Labor Shortages – Recent BLS reports indicate that the 11.3 million job opening in the U.S. is approximately 5 million more than the number of unemployed workers (~6 million).

Heritage Foundation, Feb 24, 2022: Evidence from past studies of welfare -without-work benefits find that they tend to reduce the supply of work, and a recent National Bureau of Economic Research study on the effects of the pandemic unemployment insurance benefits found that they significantly restricted employment.

One of the unintended consequences of social welfare benefits is that they disincentivize work.

The Leviticus 25 Plan avoids that consequence by not penalizing work, and by giving participating U.S. citizens a more powerful ‘boost’ up out of poverty than current anti-poverty programs are providing.

………………………………….

Education – Teacher Benefits

The Leviticus 25 Plan would extend direct liquidity benefits for millions of public and private school teachers across America, sufficient to eliminate vast amounts of mortgage and consumer debt balances – saving teachers and their families enormous amounts of debt service obligations each year.

Example: A participating family of four, receiving $240,000 ($60,000 per family member) in their Family Account and $120,000 ($30,000 per family member) in their Medical Savings Account) would be able to eliminate, or significantly reduce, a mortgage balance – which would then save them $700 – $1,000 per month in principal and interest payments…. for possibly the next 15-20 years, depending on the number of years to maturity.

And they might be able to pay off other forms of installment debt, saving hundreds of dollars per month.

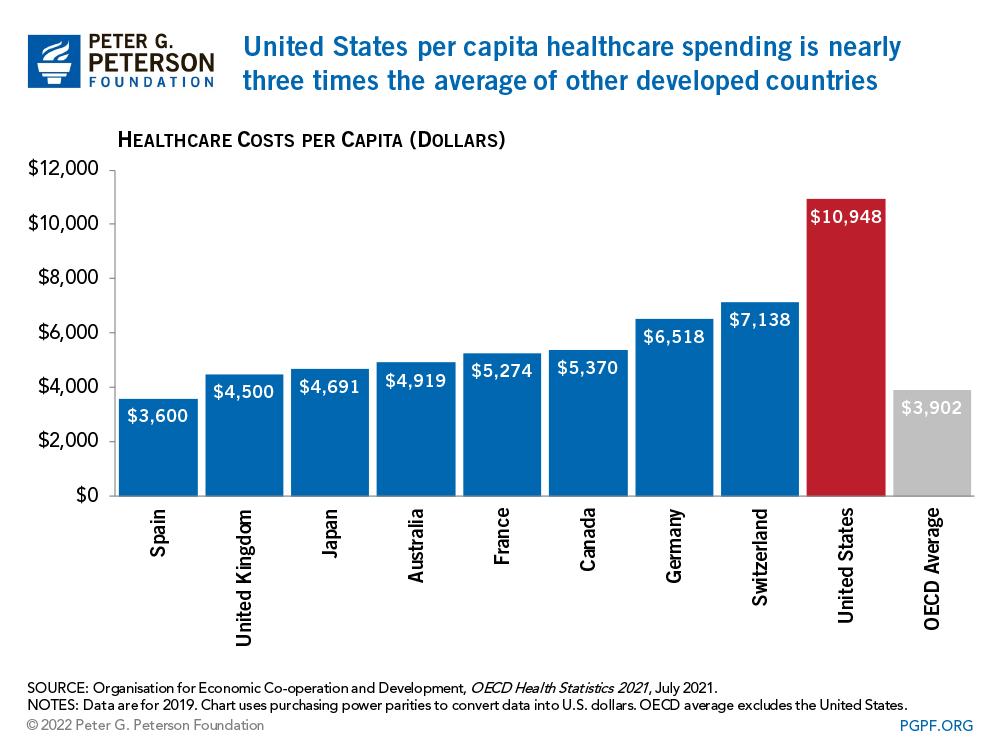

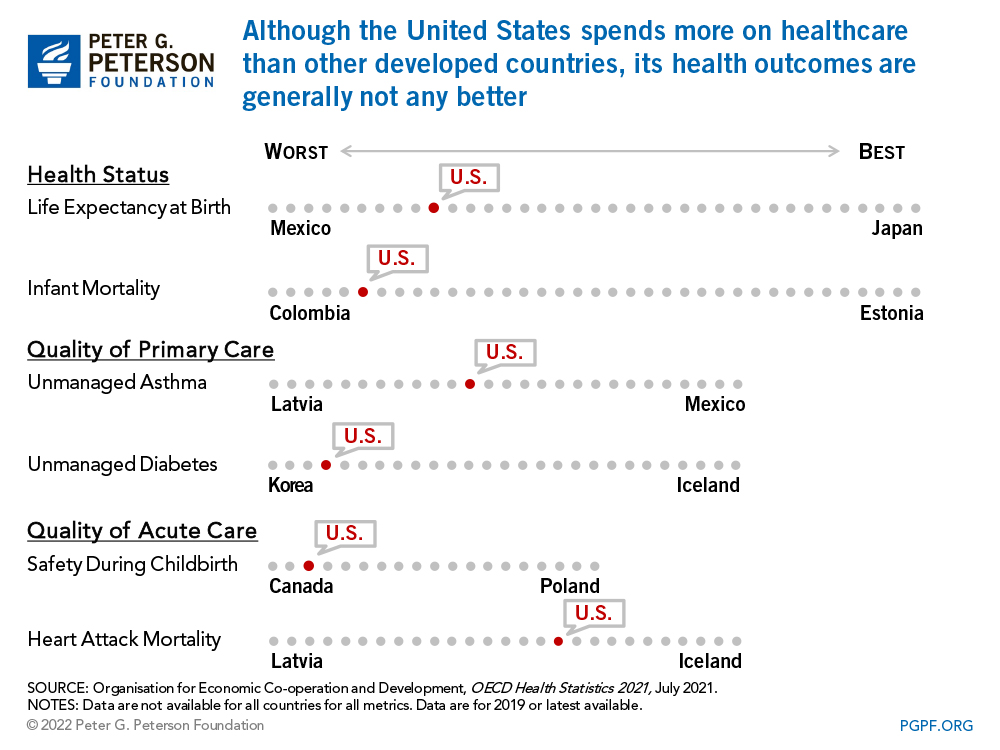

Participating teachers’ families would also have significant additional funds available for primary health care needs.

The Leviticus 25 Plan would be far and away more effective at improving financial security for teachers than any tax-and-spend teacher pay mandates imposed by government.

………………………………..

Education – Student Loans

Wall Street Journal, Apr 6, 2022: “The Committee for a Responsible Federal Budget (CRFB) estimates the loan pause [college loan forbearance] has cost taxpayers more than $100 billion, and the latest four-month extension will add another $15 billion to $20 billion.”

The Leviticus 25 Plan, with each participating college student receiving a deposit of $60,000 into a Family Account and $30,000 into a Medical Savings Account, offers benefits which are far superior to government ‘forbearance’ or ‘forgiveness’ programs – which apply only to government-backed student loans, not private loans.

1. Participating students would be able to pay off or significantly reduce loan balances of both government and private student loans

2. Students would also have additional available funds for primary health care needs.

3. Government-backed forbearance / forgiveness plans are unfair to all of the hundreds of thousands of students from the past who have worked hard and budgeted to pay off their student loans.

4. The Leviticus 25 Plan would eliminate U.S. taxpayer losses of hundreds of billions of dollars in forbearance costs and/or trillions of dollars in loan forgiveness.

____________________________________

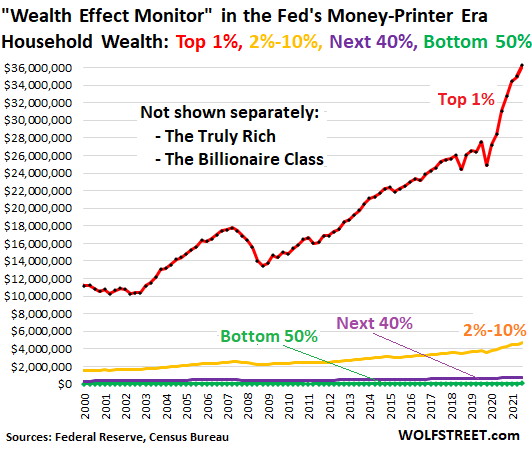

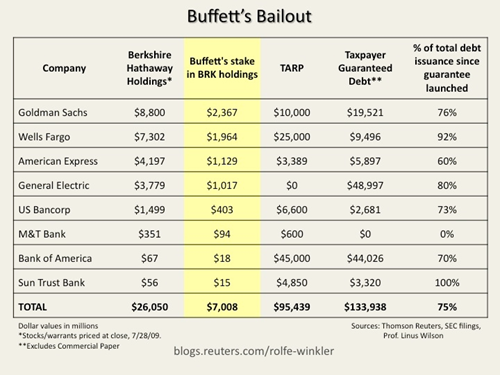

The Leviticus 25 Plan grants U.S. citizens the same direct access to liquidity that was provided, courtesy of the Fed, to major Wall Street financial institutions like Moran Stanley, JP Morgan, Goldman Sachs, Bank of America, Citigroup, Wells Fargo, AIG, Merrill Lynch, State Street, Deutsche Bank, UBS AG, Barclays, BNP Paribas, Royal Bank of Scotland, and many others.

The Leviticus 25 Plan would conservatively generate a federal budget surplus of $583 billion per year for each of the first five years of activation (2023-2027) – and would pay for itself entirely over the following 10-15 years.

“He who will not apply new remedies must expect new evils.” – Sir Francis Bacon

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2023 (4051 downloads)