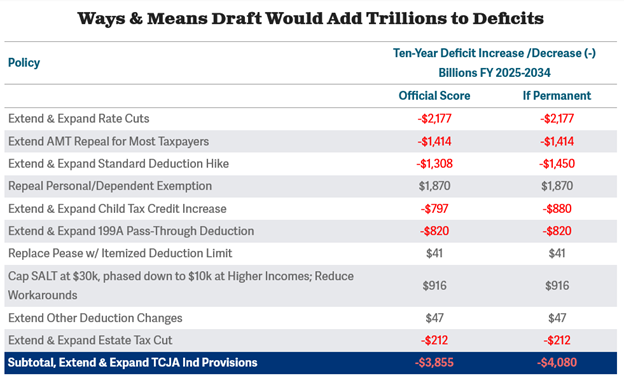

President Donald Trump’s “Big, Beautiful Tax Bill” is creating rancor in the ranks – over its projected budget deficit increases, ranging from $2.4 trillion through 2035.

Note: The budget hawks are talking about increases to the projected deficits, which are (conservatively) expected to ramp up on their own to a jolly $21.785 trillion through 2035.

………………………..

Longtime Trump loyalist flips on GOP’s ‘big, beautiful bill’ – Rep Marjorie Taylor Greene admits she ‘would have voted NO’ on the One Big Beautiful Bill Act By Deirdre Heavey Fox News | Published June 5, 2025 11:47am EDT Much of the discontent over the bill is rooted in Republicans’ reluctance to increase the U.S.’ national debt. The Congressional Budget Office (CBO) on Wednesday reported that the One Big Beautiful Bill Act will cut taxes by $3.7 trillion while raising deficits by $2.4 trillion over a decade.

Meanwhile, the national debt rose to $36,215,207,426,690.65 as of June 4, according to the latest numbers published by the Treasury Department. That is up about $806 million from the figure reported the previous day.

……………………….

WSJ Politics | The Trump-Musk Relationship Ruptures in Real Time | 6-5-25

WSJ Politics | Musk Burns MAGA Bridges as Republicans Back Trump in Brawl | 6-5-25

WSJ Trump Megabill Would Expand Deficits by $2.4 Trillion, CBO Estimates | 6-4-25

______________________________

Elon Musk and the Republican House and Senate budget hawks are not being forthright about the alternatives. Under the current Congressional Budget Office (CBO) 10-year deficit projections, without any of the Trump tax plan provisions, the federal government is on track to add $21.785 trillion in additional deficits for the years 2026-2035. All in all, these budget hawks are ‘quibbling’ about adding another $2.4 trillion on top of the $21.785 trillion – projected at the end of the Biden term.

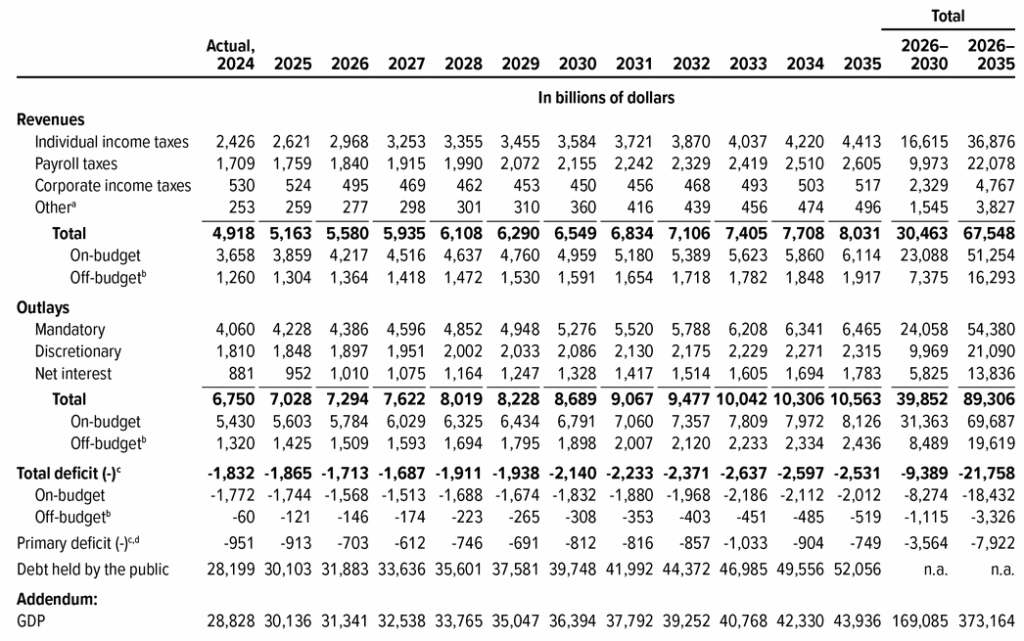

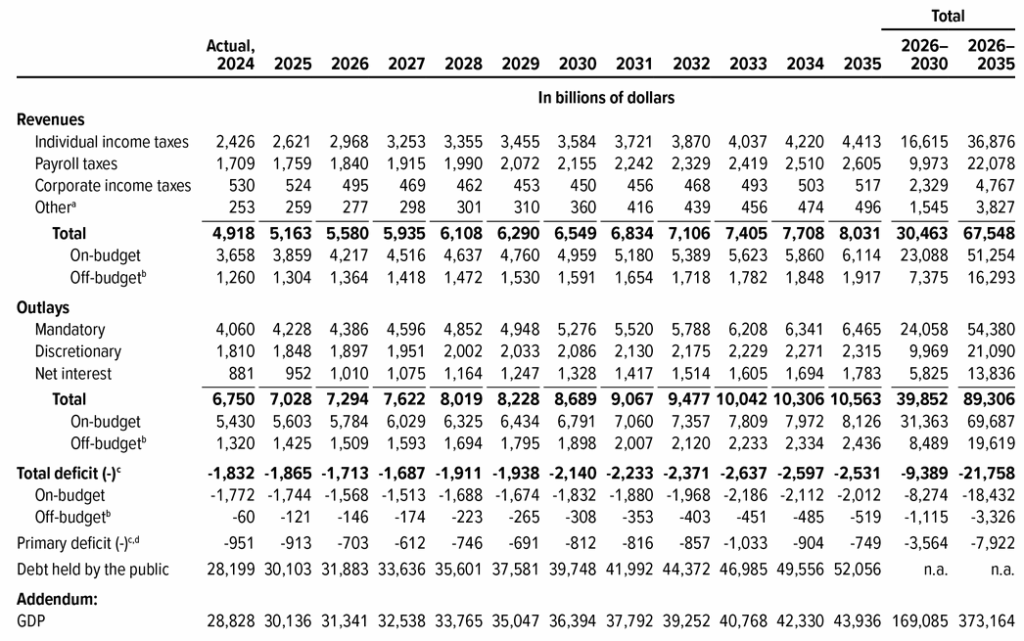

Federal Budget Deficit Projections – Congressional Budget Office

The Budget and Economic Outlook: 2025-2035 projects budget deficits ranging from $1.713 trillion 2026 to $2.531 trillion by 2035. Actual deficits for the out years are likely to be higher than CBO projections, based upon history (“actual” versus “projected”).

Congressional Budget Office (CBO) Deficit Projections 2025-2035

CBO deficit projections for target period (2026-2035)

2026: $1.713 trillion

2027: $1.687 trillion

2028: $1.911 trillion

2029: $1.938 trillion

2030: $2.140 trillion

2031: $2.233 trillion

2032: $2.371 trillion

2033: $2.637 trillion

2034: $2.597 trillion

2035: $2.531 trillion

Total deficits projected 2026-2034: $21.758 trillion

Again, at the end of President Biden’s term in office the federal government was on track to add another $21.785 trillion to the national debt over the following 10 years. And what is worse, since the CBO employs a ‘rosy scenario’ economic forecast in its ‘static’ analysis projections, the ‘actual’ deficits will unquestionably be higher than the CBO ‘projected’ deficits.

The GAO has warned, “The federal government is on an unsustainable fiscal path that poses serious economic, security, and social challenges if not addressed.”

Neither the Trump “Big, Beautiful Tax Bill,” nor Elon Musk’s DOGE cuts, nor the House and Senate budget hawks’ alternative course will do anything to meaningful change the dynamic on America’s massive, snowballing debt load. Neither will do anything to effect wide-scale entitlement program reductions. Neither will do anything to broadly restore financial health to millions of working American families.

Fortunately for Washington Republicans, there is an economic acceleration plan which will cover President Trump’s goals and eliminate deficits.

The Main Street America Republican’s plan is the most powerful debt elimination / economic revitalization plan in the world will revitalize America’s economy, restore financial security for millions of U.S. citizens.

And it will do the very thing that President Trump, and Elon Musk, and all Republicans in the U.S. Congress are desperately seeking to do: Generate $36.568 billion budget surpluses in each of its first five years of activation (2026-2030).

The Leviticus 25 Plan is loaded up and ready to launch.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2026 (30323 downloads )