The Leviticus 25 Plan is based upon the presumption that U.S. citizens deserve nothing less than to be granted the same access to liquidity that the Federal Reserve so generously provided to the Wall Street financial sector during the Global Financial Crisis (2007-2012).

Take HSBC, for instance. This U.K. banking titan (formerly the Hong Kong Shanghai Banking Corp) and current Fed-approved Primary Dealer, had purchased billions of dollars in credit default swaps from AIG by the fall of 2008 – not bothering to employ any serious risk assessment on the creditworthiness of AIG Financial Products and the reserves behind their potential CDS obligations.

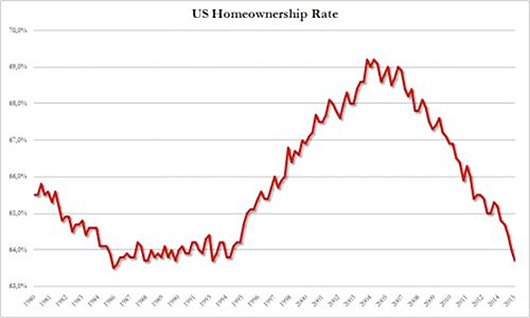

The housing bubble popped that fall and AIG went into financial meltdown as their counterparties (HSBC and numerous other multinational banking concerns) sought to collect on the supposedly gold-plated AIG-backed hedges. .

The U.S. government immediately stepped in to fully fund (100 cents on the dollar) a $90 billion payout (“collateral postings”) to the major AIG counterparties involved.

HSBC Holdings received a pass-through payment, courtesy of U.S. taxpayers, of $3.5 billion.

For at least a half-decade prior to their $3.5 billion rescue package, HSBC had also been running “the largest drug-and-terrorism money laundering case ever”uncovered by the Justice Department.Their penalty – a slap on the wrist.

……………………………

REUTERS: HSBC among banks that received AIG payouts (03-16 12:59) American International Group has disclosed that US and European banks such as HSBC have been among the biggest beneficiaries of the up to US$180 billion (HK$1.4 trillion) taxpayer bailout of the insurer.

AIG disclosed that more than US$90 billion has been paid to banks through collateral postings under credit default swaps, payments to CDS counterparties and payments to securities lending counterparties from September 16 to the end of December. Based on data provided by AIG, the largest recipients of funds were:

Goldman Sachs Group US$$12.9 billion Societe Generale US$11.9 billion Deutsche Bank US$11.8 billion Barclays US$8.5 billion Merrill Lynch US$6.8 billion Bank of America Corp US$5.2 billion UBS US$5 billion BNP Paribas US$4.9 billion HSBC Holdings US$3.5 billion Dresdner US$2.6 billion

REUTERS http://www.thestandard.com.hk/breaking_news_detail.asp?id=13217

…………………………………………

(Excerpts from Rolling Stone)

TOO BIG to JAIL – by Matt Taibbi

February 14, 2013 8:00 AM ET

The deal was announced quietly, just before the holidays, almost like the government was hoping people were too busy hanging stockings by the fireplace to notice. Flooring politicians, lawyers and investigators all over the world, the U.S. Justice Department granted a total walk to executives of the British-based bank HSBC for the largest drug-and-terrorism money-laundering case ever. Yes, they issued a fine – $1.9 billion, or about five weeks’ profit – but they didn’t extract so much as one dollar or one day in jail from any individual, despite a decade of stupefying abuses.

For at least half a decade, the storied British colonial banking power helped to wash hundreds of millions of dollars for drug mobs, including Mexico’s Sinaloa drug cartel, suspected in tens of thousands of murders just in the past 10 years – people so totally evil, jokes former New York Attorney General Eliot Spitzer, that “they make the guys on Wall Street look good.” The bank also moved money for organizations linked to Al Qaeda and Hezbollah, and for Russian gangsters; helped countries like Iran, the Sudan and North Korea evade sanctions; and, in between helping murderers and terrorists and rogue states, aided countless common tax cheats in hiding their cash.

“They violated every [sic] law in the book,” says Jack Blum, an attorney and former Senate investigator who headed a major bribery investigation against Lockheed in the 1970s that led to the passage of the Foreign Corrupt Practices Act. “They took every imaginable form of illegal and illicit business.”

In April 2003, with 9/11 still fresh in the minds of American regulators, the Federal Reserve sent HSBC’s American subsidiary a cease-and-desist letter, ordering it to clean up its act and make a better effort to keep criminals and terrorists from opening accounts at its bank. One of the bank’s bigger customers, for instance, was Saudi Arabia’s Al Rajhi bank, which had been linked by the CIA and other government agencies to terrorism.

According to a document cited in a Senate report, one of the bank’s founders, Sulaiman bin Abdul Aziz Al Rajhi, was among 20 early financiers of Al Qaeda, a member of what Osama bin Laden himself apparently called the “Golden Chain.” In 2003, the CIA wrote a confidential report about the bank, describing Al Rajhi as a “conduit for extremist finance.” In the report, details of which leaked to the public by 2007, the agency noted that Sulaiman Al Rajhi consciously worked to help Islamic “charities” hide their true nature, ordering the bank’s board to “explore financial instruments that would allow the bank’s charitable contributions to avoid official Saudi scrutiny.” (The bank has denied any role in financing extremists.)

For more than half a decade, a whopping $19 billion in transactions involving Iran went through the American financial system, with the Iranian connection kept hidden in 75 to 90 percent of those transactions. HSBC has been headquartered in England for more than two decades – it’s Europe’s largest bank, in fact – but it has major subsidiary operations in every corner of the world. What’s come out in this investigation is that the chiefs in the parent company often knew about shady transactions when the regional subsidiary did not. In the case of banned Iranian transactions, for instance, there are multiple e-mails from HSBC’s compliance head, David Bagley, in which he admits that HSBC’s American subsidiary probably has no clue that HSBC Europe has been sending it buttloads of banned Iranian money.

By that time, numerous agencies, including the Department of Homeland Security, had crawled all the way up HSBC’s backside, among other things examining it as part of a major international narcotics investigation. In one four-year period between 2006 and 2009, an astonishing $200 trillion in wire transfers (including from high-risk countries like Mexico) went through without any monitoring at all. The bank also failed to do due diligence on the purchase of an incredible $9 billion in physical U.S. dollars from Mexico and played a key role in the so-called Black Market Peso Exchange, which allowed drug cartels in both Mexico and Colombia to convert U.S. dollars from drug sales into pesos to be used back home. Drug agents discovered that dealers in Mexico were building special cash boxes to fit the precise dimensions of HSBC teller windows.

Former bailout inspector and federal prosecutor Neil Barofsky, who has helped secure numerous foreign money-laundering indictments, points out that the people HSBC was doing business with, like Colombia’s Norte del Valle and Mexico’s Sinaloa cartels, were “the worst trafficking organizations imaginable” – groups that don’t just commit murder on a mass scale but are known for beheadings, torture videos (“the new thing now,” he says) and other atrocities, none of which happens without money launderers. It’s for this reason, Barofsky says, that drug prosecutors are not shy about dropping heavy prison sentences on launderers. “Frankly, our view of money-laundering was that it was on par with, and as significant as, the traffickers themselves,” he says.

Barofsky was involved in the first extradition of a Colombian national (Pablo Trujillo, a member of the same cartel that HSBC moved money for) on moneylaundering charges. “That guy got 10 years,” says Barofsky. “HSBC was doing the same thing, only on a much larger scale than my schmuck was doing.”

…………………………………

American citizens deserve the very same regard from their own government that major banking conglomerates have received in their times of need, particularly those engaging in blatant criminal activity.

The Leviticus 25 Plan 2017 – $75,000 per U.S. citizen The Leviticus 25 Plan 2017 (1505)