed significantly fewer sugar-sweetened beverages, and their diets improved more over time.

__________________________________

What exactly are transfer payments?

Answer: “In macroeconomics and finance, a transfer payment is a redistribution of income and wealth by means of the government making a payment, without goods or services being received in return. These payments are considered to be non-exhaustive because they do not directly absorb resources or create output.”

How would The Leviticus 25 Plan differ from traditional government ‘free money’ programs?

Answer: The Leviticus 25 Plan does not involve redistribution of income and wealth from one group to another, since every U.S. citizen is potentially eligible to participate, pending credit check.

Applicants, applying through registered financial institutions, must pass a job history / credit history / illicit drug history credit check to be eligible to participate.

The Leviticus 25 Plan is not a ‘free money’ program. There are major ‘strings attached.’ It does require U.S. citizen participants to give up income tax refunds and specified government transfer payments for a period of 5 years.

The Leviticus 25 Plan will generate $583 billion federal budget surpluses for the initial 5 years of activation (2023-2027), and completely pay for itself over the next 10-15 years.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America 2023

Economic Scoring links:

Full Plan:Leviticus 25 Plan 2023 (4123 downloads)

Website: https://Leviticus25Plan.org

__________________________________________

Preview 1:

The Leviticus 25 Plan provides a $90,000 credit extension, direct from the Federal Reserve, to every participating U.S. citizen: $60,000 into a Family Account (FA) and $30,000 into a Medical Savings Account (MSA).

Example: Qualifying family of four would receive $240,000 in their FA, and $120,000 in their MSA.

Primary goals: Massive debt elimination at family level: mortgage debt, consumer debt, student loan debt. Federal budget surpluses.

Eligibility: U.S. Citizen. Job history, credit history requirement (similar to traditional credit checks for bank loans). Clean recent drug history. Clean crime history.

Requirements: Forego all federal and state tax refunds for 5-year period.

Forego selected means-tested welfare benefits – for minimum 5-year period.

Forego all income security program benefits – for minimum 5-year period.

Forego new federally-subsidized ‘Family Medical Leave’ benefits – for minimum 5-year period.

Forego Child Tax Credit benefits – for minimum 5-year period.

Forego enhanced federal rental forbearance/assistance – for minimum 5-year period.

Forego SSI and SSDI for minimum 5-year period.

New $6,000 deductible on primary care access to: Medicare, Medicaid, VA, TRICARE, FEHB – for minimum 5-year period.

The Plan assumes that the elite-wealthy will not participate, because their refunds are too valuable to give up over the requisite 5-year period.

The Plan also assumes that many who heavily depend on social welfare benefits will also choose not to participate, because the overriding value of those benefits, vs foregoing them, over the 5-year period.

Preview 2:

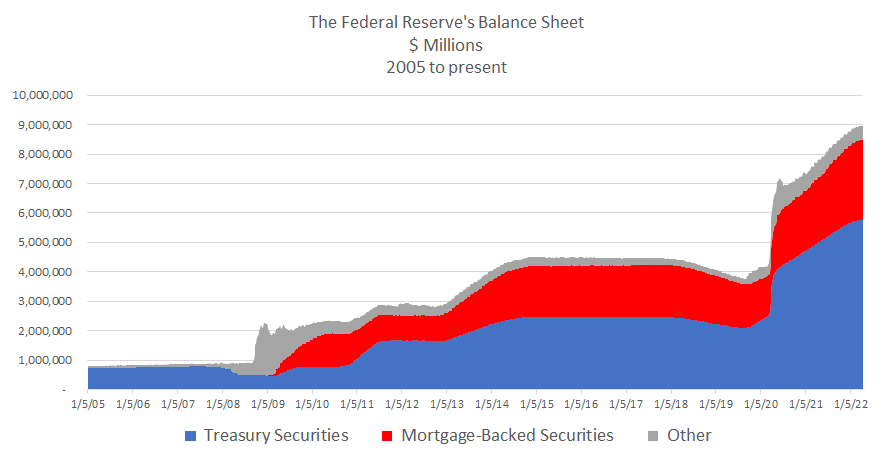

The Leviticus 25 Plan grants the same direct access to liquidity, through a Fed-based Citizens Credit Facility, similar to the credit facilities that were created by the Fed to transfuse trillions of dollars in direct transfers and credit extensions to Wall Street’s major banks, credit agencies and insurers during the great financial crisis.

The following facilities were created and activated by the Fed for this massive Wall Street bail out operation: Term Auction Facility (TAF), Primary Dealer Credit Facility (PDCF), Term Securities Lending Facility (TSLF), currency swap agreements with several foreign central banks, Commercial Paper Funding Facility (CPFF), Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility (AMLF), Money Market Investor Funding Facility (MMIFF), and the Term Asset-Backed Securities Loan Facility (TALF), and access to the Fed’s Discount Window.

Additional perspective: SIGTARP, the oversight agency of the Troubled Asset Relief Program (TARP), in its July 2009 report, vetted by Treasury, noted that the U.S. Government’s “Total Potential Support Related to Crisis” (page 138) amounted to $23.7 trillion. While this figure represents a backstop commitment, not a measure of total potential loss, it is nonetheless an astounding degree of support, in the form of liquidity infusions, credit extensions and guarantees, various other forms of assistance for financial institutions and other business entities affected by the financial crisis.

Preview 3:

The Leviticus 25 Plan website has been accessed on one or more occasions by the following financial enterprises/agencies:

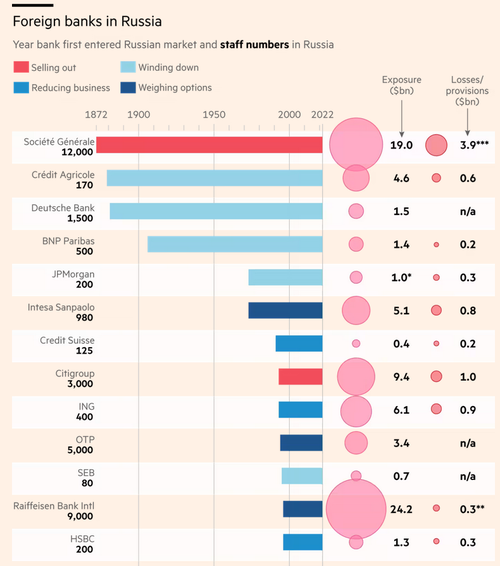

JP Morgan, Goldman Sachs, Morgan Stanley, Bank of America, Citigroup, Wells Fargo, State Street, Merrill Lynch, AIG, Barclays Plc, Royal Bank of Scotland, Deutsche Bank, Société Générale S.A, UBS AG, Credit Suisse, BNP Paribas,The U.S. Department of Treasury, General Accountability Office (GAO), The European Central Bank (ECB), Bank of England (BOE), Swiss National Bank (SNB), Bank of Canada, Bank of Montreal, Bank for International Settlements (BIS).

………………………………………………………..

The General Accountability Office has stated that America’s ongoing debt crisis is unsustainable.

It is time for America to initiate a bold, new plan.

The Leviticus 25 Plan is loaded up and ready to launch.