Washington Democrats have another new race-centric subsidy plan.

Washington Republicans, once again ‘dead in the water’ – have no better alternative to present to American families…

Fannie Mae’s New Racial Bias – WSJ

The government-sponsored housing giant embraces race-based subsidies.

June 13, 2022 – Excerpts:

It was probably inevitable that the Biden Administration would enlist housing giants Fannie Mae and Freddie Mac to advance its woke agenda, and now it has. Last week the government-sponsored enterprises released plans to promote housing “equity” that are chock-full of race-based subsidies.

Fannie and Freddie have been under federal conservatorship since Treasury rescued them during the housing meltdown with a $190 billion taxpayer bailout. The Federal Housing Finance Agency (FHFA) has since regulated their capital, liquidity and underwriting, as well as the mortgages they can acquire. Trump FHFA director Mark Calabria kept the monsters on a tight leash, but there was always a risk that a future Administration would ease up and politicize home lending again. That day has come.

In September the Biden FHFA announced it would require Fannie and Freddie to “prepare and implement three-year Equitable Housing Finance Plans that describe each Enterprise’s planned efforts to advance equity in housing finance.” Translation: They must find ways to boost minority homeownership no matter the risk for taxpayers.

Calling all of this mission creep is an understatement. The GSE equity plans would let the Administration spend billions of taxpayer dollars on housing without Congress appropriating a cent.

Freddie Mac’s equity plan also includes credit programs to address “systemic barriers” to housing for minorities but at least tries to camouflage its racial preferences. Fannie makes its subsidies for blacks explicit, but they don’t appear to extend to other racial groups such as Hispanics and Asians. Low-income white borrowers are also excluded.

These racially targeted subsidies are probably unconstitutional. Multiple federal courts have blocked a $3.8 billion Covid relief program to forgive loans for minority farmers. The Biden Administration may argue that a different legal standard applies to private companies like Fannie and Freddie, and that the credit programs are aimed at remedying past redlining.

But the GSEs are de facto state actors, and the Supreme Court held in Richmond v. Croson (1989) that governments may adopt racial set-asides only to remedy specific episodes of past discrimination that the government had a hand in. The GSE plans are supposedly intended to compensate for government-sanctioned redlining in the 1930s that Congress banned in 1968.

…… No economic good, and much social harm, will come from turning Fannie and Freddie into agents of progressive racial division.

_____________________________________________

America needs economic initiatives that provide equal opportunities for all Americans – and honor the sacred principle of equal justice under the law.

Washington Republicans again have nothing to put on the table – to transcend the politics and to ‘lift all ships.’

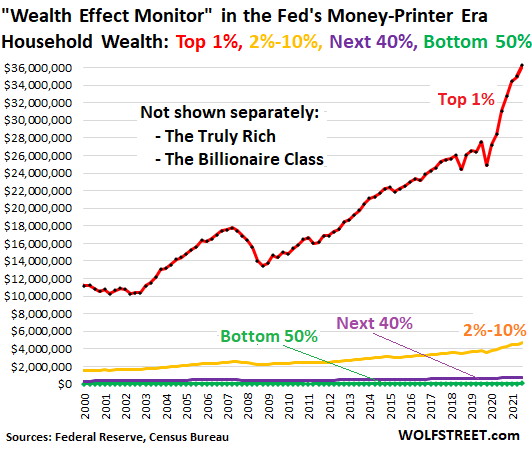

Main Street ‘ground level’ Republicans do have a plan, the most powerful economic acceleration plan on the face of the earth – one that treats all U.S. citizens equally, and provides a dynamic boost to home ownership opportunities and massive debt elimination for millions of American families.

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2023 (4089 downloads)