Important to note: “House Republicans opened the earmark door with a secret caucus vote three years ago. Now, it’s nearly a ‘free’ for all…”

…………………………

ZeroHedge, Mar 26, 2024 – Authored by Adam Andrzejewski via OpenTheBooks substack, Excerpts:

“The Squad’ is a group of ultra-left wing Congressional socialists which has been the toast of so-called “progressives” for the last several years.

Its members might promise a worker’s paradise, in which government “withers away,” in the words of Vladimir Lenin, but for now they are only too happy to direct government largesse to the folks back home.

In fact, The Squad members have earmarked $224 million and many absurd pet projects since 2023.

Download the full database of The Squad’s 2023 and 2024 earmarks here.

Our figures include the earmarks in the most recent $1.2 trillion spending bill from last week.

It’s a stunning display of logrolling – deep inside the status quo – they say they hate as a tool of capitalist oppression.

The Squad maxed out their pork in 2023 and 2024. Their 215 earmarked projects cost the rest of us (overwhelmingly non-socialist) U.S. taxpayers $224.1 million. Every dime was borrowed against our national debt.

New York’s Alexandria Ocasio-Cortez (D-NY), AKA, “AOC,” who last week did not know that “RICO” names a crime, is The Squad’s most prominent voice. She is celebrated as a “socialist superstar” by the Democratic Socialists of America.

Representative Ocasio-Cortez earmarked $1.2 million for a new building for the International Muslim Women’s Empowerment Project. Its founder teaches a “hijab grab” self-defense move involving a “kick to the groin.”

And then there’s the $500,000 for the Billion Oyster project in her district. Rich people eat oysters. However, the law prohibits anyone from either fishing or eating oysters in the Hudson River. So, this is only an engineering project for eco-marginalized people in Queens.

Other Squad members are Jamaal Bowman (D-NY), Cori Bush (D-MO), Greg Casar (D-TX), Summer Lee (D-PA), Ilhan Omar (D-MN), Ayanna Pressley (D-MA), and Rashida Tlaib (D-MI).

The Squad Practices Race-based Earmarking – Squad members shoveled some pretty stinky stuff into spending bills. It appears race-based legislating is OK if a progressive does it:

- $850,000 to create jobs for the Black community near George Floyd Square, whose death in 2020 “added to the stress faced by the community and increased the need for support and stability in housing and commerce.” Patron: Congresswoman Ilhan Omar.

- $1.7 million to help the Environmental Leaders of Color build a “green tech park.” The group’s goal is to “assist marginalized communities in preparing for climate change’s adverse effects … so that they can thrive like healthy plants in their natural ecosystem.” Patron: Congressman Jamaal Bowman.

- $1 million for the Immigrant Opportunity Center expansion. It’s run by CAPI USA, a nonprofit that “guides refugees and immigrants in their journey toward self-determination and social equality.” Patron: Congresswoman Ilhan Omar.

- $1.35 million to New Immigrant Community Empowerment, a nonprofit that advocates for citizenship for all illegal immigrants. Patron: Congresswoman Alexandra Ocasio-Cortez ($500,000). The group received another $850,000 this year from Rep. Grace Meng (D-NY).

- $1.5 million to build special grocery stores and education facilities for Black farmers in the community of St. Louis. Patron: Congresswoman Cori Bush.

- $1 million for the San Antonio College Empowerment Center, which runs an Undocumented Student Support Program to help immigrants enroll in the school. Patron: Congressman Greg Casar.

The Squad’s Green Earmarks

Congresswoman Ocasio-Cortez introduced her Green New Deal, in 2019. It’s the focus of 21 earmarks to build green infrastructure, move away from fossil fuels, and involve minority communities in climate policy. She and her colleagues find ways to get us to pay for their policy preference, such as:

- $1 million to build “a network of intergenerational, trauma-informed waterfront green spaces.” The project already received $792,000 in 2022 earmark funding. Patron: Congresswoman Ayanna Presley

- $466,000 to improve the energy efficiency of a St. Louis homeless shelter. Patron: Congresswoman Cori Bush.

- $4 million to build an “industrial green beltway” in Dearborn, Michigan. Patron: Congresswoman Rashida Tlaib.

- $500,000 from Ocasio-Cortez will build an oyster reef to “address longstanding environmental justice inequities facing underrepresented communities in Queens.” Oyster habitats in New York have been damaged by pollution and harvesting them for food is illegal.

- $850,000 to repair a bridge that “connects minority environmental justice communities” in Pennsylvania. Patron: Congresswoman Summer Lee.

- $2 million for Everett, Mass. to build a park for “low-income BIPOC residents” to “stay cool during increasingly hot summers.” (“BIPOC” is an acronym for “Black, indigenous and other people of color.”) Patron: Congresswoman Ayanna Pressley.

Stopping Insane Earmarks. Or Not.

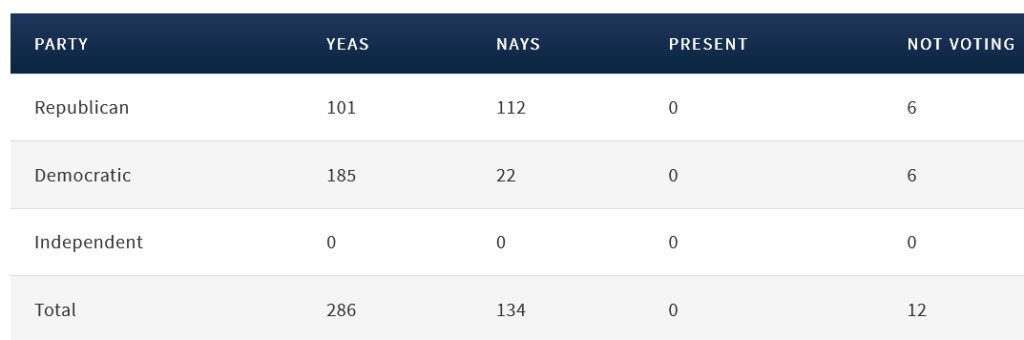

In 2024, when it got too insane, Republican members of the House finally got serious and cut a few of the whacky earmarks.

For example, Rep. Pressley’s earmark to build affordable housing for LGBTQ seniors did not make it into the final House bill.

However, in the second minibus bill, Pressley was able to add back $850,000 for LGBTQ “The Pryde” senior housing by moving the earmark to the U.S. Senate. Pressley called Republicans homophobic for attempting toeliminate her LGBTQ earmarks.

Background

From time immemorial, politicians of every stripe have used their positions to benefit those who sent them to D.C., while sticking taxpayers with the tab.

Congresspeople all play together in the sandbox, promising not to rat each other out for some strikingly goofy – or downright weird – local spending. Things got so out of hand 15 years ago, that a bi-partisan coalition led by former U.S. Senator Dr. Tom Coburn (R-OK) and President Barack Obama actually banned earmarking for ten years.

It didn’t last.

Regardless of what you may have heard about GOP hate for former U.S. House Speaker Nancy Pelosi (D-CA), three years ago, the House Republican caucus, in a secret vote, joined Speaker Pelosi and the Democrats to reinstate earmarks.

That moment of fiscal fealty was replaced by the naked need for pork, and in the instance, a new alliance with the Speaker.

And so, we have more tabs to face than a diet soda aisle at a big Costco.

In 2024, the so-called “minibus measures” contained 8,051 earmarks totaling $15.7 BILLION TAXPAYER DOLLARS. In 2023, the year-end omnibus was stuffed with 7,510 earmarks worth just over $16 BILLION TAXPAYER DOLLARS.

Congress must disclose earmarks online. However, it posts them in hard-to-review PDF files. (Our team at OpenTheBooks.com converts those files into Excel spreadsheets to more effectively parse what they are hiding.)

When Congress knows what it is doing is wrong, it always makes it a bit harder to find.

In all too many ways, earmarks – from both Democrats and Republicans — are no exception.

Next week – “The Freedom Caucus Decides It Is Free to Earmark”

_________________________________

It is critical now for America to get back on track.

Step 1: Eliminate Earmarks – eliminate budget blowouts from special interest politics.

Step 2: The Leviticus 25 Plan – Leviticus 25 Plan 2025 (12185 downloads )

Step 3: Less government, more freedom.