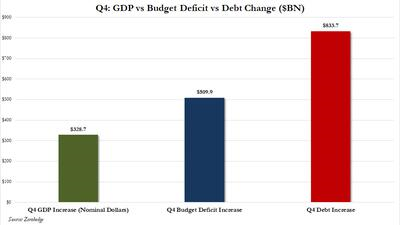

Washington Republicans appear to be losing ground in America’s ‘election integrity’ battles, while at the same time offering ‘nothing’ to restore prosperity, reignite economic growth, maintain confidence in the American Dream – to win back the hearts, and votes, of U.S. citizens.

…………………………………..

GOP Efforts To Shore Up Election Security In Swing States Face Challenges

ZeroHedge, Feb 19, 2024 | Authored by Steven Kovac via The Epoch Times

Excerpts:

Massive voter fraud allegations that marred the 2020 election spurred a political and grassroots movement from coast to coast to pursue an array of election reforms designed to increase election integrity.

However, with just months left ahead of the 2024 election, Republicans say little was mended, especially in contested states where they thought fixes were needed most.

Much concern is centered around five key swing states that became the focus of 2020: Georgia, Pennsylvania, Arizona, Michigan, and Wisconsin.

Election reforms tend to follow party lines. Democrats commonly castigate increased election security measures as voter suppression, while Republicans often condemn laws and directives that loosen security as aiding and abetting voter fraud.

According to a report from the Brennan Center for Justice, a left leaning, non-profit, law and research foundation, 23 states enacted 53 laws relaxing election security restrictions in 2023, while 14 states enacted 17 laws tightening them.

The statistics suggest that Democrats are still winning the nationwide battle, as they have for the past several years. The report found the states that took the most actions to tighten election security are the places that already had security measures in place.

Of the 14 states that tightened voting procedures, President Trump won all but one (New Mexico) in both 2016 and 2020. The 14 states listed by the Brennan Center include Arkansas, Florida, Idaho, Indiana, Kansas, Mississippi, North Carolina, North Dakota, Nebraska, New Mexico, South Dakota, Texas, Utah, and Wyoming.

The methods by which Americans cast their ballots have changed markedly over the last four federal election cycles, with many people embracing election procedures such as no-excuse absentee voting, early voting, and same-day voter registration.

As early as 2005, the bipartisan Carter-Baker Commission raised concerns that mail-in voting was a vehicle for potentially significant election fraud, yet the method has since steadily grown.…

In the 2022 election, half the states and territories allowed same-day voter registration.

In the election cycles before the pandemic, the EAC study said that nearly 60 percent of Americans voted in person on election day. In 2022, the figure was 49 percent.

Before the pandemic, mail-in ballot drop boxes were rare, with most being deployed in or around an election office. By 2022, there were 13,000 drop boxes being used in 39 states, with many boxes placed in settings that lacked security and surveillance measures.

Fifteen of the 39 states and territories using drop boxes, including Georgia, Michigan, Pennsylvania, Wisconsin, New York, and Maine, couldn’t report how many ballots were collected from their receptacles in 2022, the report said….

Despite the push by some election integrity activists for the hand-counting of ballots as a means to improve accuracy and security, the method was used by only 17.8 percent of jurisdictions in 2022, down from 20.7 percent in 2020.

And although chain of custody protections for ballots are being tightened in several states, dirty voter registration rolls—resulting in mail-in ballots being sent to ineligible people, undeliverable addresses, or multiple ballots being sent to the same individual—are still a widespread issue….

Georgia – The state of Georgia has been the scene of continuous controversy over the conduct of the Nov. 3, 2020, presidential election in which challenger Mr. Biden defeated incumbent President Trump by 11,779 votes (0.23 percent).

The persistent public outcry over alleged election fraud prompted the Republican-controlled Georgia General Assembly to pass the 95-page Georgia Election Integrity Act of 2021.

The declared purpose of the legislation is to apply “the lessons learned” in 2020 and “make it easy to vote and hard to cheat,” in the future.

An explanatory notation in the bill acknowledged that there was a “significant lack of confidence” in the state’s election systems stemming from persistent allegations of “rampant voter fraud” and “rampant voter suppression.”

“The changes made in this legislation in 2021 are designed to address the lack of elector confidence in the election system on all sides of the political spectrum,” the notation said….

The act prohibits local officials from accepting non-government funds, grants, or gifts in connection with election administration.

In 2023, the Georgia legislature passed SB-222 to bolster the 2021 prohibition to make it a crime.

In protest to the new 2021 measures, Major League Baseball deemed them “restrictive,” and moved that year’s All-Star Game from Georgia to Colorado.

Georgia state Sen. Colton Moore, a Republican, said that although improvements have been made since 2020, much meaningful work is still needed.

“Nothing of substance has changed since 2020. Every mechanism to facilitate a steal is still in place,” he told The Epoch Times. “We must work to eliminate the vulnerabilities still in place today.”

Mr. Moore also highlighted the “ridiculous” number of absentee ballots still used in Georgia elections and said they ought to be restricted to military personnel and medically disabled citizens. He said he was also worried about the institutionalization of the use of absentee ballot drop boxes, which he believes should be done away with altogether.

“We need to make it a legislative priority to stop authoritarian figures like [Fulton County District Attorney] Fani Willis from prosecuting people for merely questioning our elections. Her actions have created a chilling effect among my colleagues in the legislature,” he said.

“Unless we obtain a legislative solution soon, we must resolve to overcome fraud through an overwhelming turnout in November.”

Michigan

Right after being elected in 2018, Michigan’s Democrat Gov. Gretchen Whitmer used her veto power to shoot down nearly 20 election integrity reform bills sent to her desk by the then-Republican-controlled state legislature.

In the 2020 presidential election, President Donald Trump lost Michigan to Joe Biden by 154,000 votes or 2.8 percent.

Afterwards, judges in six different court cases found that Michigan’s Democrat Secretary of State Jocelyn Benson issued inaccurate or legally unauthorized guidance to local officials in the runup to the 2020 general election.

When Ms. Whitmer was reelected in 2022 and Democrats captured control of the legislature, within a year 12 new Democrat-sponsored election laws were enacted—all of which Republicans say loosen security.

The new Democrat-authored statutes extend automatic voter registration to other state agencies and offices beyond the Secretary of State’s office, which issues driver’s licenses in Michigan.

They liberalize online registration and allow a person to apply for an absentee ballot online. They permit 16-year-olds to pre-register to vote.

During the past several election cycles, Democrat activists, backed by out-of-state, big-money donors, effectively used the ballot initiative process to repeal existing election laws, enact new laws, and amend the state constitution. Two of the largest contributors were the Sixteen Thirty Fund ($11 million) and the George Soros-founded Open Society Foundation ($1.2 million)….

The initiative process was also used to weaken photo ID requirements by mandating that election officials accept an affidavit of identity signed by the prospective voter instead. It also enabled people to request to automatically receive an absentee ballot for every election in perpetuity, and it authorized taxpayer-funded, postage-free mailing for people returning absentee ballot applications or mail-in ballots….

The ballot proposals enacting these new laws were approved handily by the Michigan electorate at the polls.

Read the rest here…

______________________

Dear Washington Republicans –

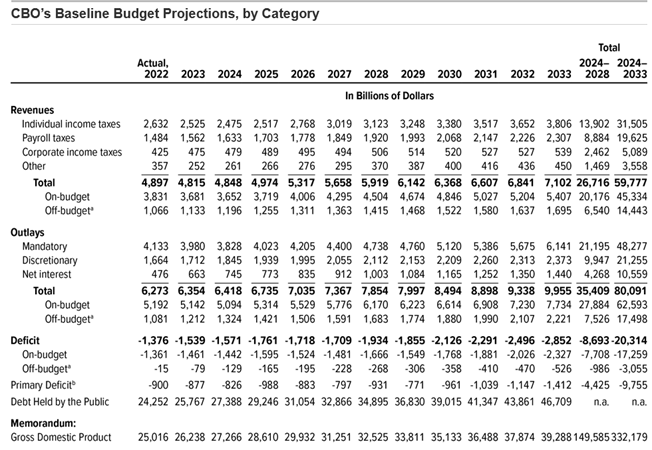

It is high time for you to win over voters – and win elections – the old fashioned way, with powerful economic plans and strategies to: 1) Improve financial security and enact a sweeping debt relief plan for millions of American families (like you did for Wall Street’s banks and insurers during 2008-2010 and again during the Covid years 2021-2022); 2) Reduce the pressures on state and federal government agencies to continue expanding entitlement spending; 3) Get America’s snowballing federal deficits back under control; and 4) Minimize governmental intrusion into the daily affairs of U.S. citizens.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America Leviticus 25 Plan 2025 (11646 downloads )