“You never change things by fighting the existing reality. To change something, build a new model that makes the existing model obsolete. –R. Buckminster Fuller

……………………………………..

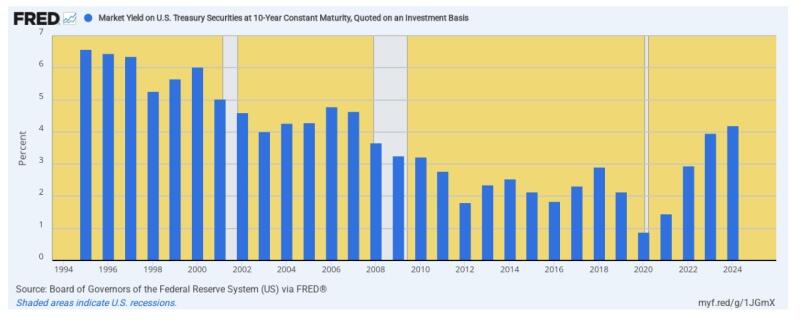

The Leviticus 25 Plan and its U.S. Health Care Freedom Plan component shift a sizeable portion of government subsidy payments from layers of embedded health care ‘middlemen’ to Medical Savings Accounts for direct allocation by U.S. citizens – all through a special Federal Reserve / U.S. Treasury U.S. Citizens Credit Facility (similar to the gigantic credit facilities which were set up to bail out Wall Street financial institutions during the 2008-2010 great financial crisis and the 2021-2022 Covid-19 crisis).

Imagine millions of patients paying cash for billions of prescriptions processed each year.

Imagine a new model where the MediCare Trust fund collects payroll taxes, while at the same time Part C and D Prescription Drug Event claims plummet – effectuating Medicare Trust Fund bailout, through the hands of hard-working, tax-paying U.S. citizens.

That time is here. The Leviticus 25 Plan – loaded up and ready to launch.

………………………………………

Over 300 Pharmacy Closures Reported in the Last 3 Months

Drug Topics – News Article

March 14, 2025

By Brian Nowosielski

Excerpt:

A new report from the American Economic Liberties Project presents the continued challenges pharmacies face since Congress’ failure to pass PBM reform at the end of 2024.

Since December 19, 2024, as many as 326 pharmacy storefronts have closed their doors for good, according to a news release.1 That late-2024 December day is notable because it was when Congress’ plan for pharmacy benefit manager (PBM) reform was abandoned in the 2025 spending package, leading to continued hardships within the pharmacy industry.

“As predicted, without Congressional intervention, the Big Three PBMs have continued to abuse their market power, squeezing at least 326 pharmacies—237 of them independent—out of business in fewer than 10 weeks and stranding their most vulnerable patients in pharmacy deserts without access to lifesaving care,” said Emma Freer, Senior Health Care Policy Analyst with the American Economic Liberties Project (AELP). “Given these high stakes, it is critical that Congress stand up to these health care monopolist middlemen and pass structural PBM reforms that will save their constituents’ time, money, and lives.”

From A Plus Pharmacy in El Paso, Texas, to Woodside Rx Inc in New York City, pharmacy closures have become common within the industry in recent history. Going back even further, a Health Affairs study found that 29.4% of all retail pharmacies operating in the US had closed at some point from 2010 to 2021. They also found that closures were more likely in minority communities than in those that were predominantly White.2

With pharmacy closures and their subsequent deserts becoming an increasingly pressing issue, many experts blame it on Congress’ failure to pass PBM reform. Last year was unprecedented for the pharmacy industry, partially because of the record number of store closures, but also due to the increased attention on PBMs and their controversial tactics that harm smaller community pharmacies.

Increased attention on PBMs led to a Federal Trade Commission (FTC) investigation into the prescription drug middlemen. With its first report released in July 2024—and eventually a second report in early 2025—the FTC confirmed many of the PBMs’ common tactics used to grow their profits at the expense of patients and pharmacies.3,4

However, despite all of the positive movement in the eyes of PBM critics, what was considered significantly bipartisan support for PBM reform failed to come to fruition at the end of 2024.

Now, with a new administration settling into the White House, PBM reform has since taken a back seat and the provisions that community pharmacies were hoping for must now be put on hold. In the meantime, reform advocates on both sides of the political aisle are continuing to highlight the need for PBM legislation and what it will do for the industry.

Simultaneously, they are highlighting the sheer unsustainability of the Big 3 PBMs— Caremark Rx, LLC (CVS), Express Scripts, Inc. (ESI), and OptumRx, Inc.—and their market control.4

“The Big Three PBMs also use their market power—combined with a rebate-driven business model that biases PBMs toward higher list price drugs, as Economic Liberties detailed in a February 2023 policy brief—to mark up drug prices by as much as 7,736%, according to the Federal Trade Commission,” continued the AELP press release.1 “As Economic Liberties has outlined in recent letters to Congress, the strongest PBM structural reform legislation would require PBMs to reimburse pharmacies fairly while eliminating the conflicts of interest that incentivize them to gouge patients.”

__________________________________

The Leviticus 25 Plan and its U.S. Health Care Freedom Plan component “create a model that makes the existing [PBM-centered] model obsolete.”

The most powerful economic acceleration plan in the world – restoring liquidity, profitability, and financial security for pharmacies across the nation.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$95,000 per U.S. citizen – Leviticus 25 Plan 2026 (32660 downloads )