There is a comprehensive economic acceleration plan with all of the raw power needed to resolve this debt-driven calamity. Stay tuned…

………………………………………….

The Maths of a Debt Trap

By Alasdair Macleod, January 5, 2026 | Von Greyerz AG

Excerpt:

This millennium is different from the post-war years

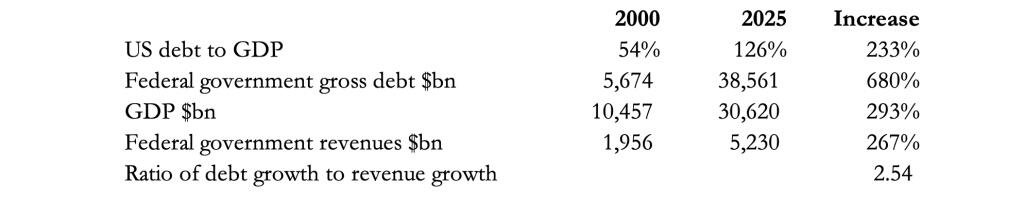

…The next table replicates the first table in this article, but for the 25 years of this current millennium.

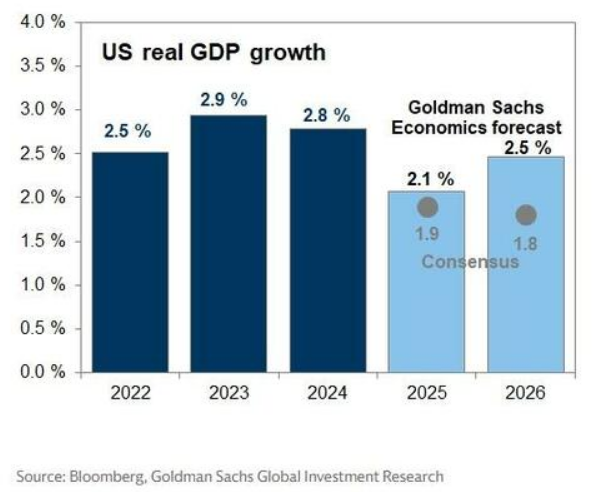

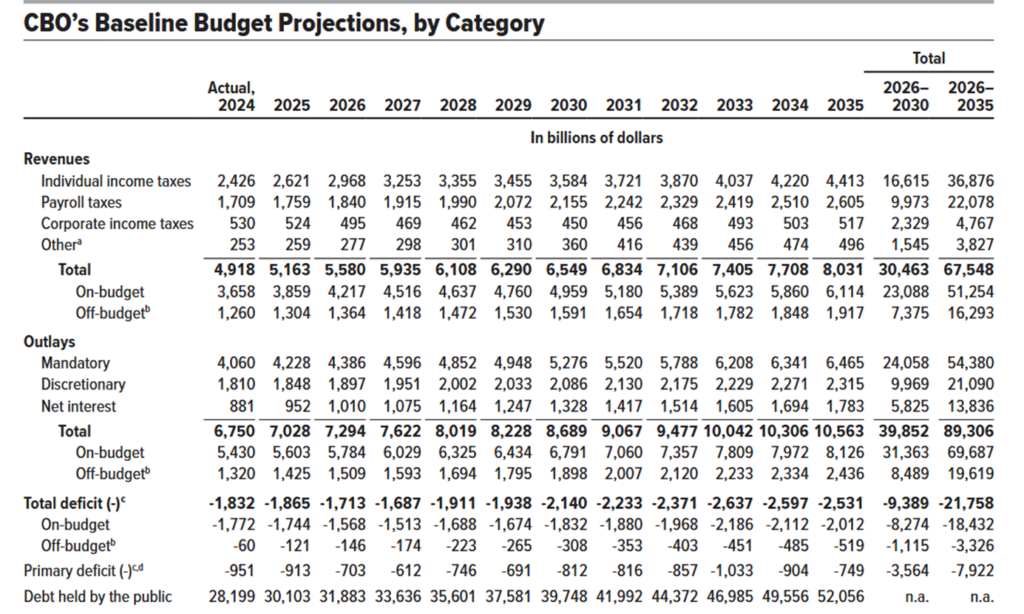

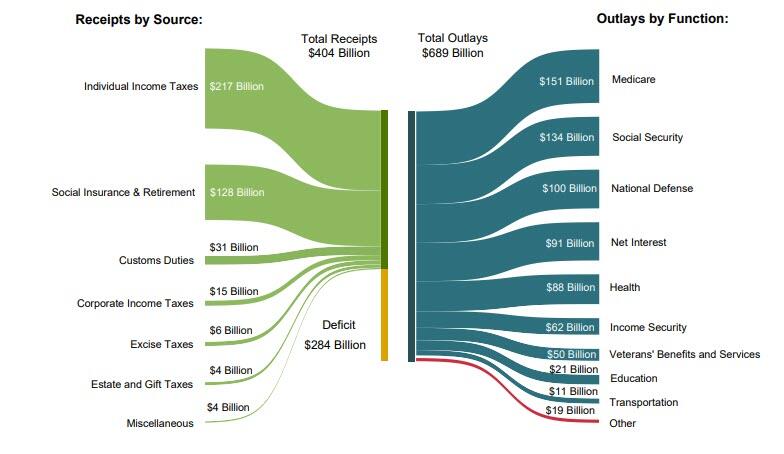

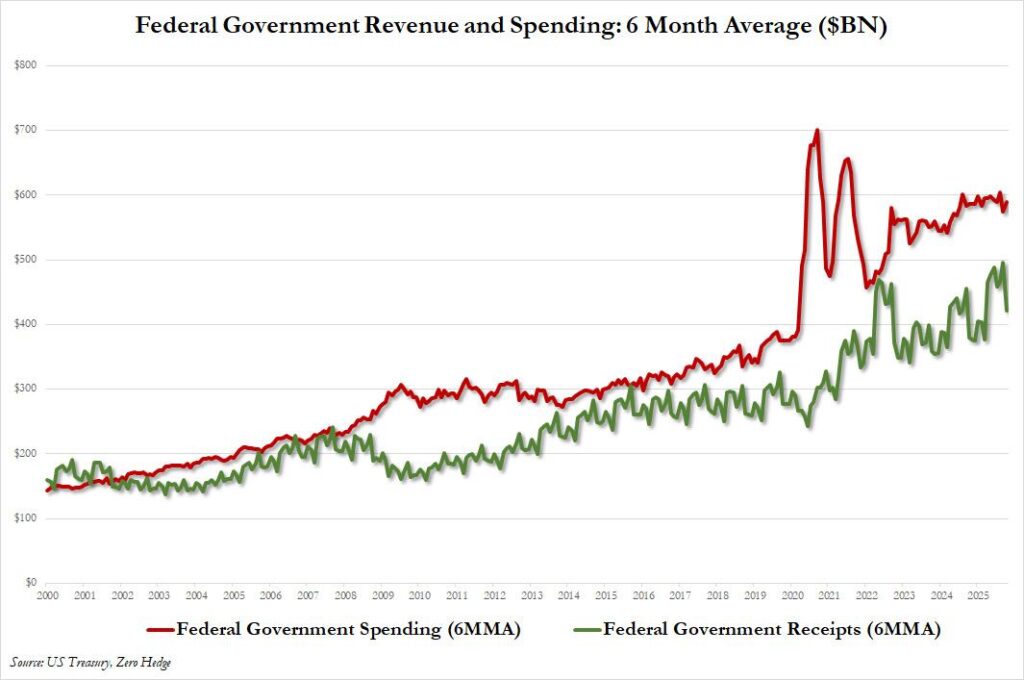

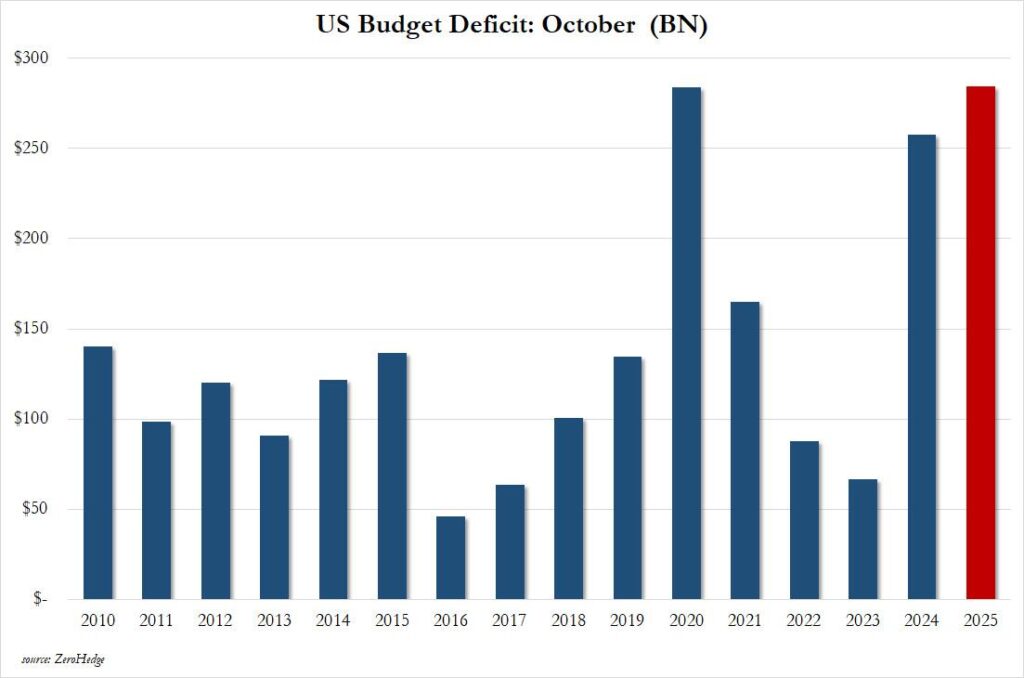

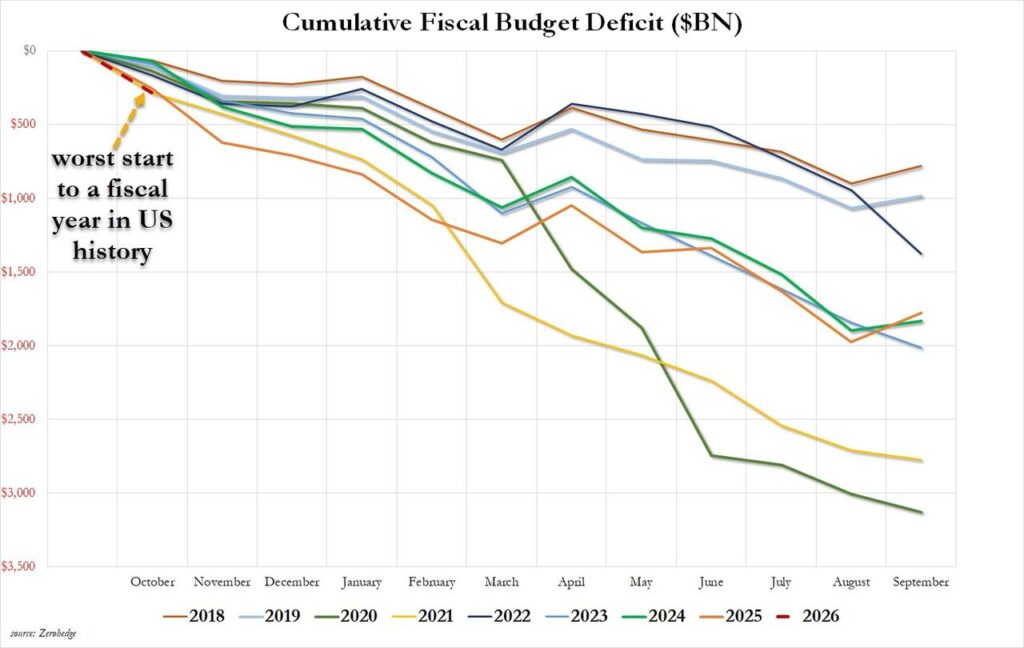

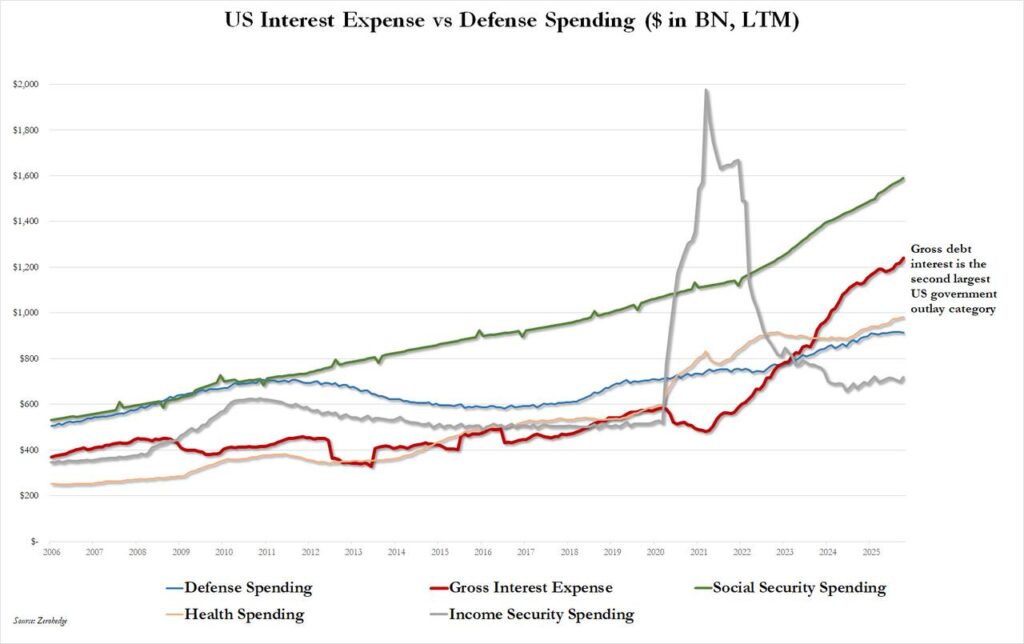

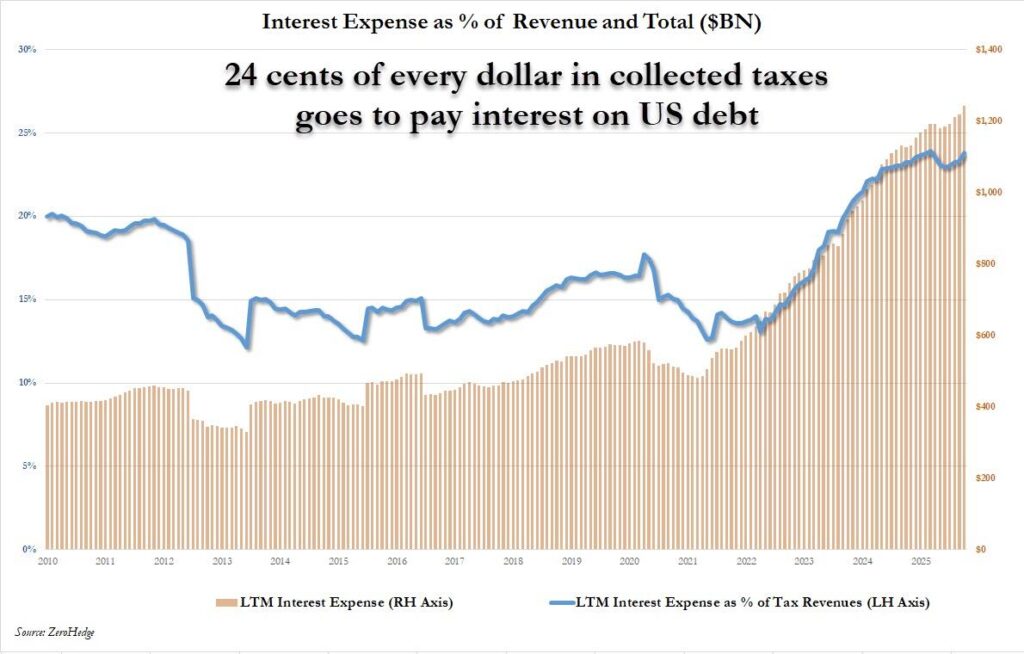

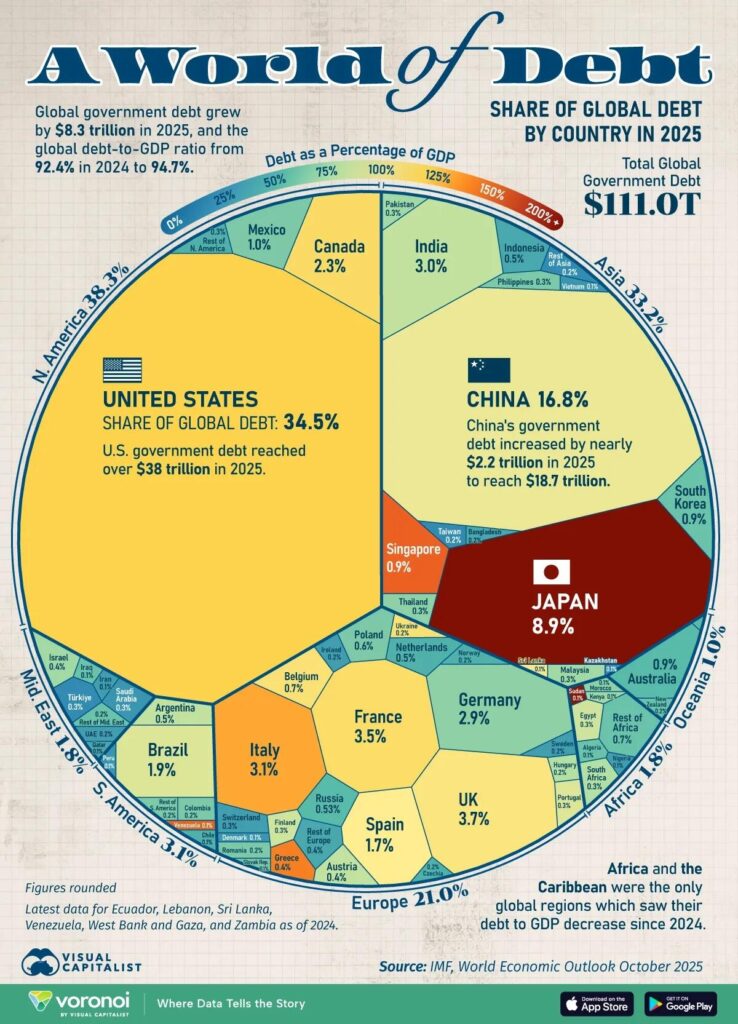

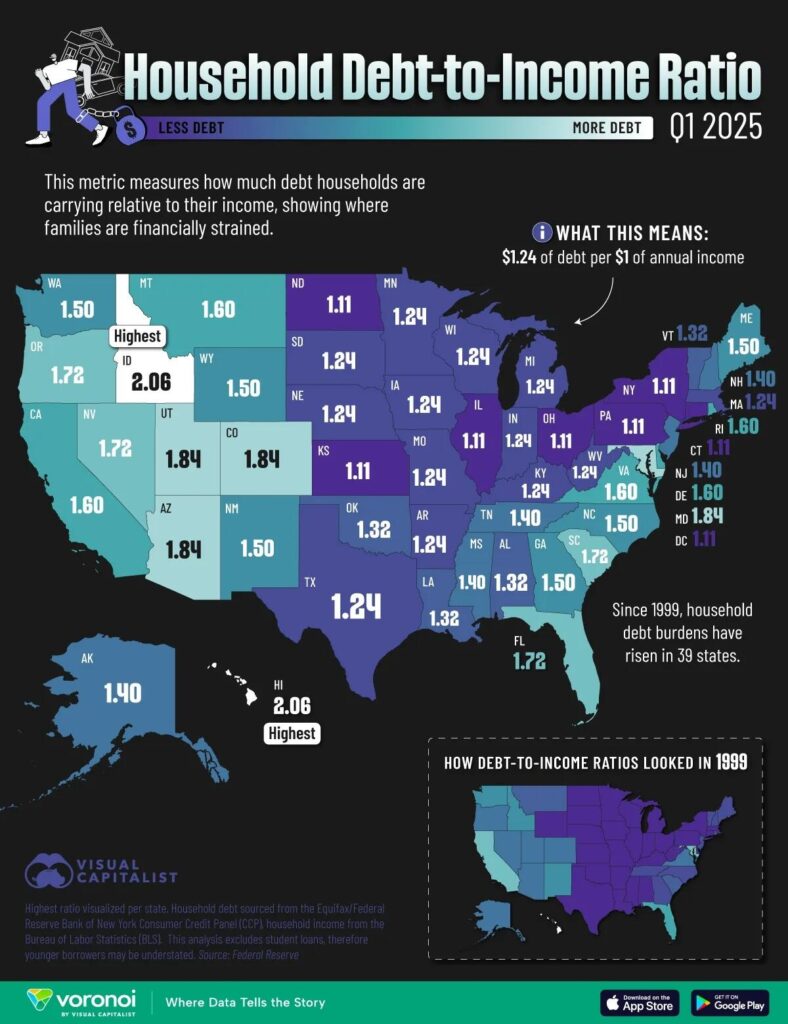

Here, we can see that gross debt has been rising nearly three times faster than GDP, and even more so measured in the federal government revenues which are behind the sustainability of the debt. With the increase in revenue badly lagging the debt increase, the US Treasury is in a classic debt trap, a condition which has been accelerating, particularly since the pandemic of 2020. It is a fact which is increasingly recognized by foreign central bankers who are getting out of dollars and into gold.

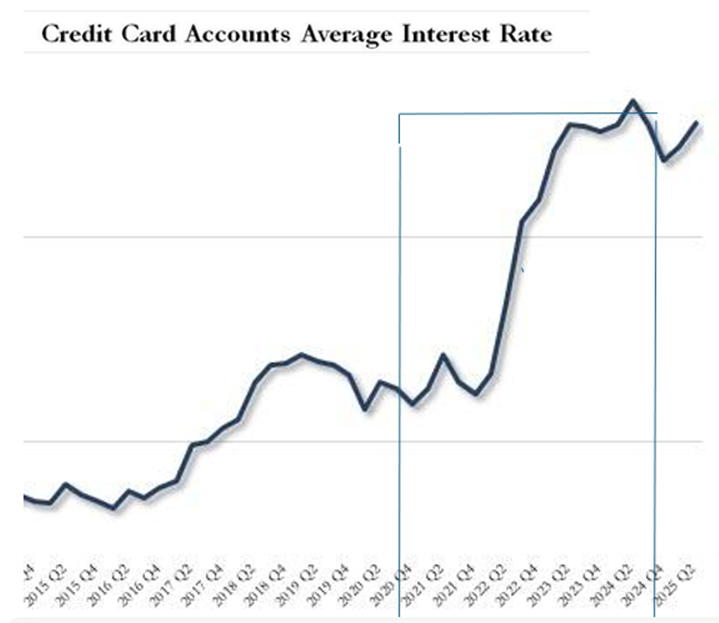

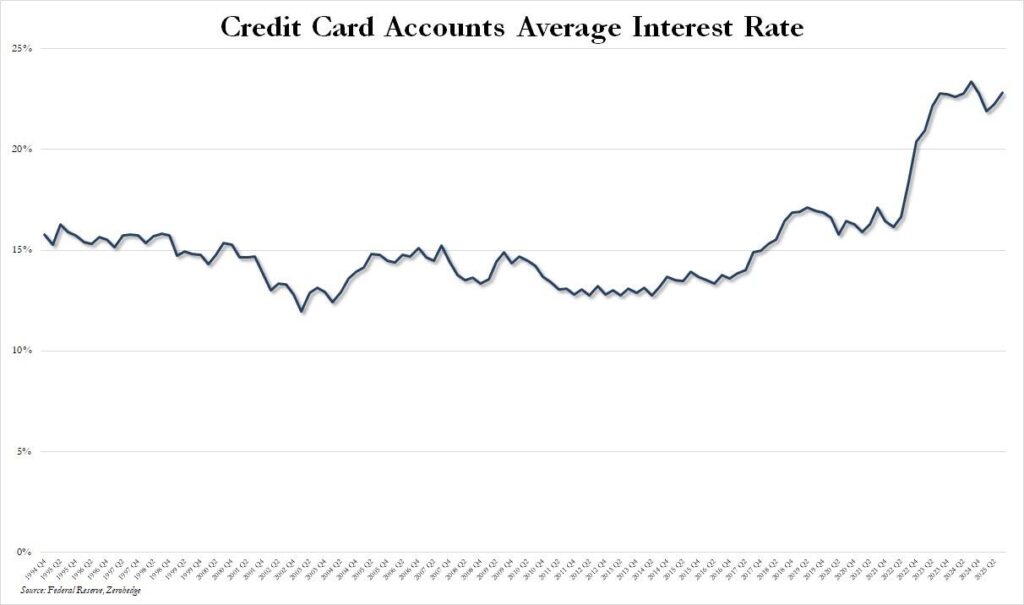

The second element of the debt trap – soaring interest rates

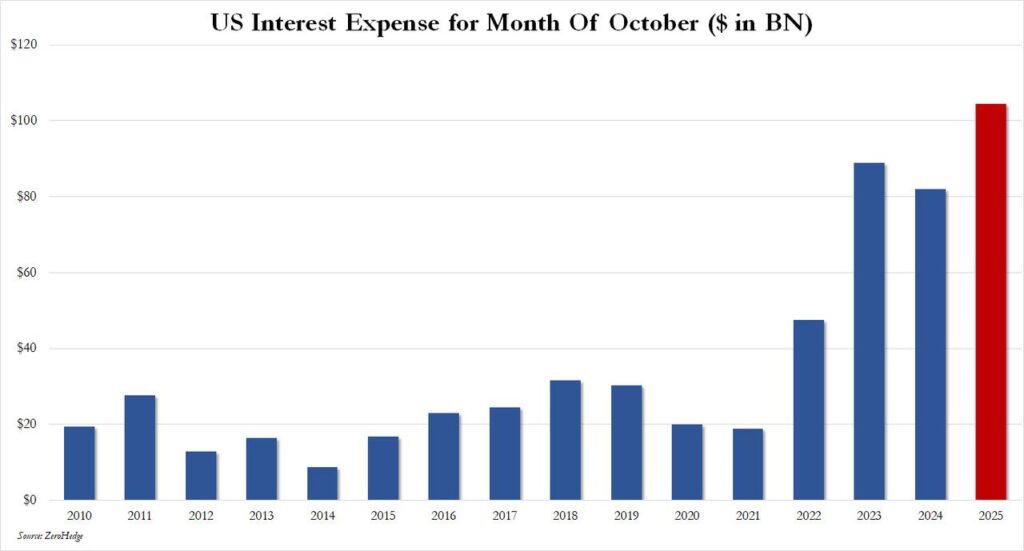

So far, we have seen that in the first 25 years of this new century, the increase in tax revenue has failed lamentably to keep pace with the increasing growth of debt. For the US Government, this has not mattered too much while the Fed was able to suppress interest rates even to the zero bound and therefore contain the compounding cost of funding. Additionally, with the dollar being everyone’s reserve currency, foreign buyers were always demanding them and investing in the regulatory “risk-free” status of US Treasury debt. It is this combination which has extended the dollar’s life as a fiat currency, pushing it even further into a debt trap waiting to be sprung by higher interest rates.

Interest rate suppression is less evident today, at least not to the degree of recent years. The sharp rise in interest rates and bond yields between 2021—2023 have only partially been corrected in the belief that inflation has receded as a problem. This is an error, because the inflationary consequences of a $2+ trillion budget deficit and a decline in the personal savings rate will continue to feed into a falling purchasing power for the currency. And geopolitical factors encourage members of the Shanghai Cooperation Organization and BRICS, representing a large majority of the world’s population, to reduce their dollar exposure as well.

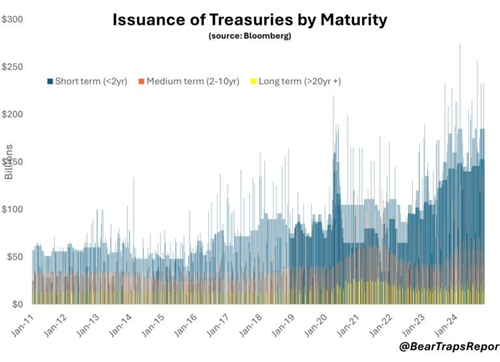

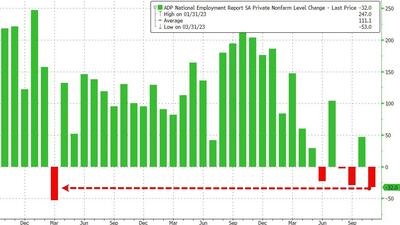

Both these factors are feeding into an inevitable funding crisis for the US Government, as foreign buyers of US Treasury debt stay away, and in some cases are actually selling. And instead of interest rates and bond yields being under the control of the Fed, they will be exposed to the brutal consequences of falling market demand. A buyers’ strike by foreign investors at the margin is already forcing the US Treasury to fund itself in short-term T-bills, with auctions for longer maturities being generally avoided. Increasingly, the $38.6 trillion debt mountain sees longer maturities being replaced by T-bills as well. The whole maturity structure of US Treasury debt is changing, and it is not for the good.

The yield curve has begun to price in maturity risk, with the 30-year long bond yielding 68 basis points more than the 10-year note, and 127 bp more than the 6-month T-bill. But there is a further problem: in a debt trap, the higher the funding cost, the less attractive an investment proposition becomes, because the compounding pace at which the debt rises accelerates.

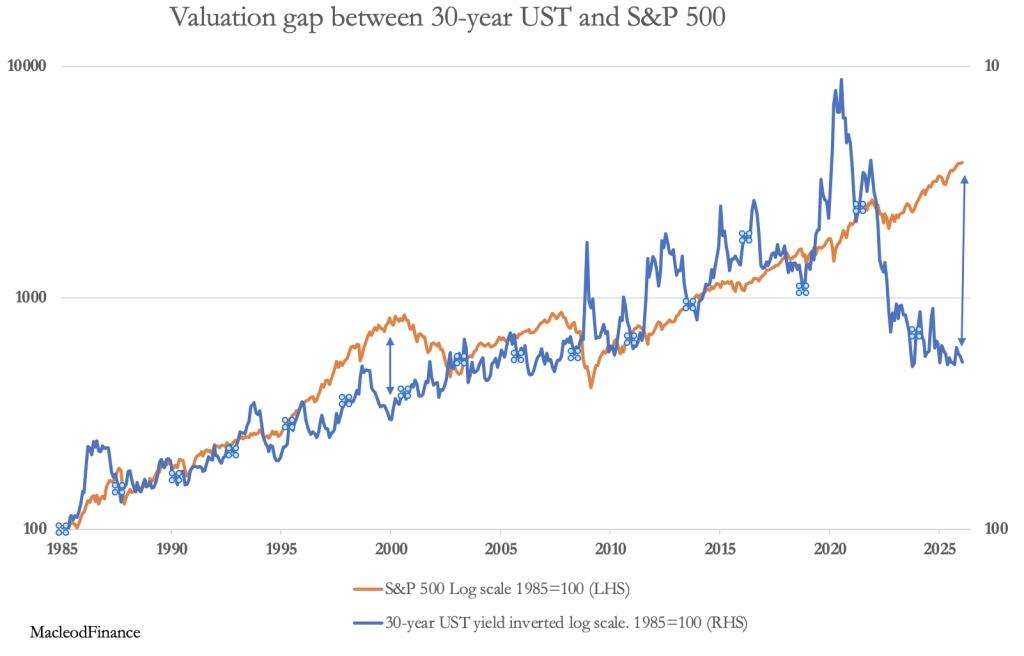

The consequences for the credit bubble

For every debt, there is a credit and in recent years significant quantities of this credit, has found its way into financial instruments, particularly equities. As the interest cost on this debt increases, the credit side of the bubble will burst. Today, the disparity between the returns on long maturity bonds and equities is at an all-time record, illustrated by the chart below:

It is worth taking time to study this chart closely. Not only is the excessive value of the S&P over the long bond greater than it has ever been, but it shows signs of going higher due to rising bond yields. This will only be resolved by an equity crash to rival or even exceed anything seen in history.

__________________________________

America is at an historic crossroad. Present a plan to solve this impending crisis, or face the consequences.

The Leviticus 25 Plan the only politically feasible, economically viable economic plan anywhere with the raw power to get America back on track.

The Leviticus 25 Plan will achieve:

• Massive public and private debt elimination

• Robust liquidity for U.S. credit markets

• Powerful, free market-driven economic growth

• Long-term stability for the U.S. Dollar

• Financial security and economic liberty for millions of American families

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$95,000 per U.S. citizen – Leviticus 25 Plan 2026 (42476 downloads )