When the Fed auctions off various financial securities each month (to raise funds to cover monthly deficits), each of those securities is identified by a specific Identification number. This unique number is called a “CUSIP.” This acronym stands for the “Committee on Uniform Securities Identification Procedures.”

Note this more complete definition: Committee on Uniform Securities Identification Procedures – A board that assigns a nine-digit number to every stock and registered bond that trades in the United States. CUSIP is owned by the American Bankers Association and is operated by S&P. A CUSIP number facilitates trade and settlement by making each security unique from every other of the same class. CUSIP numbers are recorded in each trade.

Well… on February 14, 2013, the Fed auctioned off some 30-year Bonds (note the CUSIP – “912810QZ4”):

TREASURY AUCTION RESULTS

Term and Type of Security 30-Year Bond

CUSIP Number 912810QZ4

Series Bonds of February 2043

The auction bidders typically include the Primary Dealers, the direct (non-Primary Dealer) bidders and the Indirect Bidders (Central Banks).

The Primary Dealers enjoy a practically conjugal relationship with the Fed, and they are obligated, in accordance with that special to ‘take’ or ‘buy’ whatever portion of the debt auction not bid/purchased by the other bidders. And that is generally substantial. According the Federal Reserve Bank of New York, the “primary dealers alone account for 70.9 percent of Treasu8ry securities sold to the public, on average. “

Immediately following the Valentine’s Day auction this year (5 days later, on February 19, 2013), the Fed ‘bought back’ the majority of that very same 2-14-13 CUSIP ($39 billion worth – see below) from the Primary Dealers (who were unable to ‘move’ that paper to their clients and did not wish, themselves, to ‘sit on it’).

The Fed repurchases this ‘paper’ in Permanent Open Market Operations (POMOs) and the paper then ‘sits’ in the Fed’s System Open Market Account (SOMA). The Government then ‘pays interest to itself on money that it borrowed from itself.”

And, guess who gets paid a healthy commission to ‘take’ the paper, and then shuffle it back to the Fed…?

That’s right — the Primary Dealers (see who they are here).

This would be the equivalent of making a purchase at a Wal-mart, then then returning the product, and being paid a commission to boot. Here is the 2-19-13 POMO summary (note the same CUSIP “912810QZ4” for $39 billion):

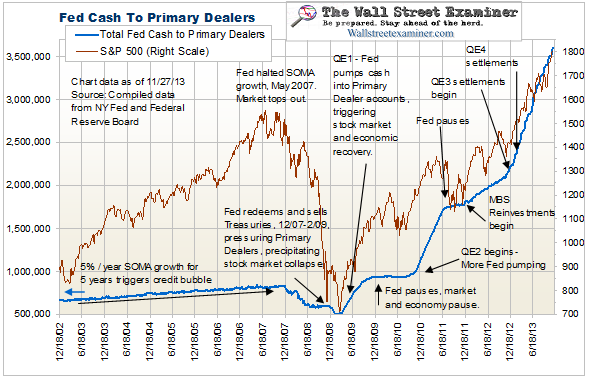

And… the Fed ‘funnels’ a lot of money through the Primary Dealers. Note the blue line (2009-2013) on this chart – courtesy of The Wall Street Examiner:

_______________________________________

The Fed’s ‘liquidity funneling’ maneuvers have been weakening the Dollar (vs hard assets) over the past 4 years (inflation). And very little of the ‘liquidity’ benefits are reaching American families.

It is time for a change.

The Leviticus 25 Plan.