Washington Democrats and Republicans are driving America headlong into a full-blown debasement of the U.S. Dollar – and an inevitable conversion to a Central Bank Digital Currency (CBDC) system.

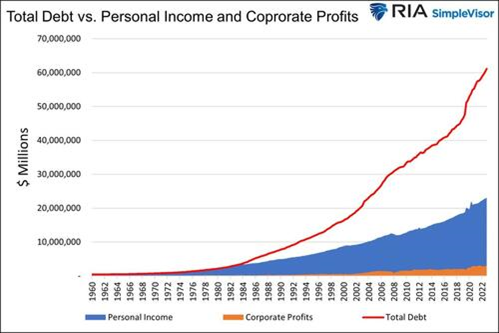

Congress added $7.5 trillion to the debt over the last 2 years, according to The Heritage Foundation report. This comprehensive report exposes the historic spending spree from both parties in Congress, March 2020 – December 2022, has added a massive $7.464 trillion to the national debt (not counting accrued interest costs). Source: Fox News, Sep 21, 2023.

Congress’ latest spending package, approved by the GOP-led House of Representatives, covers six appropriation bills totaling $460 billion.

It also includes over 6,600 earmarks at a cost of $12.7 billion dollars.

See how your state’s Congressman voted here.

The U.S. Congress has no appetite whatsoever to change its’ free-wheeling ways.

Main Street America Republicans, however, do have a plan to put this chaotic mess back in order….

………………………………………………

GOP-led House passes spending package to keep government open, includes $13 billion in earmarks

The spending bill passed 339-85 with more Democrats voting in favor of it than Republicans

By Nicholas Ballasy, Updated: March 6, 2024 10:35pm / Dig Deeper – Excerpts:

The GOP-led House of Representatives on Wednesday passed a 1,050-page spending package that includes nearly $13 billion of earmarks, commonly referred to as “pork barrel” spending.

The bill passed 339-85 with more Democrats voting in favor of it than Republicans. In total, 207 Democrats and 132 Republicans voted yes.

There are earmarks in the legislation sponsored by members of the Democrat and Republican parties. The spending package contains six appropriations bills totaling about $460 billion.

The first spending deadline in the temporary spending bill Congress passed last week is Friday, March 8. The appropriations bills in the new spending package would last for the rest of fiscal year 2024.

“One Republican Senator gets 8 earmarks in the omnibus today. No one voted to add these and no one gets to vote to take these out. We have gone backwards 14 years, to before the 2010 Tea Party wave,” Rep. Thomas Massie, R-K.Y., said in a post on X, formerly Twitter, referring to Sen. Lindsey Graham, R-S.C. “The swamp is back to buying Republican votes for the omnibus with earmarks.”

Sen. Rick Scott, R-Fla., wrote on his X account that the spending package is “packed with 6,600+ earmarks totaling $12.7 BILLION DOLLARS.”

“Skyrocketing inflation. Massive debt. But Washington keeps spending your money on stupid pet projects. NO MORE EARMARKS,” he wrote.

Sen. Rand Paul, R-K.Y., said it’s “disappointing that Republicans are going along with Democrats” in moving forward with the spending bill that has hundreds of earmarks.

“This is a real step backwards, and I will oppose it with every fiber of my being,” Paul said.

Sen. Mike Lee, R-Utah, said there was “no way any mortal could actually vet all of the earmarks in the 48-hour time period they’ve given us so far.”

“Earmarks are the corrupt currency of Congress. No self-respecting Republican should touch them,” he wrote.

Lee said Senate lawmakers can still request that their earmarks be stripped from the bill…

Sen. John Thune, R-S.D., has reportedly sponsored many earmarks in the spending package. Thune is running to replace Senate GOP Leader Mitch McConnell, R-K.Y., who is stepping down from his leadership role in November.

Lee called on Thune to request removal of the earmarks from the spending package. Thune’s office was not available for comment before press time.

Rep. Bob Good, R-Va., chairman of the House Freedom Caucus, argued that Congress “should not be giving $12.7 billion to Congressional pork projects when we are $34 trillion in debt.”…

____________________________________

The Main Street America Republican plan to save America:

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2025 (11967 downloads )