A look back….

Excerpts from Bloomberg Nov 28, 2011:

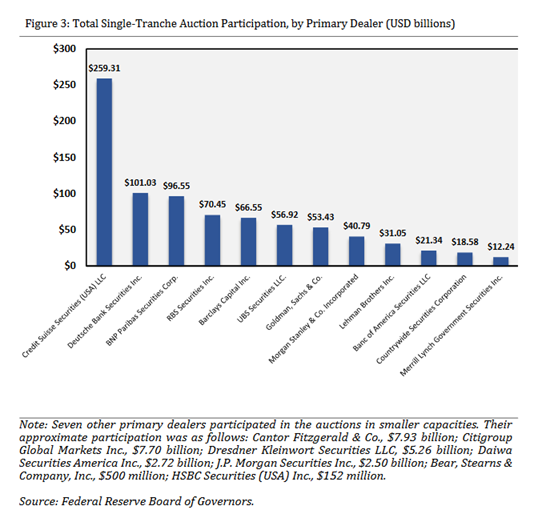

“Merrill Lynch & Co.’s stock surged 30 percent after the New York-based securities firm announced an agreement to sell itself to Bank of America Corp. in September 2008. The deal didn’t stop the firm’s liquidity from shrinking by about $27 billion in three days that month, according to internal Federal Reserve Bank of New York documents. In the ensuing weeks, the firm drew as much as $62.1 billion from the Federal Reserve’s Primary Dealer Credit Facility, Term Securities Lending Facility and single-tranche open market operations. After the takeover closed on Jan. 1, 2009, Charlotte, North Carolina-based Bank of America let Merrill’s Fed loans roll off while increasing its own liquidity draws from the central bank.”

Peak amount of debt on 09/26/2008: $62.1B

A little more background information – on some of the investment practices engaged in by Merrill Lynch during the several years immediately preceding the $62.1B secret bailout:

DealBook-NYTimes reported on January 25, 2011:

“Merrill Lynch Settles S.E.C. Fraud Case”

Merrill Lynch “ agreed to pay $10 million on Tuesday to settle fraud accusations by securities regulators.”

“The Securities and Exchange Commission had accused Merrill of fraud, saying that the firm misused private information from its customers to place trades on its own behalf and that the firm repeatedly charged its customers trading fees without their knowledge.”

Bank of America: Corporate Rap Sheet

Bank of America – Corporate Rap Sheet – Aug 1, 2020

Bank of America acquired Merrill Lynch on Sep 24, 2001.

Note their ‘corporate rap sheet.”

In August 2009 BofA agreed to pay $33 million to settle SEC charges that it misled investors about more than $5 billion in bonuses that were being paid to Merrill employees at the time of the firm’s acquisition. In February 2010 the SEC announced a new $150 million settlement with BofA concerning the bank’s failure to disclose Merrill’s “extraordinary losses.” At the same time, New York Attorney General Andrew Cuomo filed civil fraud charges against Lewis personally, as well as BofA’s former chief financial officer Joseph Price for “duping shareholders and the federal government.”

In May 2011 FINRA fined Merrill $3 million for misrepresenting loan delinquency data when selling residential subprime mortgage securities, and in October 2011 fined it $1 million for failing to properly supervise one of its registered representatives who was operating a Ponzi scheme. More FINRA fines came in 2012: $1 million for failing to arbitrate disputes with employees; $2.8 million (plus $32 million in remediation) for unwarranted fees; and $500,000 for failing to file hundreds of required reports. In December 2011 BofA agreed to pay $315 million to settle a class-action suit alleging that Merrill had deceived investors when selling mortgage-backed securities. June 2012 court filings in a shareholder lawsuit against BofA provided more documentation that bank executives knew in 2008 that the Merrill acquisition would depress BofA earnings for years to come but failed to provide that information to shareholders. In September 2012 BofA announced that it would pay $2.43 billion to settle the litigation.

The Countrywide acquisition also came back to haunt BofA. In June 2010 it agreed to pay $108 million to settle federal charges that Countrywide’s loan-servicing operations had deceived homeowners who were behind on their payments into paying wildly inflated fees. Four months later, Countrywide founder Angelo Mozilo reached a $67.5 million settlement of civil fraud charges brought by the SEC. As part of an indemnification agreement Mozilo had with Countrywide, BofA paid $20 million of the settlement amount, which consisted of a $22.5 million penalty (a record amount for a case against a public company executive) and $45 million in “disgorgement of ill-gotten gains.” A criminal case against Mozilo was shelved.

In May 2011 BofA reached a $20 million settlement of Justice Department charges that Countrywide had wrongfully foreclosed on active duty members of the armed forces without first obtaining required court orders. And in December 2011 BofA agreed to pay $335 million to settle charges that Countrywide had discriminated against minority customers by charging them higher fees and interest rates during the housing boom. In mid-2012 the Wall Street Journal reported that “people close to the bank” estimated that Countrywide had cost BofA more than $40 billion in real estate losses, legal expenses and settlements with state and federal agencies.

BofA faced its own charges as well. In December 2010 it agreed to pay a total of $137.3 million in restitution to federal and state agencies for the participation of its securities unit in an alleged conspiracy to rig bids in the municipal bond derivatives market. In January 2011 BofA agreed to pay $2.8 billion to Fannie Mae and Freddie Mac to settle charges that it sold faulty loans to the housing finance agencies. In September 2011 the Federal Housing Finance Agency sued BofA and other firms for abuses in the sale of mortgage-backed securities to Fannie Mae and Freddie Mac.

BofA was one of five large mortgage servicers that in February 2012 consented to a $25 billion settlement with the federal government and state attorneys general to resolve allegations of loan servicing and foreclosure abuses. An independent monitor set up to oversee the settlement reported in August 2012 that BofA had not yet completed any modifications of first-lien mortgages or any refinancings. The New York Attorney General later sued BofA for breaching the terms of the foreclosure settlement.

In September 2012 BofA settled federal allegations that it discriminated against recipients of disability income. In January 2013 BofA was one of ten major lenders that agreed to pay a total of $8.5 billion to resolve claims of foreclosure abuses. At the same time, BofA by itself agreed to pay $10.3 billion ($3.6 billion in cash and $6.75 billion in mortgage repurchases) to Fannie Mae to settle a new lawsuit concerning the bank’s sale of faulty mortgages to the agency. BofA also agreed to sell off about 20 percent of its loan servicing business.

In April 2013 the National Credit Union Administration announced that BofA had agreed to pay $165 million to settle claims relating to losses from the purchases of residential mortgage-backed securities.

In May 2013 BoA agreed to pay $1.7 billion to MBIA to settle a long-running lawsuit in which the bond insurer had sued Countrywide for misleading it about the quality of mortgages packaged into securities that MBIA agreed to insure.

In August 2013 the Justice Department filed a civil suit charging BofA and its Merrill Lynch unit of defrauding investors by making misleading statements about the safety of $850 million in mortgage-backed securities sold in 2008.

In October 2013 a federal jury found BofA’s Countrywide unit liable for the sale of defective mortgages to Fannie Mae and Freddie Mac. A former Countrywide midlevel manager, Rebecca Mairone, was found individually liable in the civil fraud case.

In December 2013 Freddie Mac announced that BofA had agreed to pay $404 million to settle claims by the mortgage agency that the bank had sold it hundreds of thousands of defective home loans.

That same month, the SEC announced that BofA would pay $131.8 million to settle allegations that Merrill Lynch had misled investors about collateralized debt obligations.

In March 2014 the Federal Housing Finance Agency announced that BofA would pay $9.3 billion to settle the case involving the sale of deficient mortgage-backed securities to Fannie Mae and Freddie Mac. The total included $3.2 billion in securities repurchases.

In April 2014 the U.S. Consumer Financial Protection Bureau ordered BofA to pay $727 million to compensate consumers harmed by deceptive marketing of credit card add-on products.

That same month, BofA disclosed that it had mistakenly overstated its capital by $4 billion.

In July 2014 a federal judge ordered BofA to pay $1.27 billion in damages after being found guilty by a jury in a case involving defective mortgages sold by Countrywide. (In May 2016 a federal appeals court overturned that penalty.)

That case paled in comparison to the $16.65 billion settlement BofA reached with the Justice Department the following month to resolve federal and state claims relating to the practices of Merrill Lynch and Countrywide in the runup to the financial meltdown. The amount was made up of about $10 billion in cash payments and $7 billion in so-called mortgaged relief to consumers.

In December 2014 FINRA fined Merrill Lynch $4 million as part of a case against ten investment banks for allowing their stock analysts to solicit business and offer favorable research coverage in connection with a planned initial public offering of Toys R Us in 2010.

In May 2015 the Federal Reserve fined BofA $205 million for “unsafe and unsound” practices relating to foreign exchange markets.

In June 2016 the SEC announced that Merrill Lynch would pay $415 million to settle allegations that it misused client cash to engage in trading for the company’s benefit.

In September 2016 the SEC announced that Merrill would pay a $12.5 million penalty for maintaining ineffective trading controls that failed to prevent erroneous orders from being sent to the markets and causing mini-flash crashes.

In 2019 Merrill Lynch Commodities entered into a non-prosecution agreement and agreed to pay $25 million to resolve criminal charges of manipulating the market for precious metals futures contracts.

___________________________________

The Leviticus 25 Plan provides U.S. citizens with the same direct access to liquidity that was provided to the likes of Wall Street ‘rap sheet’ titans Merrill Lynch and Bank of America at the height of the great financial crisis.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2025 (19065 downloads )