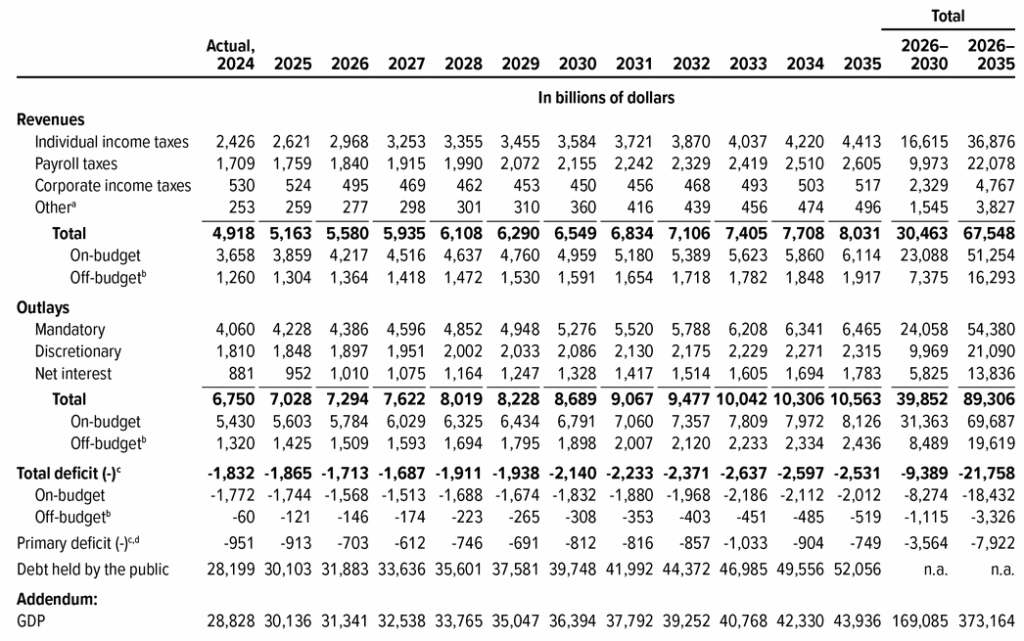

Yes… $23.7 trillion

……………………………………………………..

A look back…

Neil Barofsky, the Special Inspector General of the Troubled Asset Relief Program filed an official SIG TARP report in July 2009 projecting the government’s “Total Potential Support Related to Crisis” at an astounding $23.7 trillion.

Barofsky’s report was immediately criticized as being misleading in its characterizations, prompting him to respond on May 12, 2014 to one of the chief critics, Tim Geithner, who was Secretary of the Treasury during the crisis years.

The SIG TARP report did not say that the government might “lose” $23.7 trillion, as critics claimed.

Barofsky: “What the report actually ascribes to that number (at page 138) is the “Total Potential Support Related To Crisis” (and not potential losses) of the myriad pledges of support to the financial system from an alphabet soup of agencies and programs. The numbers underlying that estimate, of course, were provided to us by Treasury and other governmental agencies, the report was vetted with Treasury before it was issued, and the report makes clear in a series of caveats that it was not an estimate of actual potential losses.

Again, the U.S. government’s “Total Potential Support Related to the Crisis” weighed in at an astounding $23.7 trillion.

The effects of that “support” for main street America were marginal, with the best of it short-lived.

_________________________________________

The Leviticus 25 Plan features a Citizens Credit Facility – to serve as the conduit, from the Fed through the U.S. Department of the Treasury, for direct liquidity access by U.S. citizens – the same direct of access that was granted to Wall Street financial heavyweights during the crisis.

The Leviticus 25 Plan will provide for massive ‘ground level’ debt elimination and restore financial health for millions of American families. Money would still flow into the banking system – after first passing through the hands of U.S. citizens and the millions of small businesses in main street America.

The Leviticus 25 Plan would re-ignite powerful, long-term economic growth and put America on track for substantial budget surpluses. It would drastically scale back government control over the daily affairs of citizens. It would restore basic social freedoms and economic liberty for all.

Question: What would be the U.S. government’s “Total Potential Support Related to The Leviticus 25 Plan?”

Answer: $21.6 trillion – all of which would get ‘repaid’ to the government over a 10-15 year period.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

It is time for an economic recovery plan that grants access to liquidity for all Americans, not just Wall Street and the wealthy ‘elite.’

Loaded up and ready to launch: The Leviticus 25 Plan 2026.

……………………………………………………………

Global Banks 2008: “We need a transfusion.” And $23.7 trillion later, the Fed said: “Tell Us When to Stop.”

And transfuse they did.

The U.S. Treasury turned the spigot into the ‘flow’ position with the Troubled Asset Relief Program (TARP).

And the Fed followed up by turning the spigot into the ‘gusher’ position with their emergency lending, discount window lending, and their QE-based purchases of cesspool-grade MBS and agency debt from various global lending institutions.

……………………………………………………………

Notes on the liquidity transfusions:

1. SIGTARP, the oversight agency of the Troubled Asset Relief Program (TARP), in its July 2009 report, vetted by Treasury, noted that the U.S. Government’s “Total Potential Support Related to Crisis” (page 138) amounted to $23.7 trillion. While this figure represents a backstop commitment, not a measure of total potential loss, it is nonetheless an astounding degree of support, in the form of liquidity infusions, credit extensions and guarantees, various other forms of assistance for financial institutions and other business entities affected by the financial crisis.

One example of the mechanics of these backstop commitments involved two of the major investment-banks which were at the forefront of the U.S. financial crisis, Goldman Sachs and JP Morgan who, through their high-risk exposure to subprime debt and derivatives, received enormous financial assistance at the expense of U.S. taxpayers.

Goldman Sachs and J.P. Morgan received these direct liquidity infusions during the financial crisis via Fed disbursements through the Primary Dealer Credit Facility and numerous other credit facilities. The two (according to ZeroHedge 4-1-11) “had the temerity to pledge bonds that had defaulted (i.e. had a rating of D)… as in bankrupt, and pretty much worthless. . . that have no value whatsoever. . .” Goldman Sachs received $24.7 million and JP Morgan $1.4 million on the worthless collateral (September 15, 2008). Goldman Sachs pledged D-rated securities again September 29, 2008 and received $82.7 million (Citigroup received $102.8 million; Merrill Lynch – $217.8 million; Morgan Stanley – $261.0 million; UBS – $202.2 million).

In addition, the same two investment banking giants, Goldman Sachs and JP Morgan, earned free interest (again at taxpayer expense) through their access to credit extensions at the Federal Reserve discount window. Within two years, Goldman Sachs was paying out $111.3 million in “delayed bonuses” for the years 2007 and 2009 (NY Times 12-15-10).

_________________________________

U.S. citizens deserve nothing less than to be grated the same direct access to credit extensions for resolving liquidity issues of their own at the family level, than those that were so graciously provided by the Fed to major domestic and foreign financial institutions.

The initial credit extension outlay with The Leviticus 25 Plan ($21.6 trillion – assuming an 80% participation rate by U.S. citizens) would hardly be prohibitive, in light of the trillions of dollars in Federal Reserve and Treasury outlays over the past 5 years to major U.S. banking and financial institutions (Morgan Stanley, Citigroup, Bank of America, State Street Corp, Goldman Sachs, Merrill Lynch, JPMorgan Chase, Wachovia, Lehman Brothers, Wells Fargo, Bear Stearns) and major foreign financial institutions (Royal Bank of Scotland, UGS AG, Deutsche Bank AG, Barclays, Credit Suisse. Dexia, BNP Paribas).

The Federal Reserve’s various credit facilities, discount window transactions, emergency loans, Foreign Exchange swap lines, Interest on Excess Reserves (IOER) for foreign banks, and Treasury’s TARP and stimulus programs have done little to improve the financial status for the majority of American families. These government programs have also done nothing to change the dominance and risk profile of “too big to fail banks,” and they have done little to lessen the counterparty default risk in the global derivatives markets.

The time is now to rebalance the financial dynamics of America – and grant U.S. citizens the same direct access to liquidity that was provided to Wall Street’s financial sector.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2026 (28046 downloads )