Fed ‘lathered the banks up’ with trillions of dollars in free money, credit guarantees, ‘toxic paper’ transfers onto the Fed’s balance sheet. And they are still at it, 13 years later…

……………………………………………………………………………

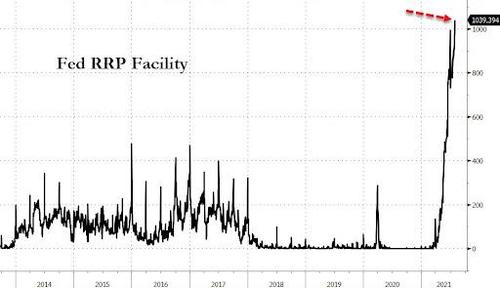

We Have The First Trillion Dollar Reverse Repo

ZeroHedge / Jul 30, 2021 – Excerpts:

It’s official: at exactly 1:15pm today, the NY Fed reported that for the first time ever, 86 counterparties parked over $1 trillion in reserves at the Fed’s Reverse Repo Facility for overnight ‘safekeeping’ and collecting a nice, fat yield of 0.05% – representing hundreds of millions in absolutely free money as these are reserves that the Fed has previously handed out to banks – for free – who then turned around and handed it right back to the Fed where it collected a small but nominal interest.

Of course, it is month-end (if not quarter-end) so we do get some window-dressing but even without it, it’s only matter of time before we got consistent $1 trillion prints… which then become $2 trillion and so on.

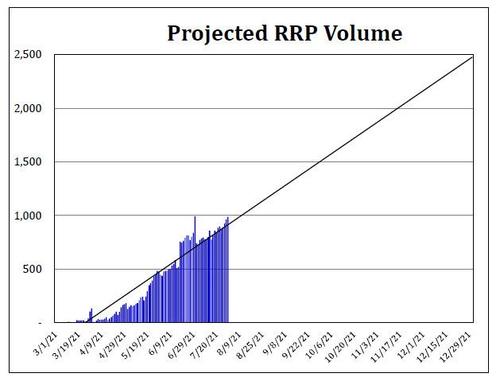

In fact, the question of how big the Fed’s reverse repo facility – which as explained previously is just how the Fed recycles all its massive reserves which it keeps injecting into the financial system (if not economy) at a pace of $120 billion per month – is one we discussed yesterday, and highlighted a calculation by Curvature’s repo guru Scott Skyrm who made the following observations:

During the month of April, RRP volume increased by $49 billion. $296 billion during the month of May, $362 billion in June, and $124 billion in July. If RRP volume continues around the same pace, say $200 billion a month, RRP volume will reach $2 trillion by the end of the year.

Looking at the trendline, it puts RRP volume at $2.5 trillion by the end of the year. However, the RRP volume at the end of the year will be a far larger number due to year-end window dressing, meaning it will likely approach if not surpass $3 trillion on Dec 31, 2021.

A few rhetorical questions from Skyrm to conclude: what will be the impact of $2 trillion going into the RRP each day? How will this affect the markets? Will the Fed need to adjust the RRP rate again?

_________________________________________

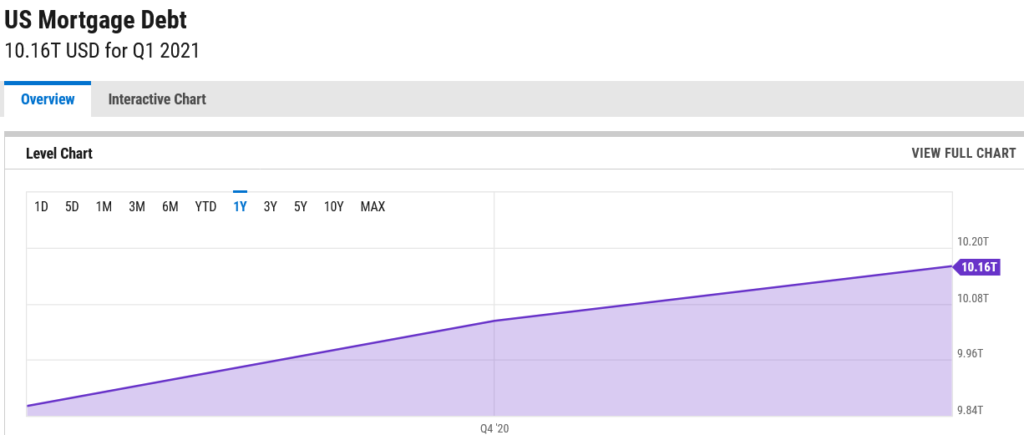

The Leviticus 25 Plan, on the other hand, re-targets the Fed’s liquidity flows, so that these types of ‘bank funding infusions’ pass first through the hands of U.S. citizens, via a Citizens Credit Facility, on their way to the banks – in the form of debt elimination (mortgage debt, credit card and household debt, student loans, car loans).

And… then everybody wins – even the Fed, as the Leviticus 25 Plan pays for itself entirely over a period of 10-15 years.

The most powerful economic acceleration plan in the universe.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2022 (3807 downloads)