Washington Democrats have an economic plan: Socialism expansion, debase the Dollar, migrate to MMT economics, roll the U.S. economic system into the coming ‘Central Bank Digital Currency’ new world order, and subvert the individual rights and liberties of all Americans.

Washington Republicans have ‘no credible plan’ … other than to lightly ‘tap the brakes’ on the Democrats’ broader socialization mission and goals.

Washington Republicans have priceless opportunity at this very moment to get America’s exploding deficits back under control, solve the ongoing the budget battles / government shutdown deadlines, restore economic liberty, and get America back on track. Shamefully… they have no plan.

Congress Has 5 Days To Avert A Shutdown | Down to the wire once again… Nov 13, 2023 – ZeroHedge

………..

No Surprise, House Speaker Johnson Proposes Same Plan as McCarthy | There are likely big surprises elsewhere, but there is no surprise in this corner regarding Johnson’s plans to keep the government running. Nov 13, 2023 – ZeroHedge

_____________________________________

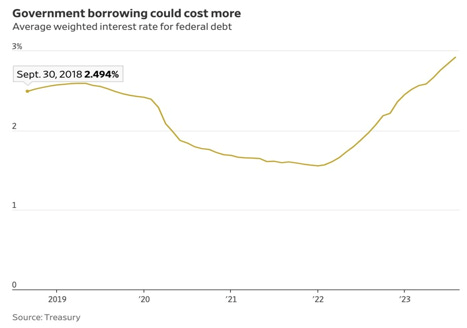

The Federal Reserve also has no plan to stabilize the financial system, avert a looming Treasury auction crisis, insure long-term strength and stability for the U.S. Dollar, and reignite economic growth.

The Fed Has No Plan, And Is Just Hoping For The Best | There is no long-term thinking here about building a sound economy, fostering investment, or helping the working man save for retirement. The Fed’s concern is keeping up appearances… Nov 12, 2023 – ZeroHedge

………………………………………………

There’s A “Crisis Brewing”: Powell & Piss-Poor Auction Spark Chaos In Credit Markets, Crypto Soars | Nov 9, 2023 – “…this is a shitshow, liquidity is disastrous and the auction is the canary in the coalmine…” – ZeroHedge

___________________________

Washington Republicans are once again playing out a ‘losing hand’ with voters in this ongoing game of budget roulette.

Washington Republicans wasting a golden opportunity, a once in a generation moment, to present a dynamic new winning plan for America – one that would put an end to these revolving-door debt ceiling impasses once and for all – and deliver a powerful debt-elimination strategy across all sectors of the U.S. economy, with major financial security gains for working Americans. A plan that will strengthen America’s long-term national security interests.

Main Street America Republicans have just such a plan – loaded up and ready to launch.

The Leviticus 25 Plan economic acceleration plan that will provide a dynamic ‘recharge’ to the U.S. economy, generate meaningful budget surpluses, reestablish citizen-centered healthcare, and restore economic liberty in America.

It will “unleash a new wave of prosperity” in America.

The Leviticus 25 Plan will generate $619 billion federal budget surpluses for the initial 5 years of activation (2024-2028), and completely pay for itself over the succeeding 10-15 years.

The Leviticus 25 Plan is a powerful economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America 2023

Economic Scoring links:

· The Leviticus 25 Plan – 2024 Generates $619.5 billion Federal Budget Surpluses (2024-2028) Part 1: Overview, Deficit Projection

____________________________________________________________________

The Leviticus 25 Plan – An Economic Acceleration Plan for America 2024

$90,000 per U.S. citizen – Leviticus 25 Plan 2023 (8479 downloads)

Website: https://leviticus25plan.org/

__________________________________________

Preview 1:

The Leviticus 25 Plan provides a $90,000 credit extension, direct from the Federal Reserve, to every participating U.S. citizen: $60,000 into a Family Account (FA) and $30,000 into a Medical Savings Account (MSA).

Example: Qualifying family of four would receive $240,000 in their FA, and $120,000 in their MSA.

Primary goals: Massive debt elimination at family level: mortgage debt, consumer debt, student loan debt. Federal budget surpluses.

Eligibility: U.S. Citizen. Job history, credit history requirement (similar to traditional credit checks for bank loans). Clean recent drug history. Clean crime history.

Requirements: Forego all federal and state tax refunds for 5-year period.

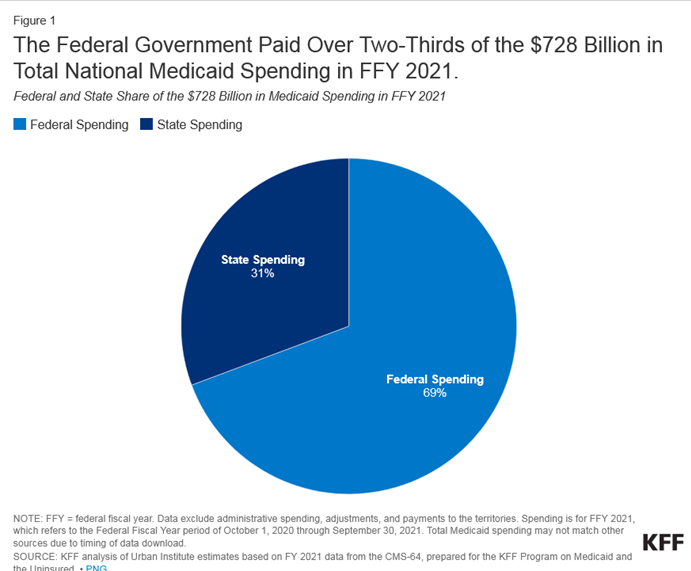

Forego Economic Security and selected means-tested welfare benefits – for minimum 5-year period.

Forego enhanced federal rental forbearance/assistance – for minimum 5-year period.

Forego SSI and SSDI for minimum 5-year period.

New $6,000 deductible on primary care access to: Medicare, Medicaid, VA, TRICARE, FEHB – for minimum 5-year period.

The Plan assumes that the elite-wealthy will not participate, because their refunds are too valuable to give up over the requisite 5-year period.

The Plan also assumes that many who heavily depend on Economic Security and social welfare benefits will also choose not to participate, because the overriding value of those benefits, vs foregoing them, over the 5-year period.

Preview 2:

The Leviticus 25 Plan grants the same direct access to liquidity, through a Fed-based Citizens Credit Facility, similar to the credit facilities that were created by the Fed to transfuse trillions of dollars in direct transfers and credit extensions to Wall Street’s major banks, credit agencies and insurers during the great financial crisis.

The following facilities were created and activated by the Fed for this massive Wall Street bail out operation: Term Auction Facility (TAF), Primary Dealer Credit Facility (PDCF), Term Securities Lending Facility (TSLF), currency swap agreements with several foreign central banks, Commercial Paper Funding Facility (CPFF), Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility (AMLF), Money Market Investor Funding Facility (MMIFF), and the Term Asset-Backed Securities Loan Facility (TALF), and access to the Fed’s Discount Window.

Additional perspective: SIGTARP, the oversight agency of the Troubled Asset Relief Program (TARP), in its July 2009 report, vetted by Treasury, noted that the U.S. Government’s “Total Potential Support Related to Crisis” (page 138) amounted to $23.7 trillion. While this figure represents a backstop commitment, not a measure of total potential loss, it is nonetheless an astounding degree of support, in the form of liquidity infusions, credit extensions and guarantees, various other forms of assistance for financial institutions and other business entities affected by the financial crisis.

Preview 3:

The Leviticus 25 Plan website has been accessed on one or more occasions by the following financial enterprises/agencies: JP Morgan, Goldman Sachs, Morgan Stanley, Bank of America, Citigroup, Wells Fargo, State Street, Merrill Lynch, AIG, Barclays Plc, Royal Bank of Scotland, Deutsche Bank, Société Générale S.A, UBS AG, Credit Suisse, BNP Paribas, The U.S. Department of Treasury, General Accountability Office (GAO), The European Central Bank (ECB), Bank of England (BOE), Swiss National Bank (SNB), Bank of Canada, Bank of Montreal, Bank for International Settlements (BIS).

………………………………………………………..

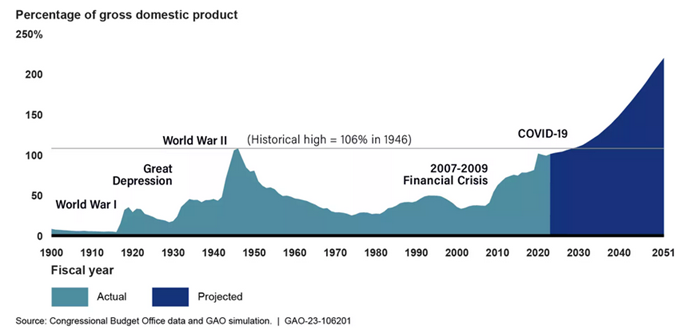

The General Accountability Office has stated that America’s ongoing debt crisis is unsustainable.

It is time for America to institute a bold, new plan.

The Leviticus 25 Plan is loaded up and ready to launch. The ‘golden moment’ for Republicans has arrived.