Washington Democrats are pressing hard for ongoing, unrestrained deficit-spending and its corollary effects: 1) fueling the ongoing inflation crisis; 2) steepening the growth curve of America’s national debt; 3) weakening the U.S. Dollar’s status as the world’s reserve currency; 4) imposing ever-greater government control over the daily affairs of U.S. citizens; 5) and ultimately endangering our national security.

Washington Republicans are proposing to lightly ‘tap the brakes’ on the Democrats’ tax, spend, and regulate big-government agenda. That’s it. They have no over-riding vision for to get America back on track.

The House GOP bill, “The Limit, Save, Grow Act,” proposes claw-backs of unspent Covid funds, along with “cutting discretionary spending for fiscal year 2024 back to 2022 levels, at about $1.47 trillion.” This would represent “an 8% reduction from this year, according to the nonpartisan Committee for a Responsible Federal Budget“ (WSJ, Apr 26, 2023).

According to the nonpartisan Congressional Budget Office, the GOP proposal “would cut government deficits by $4.8 trillion over 10 years… a significant reduction in the more than $21 trillion of projected deficits during the same period” (WSJ, Apr 26, 2023).

The White House Office of Management and Budget (OMB) is having a field day with the GOP Plan.

Shalanda Young, Director of the Office of Management and Budget is putting Republicans squarely on the defensive:

“What would that mean for the American people just in the first year of their plan? Consider just a few examples:

- Undermine Medical Care for Veterans: Cutting funding by 22 percent would mean 30 million fewer veteran outpatient visits, and 81,000 jobs lost across the Veterans Health Administration—leaving veterans unable to get appointments for care including wellness visits, cancer screenings, mental health services, and substance use disorder treatment.

- Slash Funding for Schools with Low-Income Students and Students with Disabilities: A 22 percent cut would impact 25 million students in schools that teach low-income students and 7.5 million students with disabilities, which could force a reduction of up to 108,000 teachers, aides or other key staff.

- Eliminate Preschool and Child Care for Hundreds of Thousands of Children: A 22 percent cut would mean 200,000 children lose access to Head Start slots and another 180,000 children lose access to child care—undermining our children’s education and making it more difficult for parents to join the workforce and contribute to our economy.

- Strip Nutrition Assistance from Millions of Women, Infants, and Children: A 22 percent cut would mean 1.7 million women, infants, and children would lose vital nutrition assistance through the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC), significantly increasing child poverty and hunger.

- Rob Seniors of Healthy Meals: A 22 percent cut would take away nutrition services, such as Meals on Wheels, from more than 1 million seniors. For many of these seniors, these programs provide the only healthy meal they receive on any given day.

- Raise Housing Costs for Hundreds of Thousands: A 22 percent cut would eliminate funding for Housing Choice Vouchers for over 630,000 households, including 190,000 households headed by seniors and 50,000 veterans.

- Scale Back Rail Safety Inspections: A 22 percent cut would result in 7,000 fewer rail safety inspection days next year alone, and 30,000 fewer miles of track inspected annually—enough track to cross the United States nearly 10 times.

………………………………………

Republicans are literally getting “tarred and feathered” under the flurry of Democrats claims that the GOP plan will cut social benefits to the neediest Americans.

The WSJ (May 11, 2023) reports that the Democrats are also now attacking Republicans that the GOP “House bill that couples raising the debt ceiling with sharp cuts in spending—would eviscerate veterans programs. Republican lawmakers angrily deny it….”

“The dispute springs from the vague nature of the GOP bill, which passed the House last month. The Limit, Save, Grow Act proposes cutting discretionary spending for fiscal year 2024 back to 2022 levels, at about $1.47 trillion. That works out to about an 8% reduction from this year, according to the nonpartisan Committee for a Responsible Federal Budget.

But the bill doesn’t lay out exactly how each federal agency or program would be funded—or pared back—within that framework. Democrats quickly jumped into the void, accusing Republicans of threatening a variety of veterans’ benefits and health programs, including a law that passed last August with overwhelming bipartisan support called the Pact Act. That law has been described by officials as the largest expansion of benefits in three decades, potentially benefiting 3.5 million veterans with lung issues, cancers and other health conditions related to exposure to toxins while serving.

In late April, the secretary of the Department of Veterans Affairs, Denis McDonough, held a breakfast meeting for veteran service organizations and warned them of dire problems if the GOP’s proposal came to fruition, said Joe Chenelly, executive director of Amvets, one of the “Big Six” veterans groups.

The administration says that the Republican bill would reduce funding for veterans and other non-defense discretionary programs by 22%. That estimate is extrapolated from some Republicans’ contention that they won’t reduce defense spending, which makes up about 52% of the discretionary budget—thus requiring deeper reductions in other areas of the federal budget to meet their savings goals.

Assuming defense funding remains the same, nondefense discretionary spending under the Republican plan would total $586 billion—a 22% decrease from the current level of $756 billion, according to Shalanda Young, director of the Office of Management and Budget.

House Republicans point out that there is no language in their bill that cuts funding for veterans, although nothing in the legislative text explicitly protects it either. The lack of specificity enabled the party to put off tough budgetary decisions and wrangle the votes needed to pass the bill without any Democratic support, 217-215.”

……………………………………….

Washington Republicans are once again playing out a ‘losing hand’ in this ongoing budget poker game.

Again, according to the Congressional Budget Office, the GOP proposal “would cut government deficits by $4.8 trillion over 10 years” from a projected $21 trillion of added deficits over the coming 10 years. (WSJ, Apr 26, 2023).

Under the current GOP plan, the national debt will grow from its current level of $31.796 trillion to $48 trillion by 2033, a mere $4.8 trillion decline from the $52.8 trillion projected increase.

And the Republican base is supposed to celebrate this as a victory…?

Meanwhile, President Biden, “in his budget earlier this year, also proposed deficit reductions but through increased taxes on corporations and high-income individuals” (WSJ, Apr 27, 2023). For one, corporations do not pay taxes – they pass them on to consumers. And “high-income” individuals have ways of sheltering income to reduce tax liabilities.

Washington Republicans right now have a golden opportunity, a once in a generation moment, to present a dynamic new winning plan for America – one that would put an end to these revolving-door debt ceiling impasses once and for all – and deliver a powerful debt-elimination strategy across all sectors of the U.S. economy, with major financial security gains for working Americans. A plan that will strengthen America’s long-term national security interests.

Main Street America Republicans have just such a plan – loaded up and ready to launch.

The Leviticus 25 Plan economic acceleration plan that will provide a dynamic ‘recharge’ to the U.S. economy, generate meaningful budget surpluses, reestablish citizen-centered healthcare, and restore economic liberty in America.

It will “unleash a new wave of prosperity” in America.

The Leviticus 25 Plan will generate $619 billion federal budget surpluses for the initial 5 years of activation (2024-2028), and completely pay for itself over the succeeding 10-15 years.

The Leviticus 25 Plan is a powerful economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America 2023

Economic Scoring links:

· The Leviticus 25 Plan – 2024 Generates $619.5 billion Federal Budget Surpluses (2024-2028) Part 1: Overview, Deficit Projection

· The Leviticus 25 Plan Generates $619.5 Billion Federal Budget Surpluses Annually (2024-2028). Part 2: Federal Income Tax Recapture; Economic Security / Means-Tested Welfare Recapture.

· The Leviticus 25 Plan Generates $619.5 Billion Federal Budget Surpluses Annually (2024-2028). Part 3: Medicaid, Medicare, VA, TRICARE, FEHB, SSDI Recapture.

· The Leviticus 25 Plan Generates $619.5 Billion Federal Budget Surpluses Annually (2024-2028). Part 4: Interest Expense Recapture, Totals Summary

____________________________________________________________________

The Leviticus 25 Plan – An Economic Acceleration Plan for America 2024

Leviticus 25 Plan 2023 (6127 downloads)

Website: https://leviticus25plan.org/

__________________________________________

Preview 1:

The Leviticus 25 Plan provides a $90,000 credit extension, direct from the Federal Reserve, to every participating U.S. citizen: $60,000 into a Family Account (FA) and $30,000 into a Medical Savings Account (MSA).

Example: Qualifying family of four would receive $240,000 in their FA, and $120,000 in their MSA.

Primary goals: Massive debt elimination at family level: mortgage debt, consumer debt, student loan debt. Federal budget surpluses.

Eligibility: U.S. Citizen. Job history, credit history requirement (similar to traditional credit checks for bank loans). Clean recent drug history. Clean crime history.

Requirements: Forego all federal and state tax refunds for 5-year period.

Forego Economic Security and selected means-tested welfare benefits – for minimum 5-year period.

Forego enhanced federal rental forbearance/assistance – for minimum 5-year period.

Forego SSI and SSDI for minimum 5-year period.

New $6,000 deductible on primary care access to: Medicare, Medicaid, VA, TRICARE, FEHB – for minimum 5-year period.

The Plan assumes that the elite-wealthy will not participate, because their refunds are too valuable to give up over the requisite 5-year period.

The Plan also assumes that many who heavily depend on Economic Security and social welfare benefits will also choose not to participate, because the overriding value of those benefits, vs foregoing them, over the 5-year period.

Preview 2:

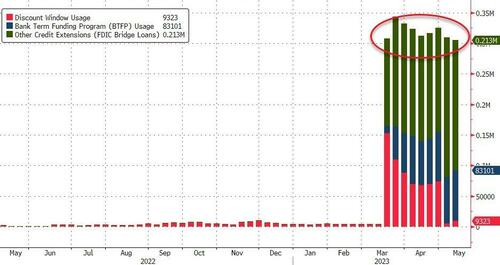

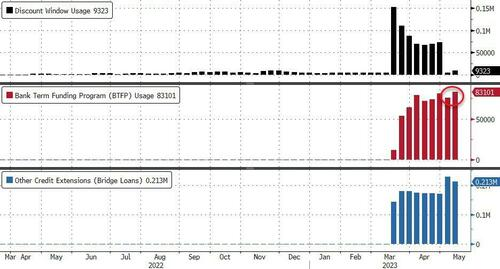

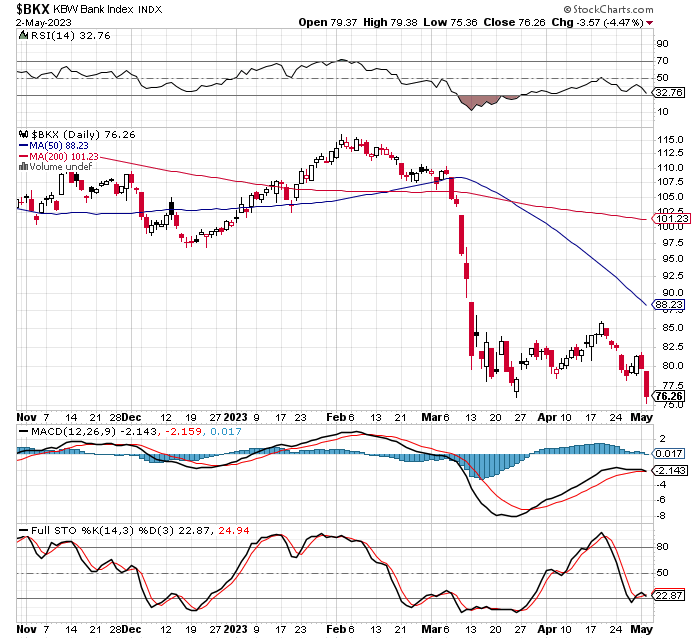

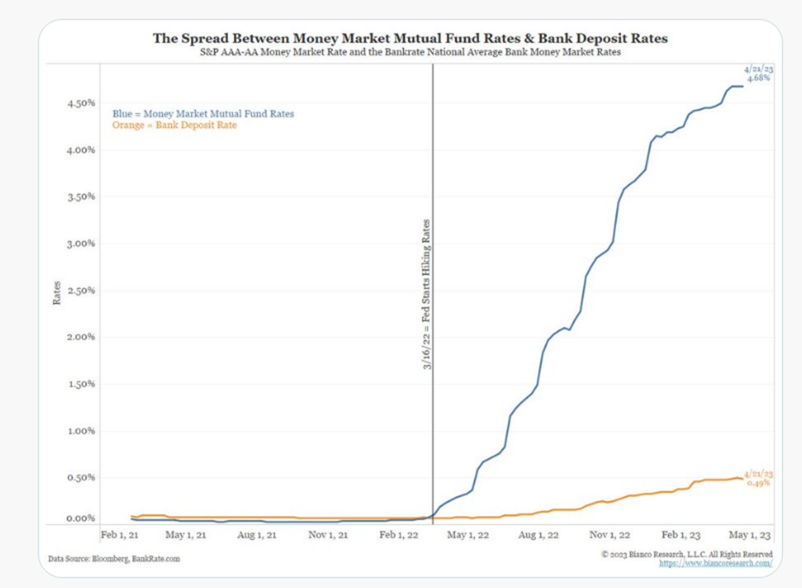

The Leviticus 25 Plan grants the same direct access to liquidity, through a Fed-based Citizens Credit Facility, similar to the credit facilities that were created by the Fed to transfuse trillions of dollars in direct transfers and credit extensions to Wall Street’s major banks, credit agencies and insurers during the great financial crisis.

The following facilities were created and activated by the Fed for this massive Wall Street bail out operation: Term Auction Facility (TAF), Primary Dealer Credit Facility (PDCF), Term Securities Lending Facility (TSLF), currency swap agreements with several foreign central banks, Commercial Paper Funding Facility (CPFF), Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility (AMLF), Money Market Investor Funding Facility (MMIFF), and the Term Asset-Backed Securities Loan Facility (TALF), and access to the Fed’s Discount Window.

Additional perspective: SIGTARP, the oversight agency of the Troubled Asset Relief Program (TARP), in its July 2009 report, vetted by Treasury, noted that the U.S. Government’s “Total Potential Support Related to Crisis” (page 138) amounted to $23.7 trillion. While this figure represents a backstop commitment, not a measure of total potential loss, it is nonetheless an astounding degree of support, in the form of liquidity infusions, credit extensions and guarantees, various other forms of assistance for financial institutions and other business entities affected by the financial crisis.

Preview 3:

The Leviticus 25 Plan website has been accessed on one or more occasions by the following financial enterprises/agencies:

JP Morgan, Goldman Sachs, Morgan Stanley, Bank of America, Citigroup, Wells Fargo, State Street, Merrill Lynch, AIG, Barclays Plc, Royal Bank of Scotland, Deutsche Bank, Société Générale S.A, UBS AG, Credit Suisse, BNP Paribas, The U.S. Department of Treasury, General Accountability Office (GAO), The European Central Bank (ECB), Bank of England (BOE), Swiss National Bank (SNB), Bank of Canada, Bank of Montreal, Bank for International Settlements (BIS).

………………………………………………………..

The General Accountability Office has stated that America’s ongoing debt crisis is unsustainable.

It is time for America to institute a bold, new plan.

The Leviticus 25 Plan is loaded up and ready to launch. The ‘golden moment’ for Republicans has arrived.