“You never change things by fighting against the existing reality. To change something, build a new model that makes the old model obsolete.” – Buckminster Fuller

It is time for a new qualitatively new economic model: The Leviticus 25 Plan

“You never change things by fighting against the existing reality. To change something, build a new model that makes the old model obsolete.” – Buckminster Fuller

It is time for a new qualitatively new economic model: The Leviticus 25 Plan

Jeroen Dijsselbloem has been a major player in European financial circles. A Dutch politician, Dijsselbloem became President of the Eurogroup, comprised of the finance ministers of the Eurozone, in January 2013 and served in that capacity until just recently.He offered a frank admission just last month about the naked, taxpayer-financed bailout of major banks.

…………………………………………..

Dijsselbloem Admits “We Used Taxpayers’ Money To Bailout The Banks”

ZeroHedge, Nov 10, 2017: Excerpts:

“We had a banking crisis, a fiscal crisis and we spent lot of the tax-payers’ money – in the wrong way, in my opinion – to save the banks” outgoing Eurogroup head Jeroen Dijsselbloem said adding “so that the people criticizing us and saying that everything was being done for the benefit of the banks were to some extent right.”

“This is valid for the banks of all our countries. Everywhere in Europe banks were saved at taxpayers’ cost,” he underlined.

“This was the reason for banking union and the introduction of higher standards, better supervision and a reform and rescue framework when banks have losses,” he said stressing “precisely so that we don’t find ourselves in that situation again.”

__________________________

Again…: “This is valid for the banks of all our countries. Everywhere in Europe banks were saved at taxpayers’ cost.”

Exactly the same in the U.S.

Fine. The Fed did what it had to do.

Now it is time to level the playing field by granting U.S. citizens the same direct access to liquidity that was provided to Wall Street’s financial sector.

If taxpayer money can be used to bailout the very institutions which precipitated the financial crisis, then taxpayer money can be used to restore the financial health of the taxpayers.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,00 per U.S. citizen – Leviticus 25 Plan 2022 (3837 downloads)

WSJ Letters: Who You Gonna Believe on Monetary Policy?

Judy Shelton on the Fed, inflation and fiscal policy.

June 24, 2021

Who’s in charge of inflation these days? Or perhaps better stated: Who’s to blame? When Congress engages in deficit spending, it must issue debt to cover the difference between federal budget revenues and expenditures. When the Federal Reserve purchases that Treasury debt, it creates new money to pay for it—and the Fed created trillions in new money during Covid by crediting depository accounts of banks.

Now that Covid seems to be receding as an economic threat, what happens to all that potential purchasing power? Who is overseeing monetary policy to ensure that inflation doesn’t undermine economic recovery? Joseph C. Sternberg poses the question: “Is There a Central Banker in the House?” (Political Economics, June 18) and wonders why, with inflation exceeding the Fed’s predictions, Fed Chairman Jerome Powell plays down the risk in his public comments. Delivering price stability is part of the U.S. central bank’s mandate from Congress, after all, yet the Fed remains in “accommodative” monetary mode.

It’s time to confront both the fiscal and monetary aspects of inflation: Government policies that cause prices to rise without expanding productive economic output amount to an expropriation of wealth—one that hurts the poor the most.

The latest “forward guidance” from Mr. Powell may assuage the fears of market investors who don’t want to see any reduction in the Fed’s monthly bond purchases. But it’s a different story for those struggling to pay rising bills—for groceries, gas, furniture and rent. “Who you gonna believe,” goes the famous line from the Marx Brothers’ “Duck Soup,” “me or your own eyes?”

Judy Shelton

Fredericksburg, Va.

Ms. Shelton, a senior fellow at the Independent Institute, was nominated to the Federal Reserve Board of Governors in 2020.

________________________________________

The Leviticus 25 Plan is a perfect counter-plan to “expand productive economic output” without expropriating wealth.

It will revitalize productivity and economic growth, restore financial health to millions of American families, stabilize the U.S. Dollar for long-term strength and viability, generate $383 billion federal budget surpluses and price stability in the U.S. economic system.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2022 (3832 downloads)

Global Central Banks are all ‘mushrooming’ their balance sheets up to unheard of levels to try to keep their respective economies from sinking deeper into the global ‘debt bog.’

And they are losing the battle. Global Debt is exploding, and economies are stagnating.

Here in the U.S., the Federal government is on a colossal spending spree, adding hundreds of billions of dollars to already-bursting entitlement programs (rent relief benefits, 25% food stamp enhancement, covering for student loans in default, expanding medicaid, broadening eligibility for Medicare benefits, billions of dollars for ‘free’ Covid immunizations), and things like….

The White House Budget (newly released details):

Aug 5, 2021: A few quotes about taxpayer money spent on useless climate studies from a fascinating site called Open The Book

Quote The Third—White House Pluted Bloatocrats

Today, on July 1st, the Biden administration released the annual Report to Congress on White House Office Personnel. President Biden hired czars, expensive “fellows,” “assistants,” and spent on a much larger First Lady (FLOTUS) staff.

The payroll report included the name, status, salary and position title of all 567 White House employees costing taxpayers $49.6 million. (Search Biden’s White House payroll and Trump’s four years posted at OpenTheBooks.com.)

Since January, the Biden administration has quickly staffed up. Here are some key findings from our auditors at OpenTheBooks.com:

• There are 190 more employees on White House staff under Biden than under Trump (377) and 80 more than under Obama (487) at this point in their respective presidencies.

• $9.6 million increase in payroll spending vs. the Trump FY2017 payroll. In 2017, the Trump White House spent $40 million for 377 employees, while the Biden payroll amounts to $49.6 million for 567 employees. All spending amounts are inflation adjusted.

• Hires include 320 female staffers ($28.9 million salaries) vs. 240 male staffers ($20.8 million salaries). In terms of top staffers — Special Assistants — there are 52 female ($6.3 million salaries) vs. 10 males ($1.2 million).

• Currently, there are 12 staffers dedicated – at least in part – to Dr. Jill Biden vs. five staffers who served Melania Trump in her first year (FY2017).

• Counts of the “Assistants to the President” – the most trusted advisors to the president – are the same (22) in for the Biden administration and the Trump and Obama administrations. This year, these advisors make $180,000.

……………………………………………………………………….

Meanwhile, over at the Fed…

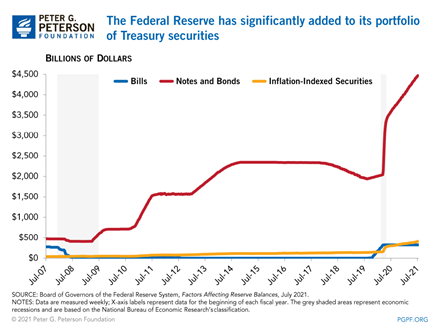

The Federal Reserve Holds More Treasury Notes and Bonds than Ever Before

Peter G. Peterson Foundation – July 28, 2021: https://www.pgpf.org/blog/2021/07/the-federal-reserve-holds-more-treasury-notes-and-bonds-than-ever-before

The U.S. Federal Reserve has significantly ramped up its holdings of Treasury securities as part of a broader effort to counteract the economic impact of the coronavirus (COVID-19) pandemic. Currently, the Federal Reserve holds more Treasury notes and bonds than ever before.

As of July 14, 2021, the Federal Reserve has a portfolio totaling $8.3 trillion in assets, an increase of about $3.6 trillion since March 18, 2020. Longer-term Treasury notes and bonds (excluding inflation-indexed securities) comprise nearly two-thirds of that expansion, with holdings of those two types of securities doubling from $2.2 trillion on March 18, 2020, to $4.5 trillion on July 14, 2021.

By comparison, the Federal Reserve only increased its holdings of Treasury notes and bonds by $116 billion, or roughly 25 percent, between December 5, 2007 and June 24, 2009 (a period known as the Great Recession). Over that same period, the Federal Reserve expanded its total portfolio from $920 billion in December 2007 to $2.1 trillion in June 2009, a total increase of $1.2 trillion. Much of that increase stemmed from the purchase of mortgage-backed securities and the implementation of new programs to address the economic slowdown.

________________________________

There is a dynamic economic acceleration plan, loaded up and ready to go, with the raw power to rescue America and restore economic liberty for U.S. citizens.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S citizen – Leviticus 25 Plan 2022 (3823 downloads)

The Fed may ‘talk’ about tapering and rate normalization, but there can be very little question that there will be a long succession of geopolitical ‘events,’ liquidity crises, and stagflationary pressures of various sorts which will require Fed ‘intervention’ – in the form of ‘new money creation’ and balance sheet expansion.

The Fed, along with the European Central Band, Bank of Japan, Bank of England, Swiss National Bank, and the People’s Bank of China, are feeding the flames of septic ‘disorder’ in the Foreign Exchange (FOREX) markets – in the form of wild valuation fluctuations among the world’s major fiat currencies.

Thankfully, there is a way out of this toxic mess….

…………………………………………………………………………….

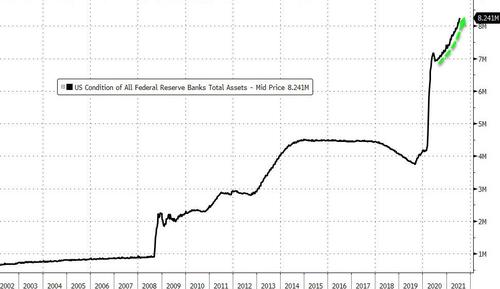

Another Fed Balance Sheet Record; Where’s The Exit Door?

ZeroHedge, Jul 28, 2021 – Excerpts:

As of July 21, the Fed balance sheet stood at a record $8.24 trillion. In the previous week, the central bank expanded the balance sheet by $39 billion. In July alone, the Fed has added $162 billion to its balance sheet. The Fed can talk about tapering all it wants. The markets can expect the Fed to give up its “transitory inflation” narrative and turn to tightening all they want. But the reality is extraordinary monetary policy continues unabated.

And there’s no sign it will stop any time soon.

The Fed balance sheet has nearly doubled in just a little over one year. It stood at a mere $4.159 trillion on Feb 24, the cusp of the COVID-19 pandemic. The New York Fed projects the balance sheet will top $9 trillion before all is said and done. And I would call that projection very conservative.

In a note, Wells Fargo Institute head of global fixed income strategy Brian Rehling said even when tapering begins, it will take a long time for asset purchases to end.

While Fed tapering whispers may have started, we expect it to be long and drawn out. Once the Fed begins the tapering process, we anticipate it will be about one year before the Fed stops increasing the size of its balance sheet.”

And Rehling said he expects that even after the Fed finishes QE, the balance sheet will remain at its ending level – however high that may end up being – until at least 2025.

What happens when you pull out props? Things fall down. The moment the Fed announces substantive monetary tightening, the stock market will tank and corporate earnings will sag. We’ve seen this song and dance before.

The Fed balance grew from $898.6 billion in August 2008 to a peak of just over $4.5 trillion in Jan. 2015. The Fed didn’t get around to significantly shrinking the balance sheet until 2018. The central bankers claimed balance sheet reduction was on autopilot, but that didn’t last long. The balance sheet dipped to $3.76 trillion in late August of 2019. From there it took an upward trajectory. Although they didn’t call it quantitative easing, the Fed had already pivoted back to QE in 2019, long before coronavirus reared its ugly head. In the fall of that year, the stock market tanked. The over-indebted economy couldn’t even handle a modest move toward monetary policy normalization. Once the stock market threw its taper-tantrum, the Fed pivoted back toward loose monetary policy.

Since the onset of the pandemic, the Federal Reserve balance sheet has grown nearly twice as large as it was at its peak in the wake of the Great Recession. Debt has skyrocketed. The US government alone added more than $4 trillion to its debt-load over the last year and a half.

If history provides any indication, the notion of a serious pivot to monetary policy normalization is nothing but a fantasy.

____________________________________________

“Fantasy” becomes reality with the most powerful economic acceleration plan in the world.

The Leviticus 25 Plan will eliminate massive amounts of ‘ground level’ debt – which is the pivotal factor in getting America back on track for long-term economic growth and financial stability.

The Leviticus 25 Plan will reduce dependence on government and sharply reverse the growth of America’s socialist entitlement programs.

The Leviticus 25 Plan will generate massive tax revenue growth and produce $383 billion government surpluses in each of its first five years of activation.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2022 (3809 downloads)

August 2021 quote: “We must make the building of a free society once more an intellectual adventure, a deed of courage…. Unless we can make the philosophic foundations of a free society once more a living intellectual issue, and its implementation a task which challenges the ingenuity and imagination of our liveliest minds, the prospects of freedom are indeed dark. But if we can regain that belief in the power of ideas which was the mark of liberalism at its best, the battle is not lost.” ― Friedrich August von Hayek

Fed ‘lathered the banks up’ with trillions of dollars in free money, credit guarantees, ‘toxic paper’ transfers onto the Fed’s balance sheet. And they are still at it, 13 years later…

……………………………………………………………………………

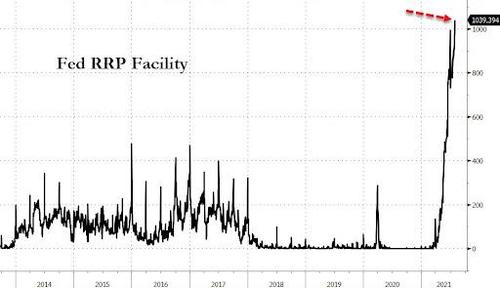

ZeroHedge / Jul 30, 2021 – Excerpts:

It’s official: at exactly 1:15pm today, the NY Fed reported that for the first time ever, 86 counterparties parked over $1 trillion in reserves at the Fed’s Reverse Repo Facility for overnight ‘safekeeping’ and collecting a nice, fat yield of 0.05% – representing hundreds of millions in absolutely free money as these are reserves that the Fed has previously handed out to banks – for free – who then turned around and handed it right back to the Fed where it collected a small but nominal interest.

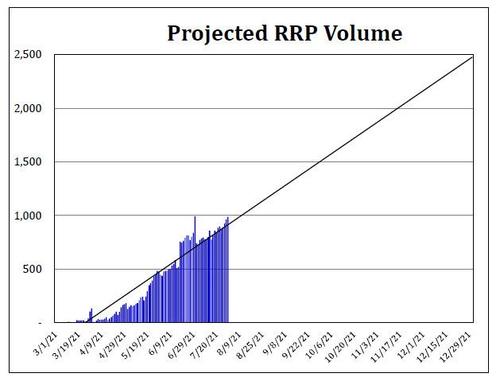

Of course, it is month-end (if not quarter-end) so we do get some window-dressing but even without it, it’s only matter of time before we got consistent $1 trillion prints… which then become $2 trillion and so on.

In fact, the question of how big the Fed’s reverse repo facility – which as explained previously is just how the Fed recycles all its massive reserves which it keeps injecting into the financial system (if not economy) at a pace of $120 billion per month – is one we discussed yesterday, and highlighted a calculation by Curvature’s repo guru Scott Skyrm who made the following observations:

During the month of April, RRP volume increased by $49 billion. $296 billion during the month of May, $362 billion in June, and $124 billion in July. If RRP volume continues around the same pace, say $200 billion a month, RRP volume will reach $2 trillion by the end of the year.

Looking at the trendline, it puts RRP volume at $2.5 trillion by the end of the year. However, the RRP volume at the end of the year will be a far larger number due to year-end window dressing, meaning it will likely approach if not surpass $3 trillion on Dec 31, 2021.

A few rhetorical questions from Skyrm to conclude: what will be the impact of $2 trillion going into the RRP each day? How will this affect the markets? Will the Fed need to adjust the RRP rate again?

_________________________________________

The Leviticus 25 Plan, on the other hand, re-targets the Fed’s liquidity flows, so that these types of ‘bank funding infusions’ pass first through the hands of U.S. citizens, via a Citizens Credit Facility, on their way to the banks – in the form of debt elimination (mortgage debt, credit card and household debt, student loans, car loans).

And… then everybody wins – even the Fed, as the Leviticus 25 Plan pays for itself entirely over a period of 10-15 years.

The most powerful economic acceleration plan in the universe.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2022 (3807 downloads)

The Leviticus 25 Plan grants the same access to liquidity extensions that were provided to the likes of Morgan Stanley, Bank of America, Goldman Sachs, JP Morgan, Citigroup, UBS AG, Barclays, Deutsche Bank, Royal Bank of Scotland, BNP Paribas, Wells Fargo, along with brokerages and insurers like Merrill Lynch and AIG during the financial crisis, to bail them out of their subprime misadventures and restore them to ‘financial health.’

The Leviticus 25 Plan’s primary goal is to, in like manner, restore ‘financial health’ for American families, through a massive debt pay-down and a revitalization of economic liberty and free market dynamics.

The Plan will materially reduce the gross levels of U.S. citizens’ dependence on government subsistence programs, and thereby relieve citizens from the stifling, freedom-robbing effects of government influence and control over their daily affairs.

The Plan will re-energize vigorous, sustainable economic growth, and it will recapture massive amounts of tax refund and social welfare payouts, with a net result at the federal level of $383 billion budget surpluses over each of the first five years following launch.

The $383 billion federal budget surplus is based solely upon The Plan’s recapture benefits. It does not include the new tax revenues that would be generated from the substantial gains in economic growth.

The $383 billion estimate therefore understates the true growth in tax revenues that would accrue.

The power and agility of The Leviticus 25 Plan Imagine the dynamic growth benefits of an economic plan granting liquidity benefits sufficient to pay off 60% of the mortgage debt in the U.S..

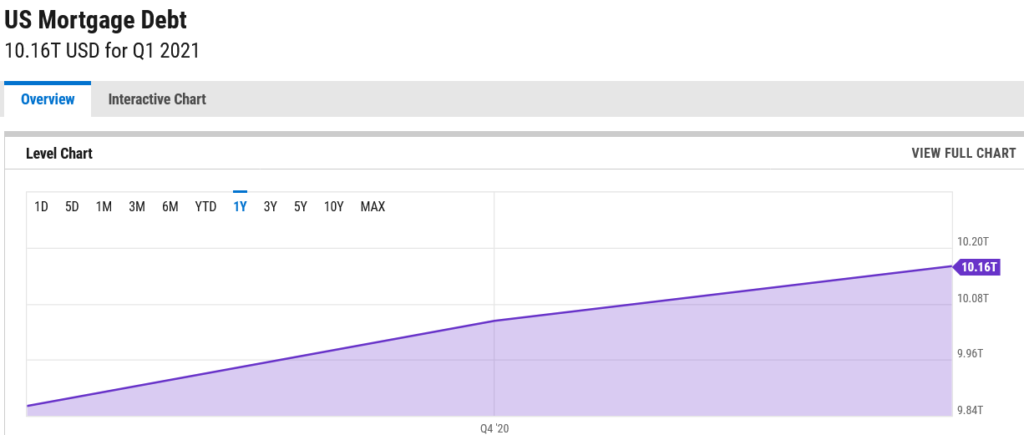

The chart below from Y-Charts shows a current mortgage debt load in the U.S. of $10.167 trillion. A 60% pay-down in that debt would eliminate $6 trillion in mortgage debt.

That $6 trillion would, in effect, pay off 30 million mortgages, each with a balance of $200,000. Assuming a 3.5% rate of interest and a period of 20 years to maturity, the “total cost of mortgage” on each of the mortgages would amount to $323,000. The net debt reduction benefit from the elimination of 6 million $200,000 mortgages over a 20 year period would be $9.69 trillion.

On a monthly basis, a $200,000 mortgage with a 3.5% rate of interest and 20 years to maturity would require principle and interest payment of approximately $898 in monthly debt service.

Eliminating that $898 monthly debt service payment for 30 million families would result in ~$900 of newfound discretionary liquidity for each family each and every month for the next 20 years. And that would amount to $27 billion in new money for main street America each month for the next 20 years.

This $27 billion in new liquidity flows for main street America would strengthen small business, increase growth in quality jobs, increase tax revenue and payroll tax growth.

________________________________

The Leviticus 25 Plan is a powerful economic growth engine like no other plan in existence. It is a powerful defender of individual freedom and liberty like no other.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2022 (3803 downloads)

………………………………………………………………………………..

Basel III & CBDCs: The Seismic Changes Facing The Global Financial System

Authored by Alasdair Macleod via GoldMoney.com, / https://www.goldmoney.com/research/goldmoney-insights/banking-faces-seismic-changes

Excerpts:

The role of commercial banks in the global economy is changing, with lending to governments and their agencies now more important than lending to goods and services industries. It is a trend which is due to continue.

The new Basel 3 regulations seem set to encourage this trend, despite retail depositors being accorded a stable funding status. Central bank digital currencies are anticipated to augment and perhaps replace non-financial business credit over the next five to ten years.

But the increasing financialisation of commercial banking brings the risk of tying its future firmly to a financial bubble. And with price inflation on the increase, it is only a matter of very little time before that bubble bursts.

……….

Behind the convenience of a CBDC solution important monetary and economic considerations are being assumed or ignored. While central and commercial bank credit is expected to be continually expanded to finance government spending and asset inflation, the increasingly obvious consequences for prices are certain to lead to higher interest rates —and soon.

Central banks will find they have to escalate their attempts to support asset prices in financial markets, by yet further monetary expansion, or risk seeing the asset bubble implode. By embarking on a policy of engendering economic confidence by a perpetual bull market, central banks have tied the fate of their currencies to stock and bond markets.

The strategy of large commercial banks being increasingly committed to purely financial activities and turning their backs on non-financial credit expansion has led to them swapping one risk for another. Furthermore, in financial activities banks are increasingly bound to each other’s fate, exchanging counterparty risk from industrial debtors for those with other banks. And nowhere does this matter more than in cross-border banking relationships, where undercapitalised banks in, say, the EU, pose a global systemic risk which is not addressed by Basel 3’s NSFR.

……………………

We are facing global systemic financial system risk – brought on by the massive debt loads that are burying governments, businesses and citizens.

For the U.S., there is one powerful solution to this looming catastrophe – a solution that will eliminate massive amounts of ‘ground level’ debt, dramatically reduce government deficits, reduce dependence on government entitlement programs, restore a ‘citizen centered’ health care system, and recharge America’s long-term economic growth engine.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2022 (3796 downloads)

Justice David Brewer on Free, Self-Governing Americans

David J. Brewer (1837-1910) served as an associate justice on the United States Supreme Court for 20 years, from 1889 to 1910. He strongly advocated equal rights and respect for women, worked for equal opportunities for black Americans, and supported freedom of association among workers. In a series of lectures delivered at Yale University on American Citizenship (1902), Justice Brewer explained what it meant to be an American in terms of defining beliefs and ideas:

“This is a government of and by and for the people. It rests upon the thought that to each individual belong the inalienable rights to life, liberty and the pursuit of happiness. It affirms that the nation exists not for the benefit of one man, or set of men, but to secure to each and all the fullest opportunity for personal development. It stands against the governments of the Old World in that there the thought is that the individual lives for the nation; here the nation exists for the individual…

“Far be it for me to affirm that we have lived up to our ideals. I am making no Fourth of July speech. On the contrary, our history has disclosed many shortcomings. We have not been free from the weaknesses of human nature. But, notwithstanding all our failures, nowhere has there been a closer living to the ideals of popular government, and nowhere are the possibilities of future success greater.

“If, therefore, the chief object of national existence is to secure to each individual the fullest protection in all inalienable rights and the fullest opportunity for personal advancement, and if this nation has come nearer than any other to the realization of this ideal, and if by virtue of its situation, its population, and its development, it has the greatest promise of full realization of this ideal in the future, surely it must be that the obligations of its citizens to it are nowhere surpassed.” (pp. 14, 17-18)