The Leviticus 25 Plan is the only economically viable, politically feasible plan on the table anywhere in the world — to clean up paralyzing debt burdens and revitalize real, non-debt driven, economic growth.

…………………………………………….

WSJ: DOGE Won’t Be Enough to Get the Federal Budget Under Control

Discretionary spending represents only 16% of the federal budget. We can’t avoid entitlement reform.

By James A. Baker III and John W. Diamond

The Wall Street Journal | Feb. 24, 2025 – Excerpts:

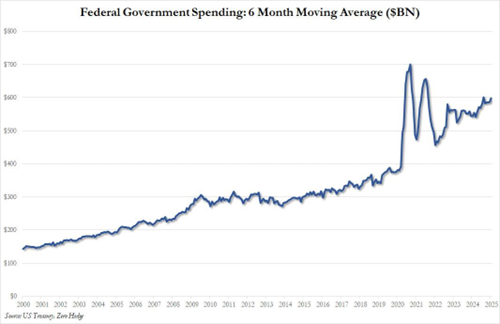

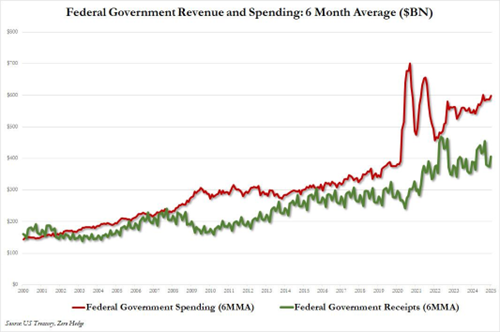

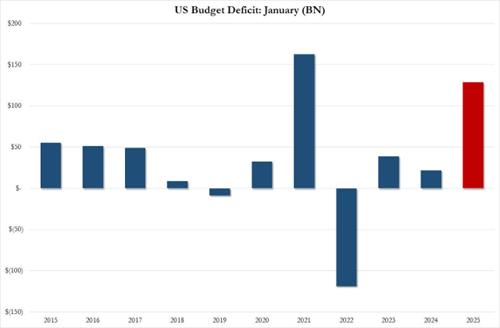

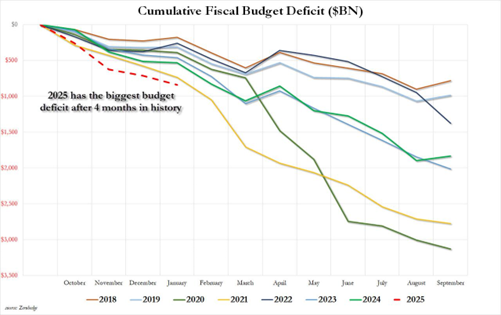

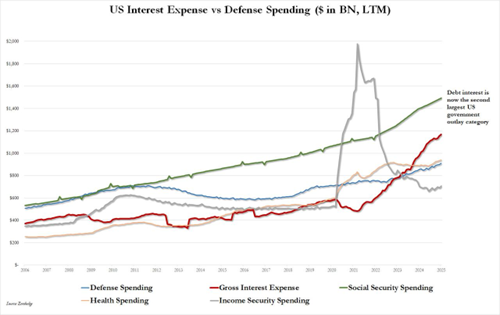

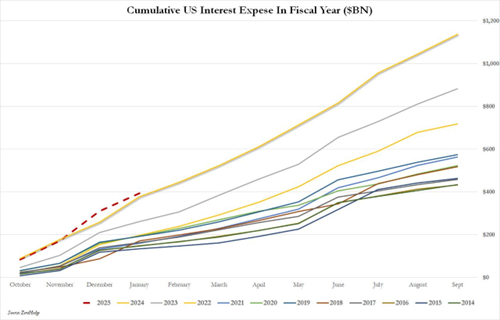

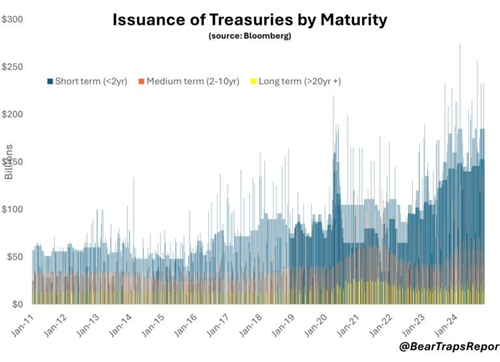

Government debt has exceeded $36 trillion and continues mounting, with no end in sight. This is unsustainable absent dramatic changes in how we allocate our tax dollars.

Budget hawks have been rare in Washington since 2010, when the bipartisan Simpson-Bowles commission put forth a comprehensive plan to reduce spending and increase revenue, only to see it sink. Today, the problem is dire. Our ratio of federal debt held by the public to gross domestic product has grown from 61% in 2010 to 100% this fiscal year. Left uncorrected for another four years, we will surpass the historic high of 106% that America hit at the end of World War II.

It’s little wonder that more Republicans and Democrats are voicing concerns that American global power—backed by economic strength—is threatened by growing budget deficits. It’s time lawmakers seek solutions rather than argue about who’s to blame.

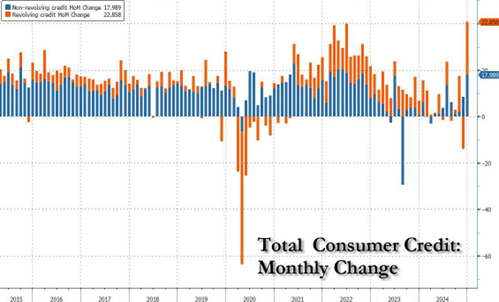

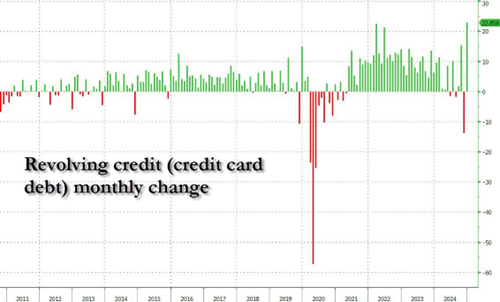

Several factors drive deficit spending, including an aging population and rapidly rising medical costs. But the major reason is reckless spending.

President Trump deserves credit for trying to make the federal bureaucracy more efficient to reduce deficits. His decision to create the Department of Government Efficiency put a much-needed brake on wasteful government spending.…

…[T]here are many steps the administration and lawmakers can take. The nondefense discretionary spending that DOGE has focused on is only 16% of the federal budget. If DOGE reaches its goal of reducing spending by $500 billion, the budget deficit for the year will be reduced by about 26%. That’s a good start. But our leaders must also develop plans to control spending on entitlement programs, because those will be the primary source for our deficits in the coming decades.

America can’t achieve a sustainable budget without reforming Social Security, Medicare and other healthcare benefits. Together, these accounted for 49% of federal spending last year, and the share is growing over time.

Meanwhile, these programs are hurdling toward insolvency. Social Security is projected to be insolvent by 2034. Unless Congress and the White House enact reforms by then, there will be a 23% reduction in benefits. Similarly, Medicare Part A is projected to exhaust its trust fund by 2036, requiring an 11% cut in benefits.…

….We’re about two presidential terms away from the Social Security and Medicare trust fund exhaustion dates. Fortunately, that’s plenty of time to identify solutions that can attract bipartisan support. Republicans and Democrats must work together to form bipartisan commissions to begin studying solutions.

Given the current political climate in Washington, it would be wise for such commissions to keep their thoughts as confidential as possible until the time comes to release a final set of recommendations. The reasoning for doing so is straightforward: Political foes are quick to use any mention of a potential solution as an immediate campaign slogan.

If America fails to act, debts will grow as deficits add up and interest payments balloon to unprecedented levels. Inflation will surge again. Such an outcome will reduce the nation’s economic vitality, impose a hardship on the least-affluent Americans most affected by inflation, and strip the U.S. of the flexibility needed to respond to economic crises and existential foreign policy challenges.

Mr. Baker served as White House chief of staff (1981-85 and 1992-93) Treasury secretary (1985-88) and secretary of state (1989-92). Mr. Diamond is senior director of the Center for Tax and Budget Policy at Rice University’s Baker Institute for Public Policy.

______________________________

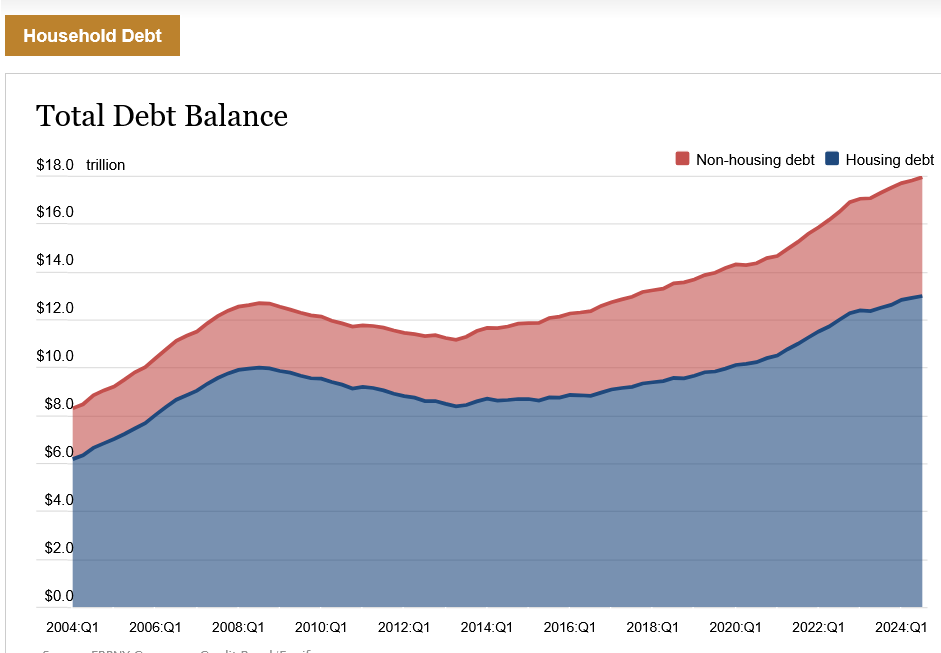

The Leviticus 25 Plan will eliminate enormous sums of Household Debt for millions of American families, at the same time, helping to lift millions of Americans up and out of poverty.

The Leviticus 25 Plan will dramatically reduce federal (and state) government outlays and generate budget surpluses:

Federal Income Tax recapture during each year of the initial 5-year activation period (2026-2030): $274.8 billion

Means-tested Welfare entitlement spending recapture during the 5-year target period (2026-2030): $3.153 trillion.

Total Medicaid/CHIP recapture (2026-2030): $2.026 trillion.

Total Medicare spending recapture (2026-2030): $1.906 trillion.

VA Healthcare total recapture (2026-2030): $239.472 billion

TRICARE recapture (2026-2030): $228.0 billion.

Social Security Disability Income (SSDI) recapture (2026-2030): $633.072 billion.

Total Interest Expense eliminated due to projected operating surpluses (2026-2030): $114.839 billion.

Federal Budget – projected average annual surplus (2026-2030): $36.568 billion per year.

The most powerful economic acceleration plan in the world – loaded up and ready to launch.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2026 (25722 downloads )