The Affordable Care Ace (ACA) was signed into law on March 23, 2010 and launched in 2013. It is not living up to its promises.

………………………………………….

.How Obamacare has worked the last six years TheDailySignal / Melissa Quinn / March 23, 2016 / Excerpts

Six years ago Wednesday, President Barack Obama signed the Patient Protection and Affordable Care Act into law. Since then, Americans have seen their premiums increase, a dozen nonprofit insurers have closed their doors and the number of people

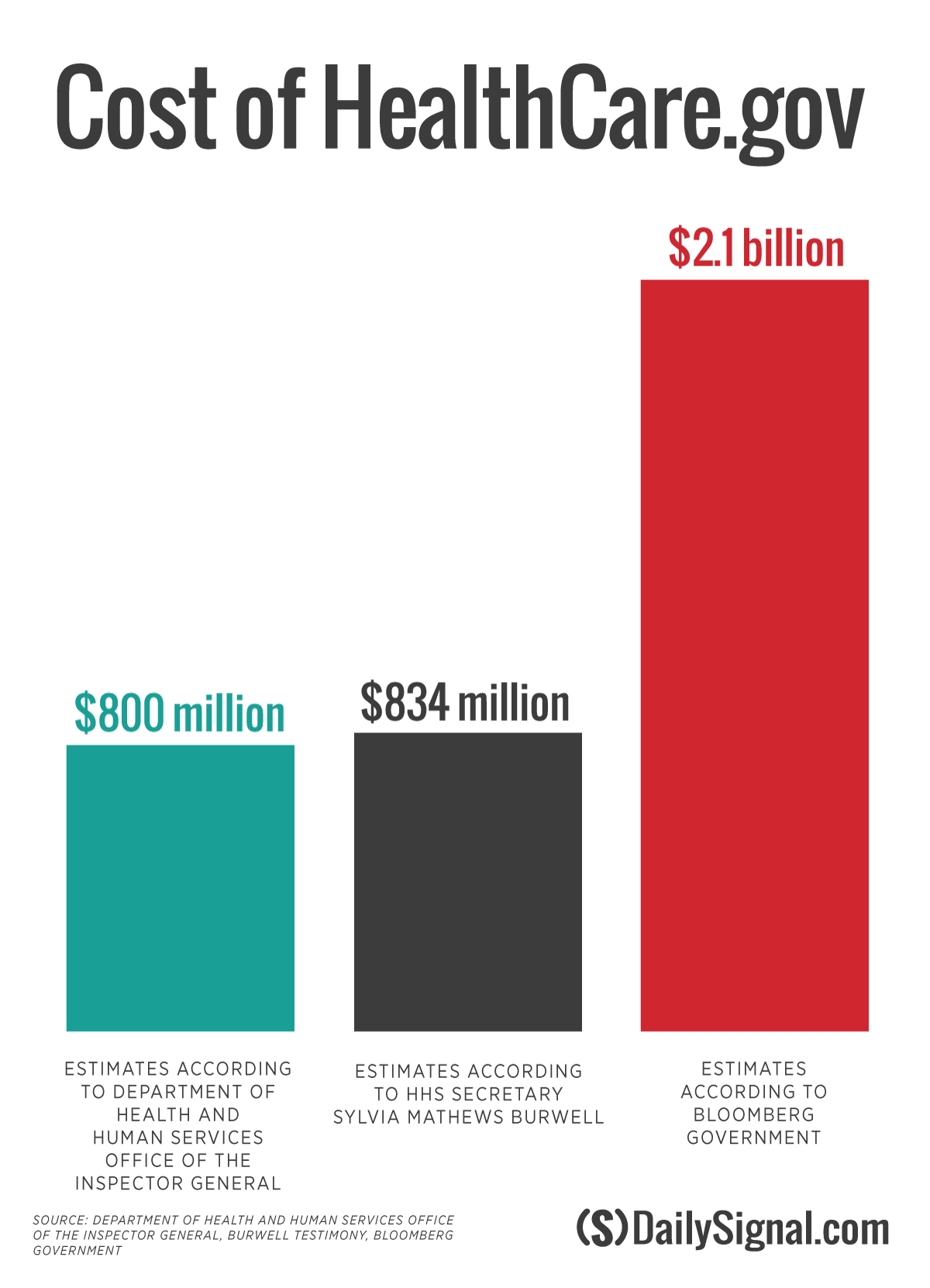

1) The Cost of HealthCare.gov Obamacare’s implementation in October 2013 came with the launch of HealthCare.gov, the federal health insurance exchange.

Though the Obama administration hasn’t formally said how much HealthCare.gov cost the taxpayers, Department of Health and Human Services Secretary Sylvia Mathews Burwell said last May that the website cost $834 million. Similarly, a report from the Department of Health and Human Services Inspector General put the cost of the exchange at $800 million.

An analysis by Bloomberg Government, though, put the total cost at $2.1 billion. Bloomberg Government took into account budgetary costs for the Internal Revenue Service and other government agencies, as well as contracts reworked to pay for the website.

_________________________

$2.1 billion is a lot of money to spend setting up the federal exchange, a bureaucratic monstrosity with layers upon layers of red tape, multiple millions of dollars in ongoing embedded costs, restricted access and surging costs for consumers, and reimbursement cuts and electronic headaches for providers.

And that cost layer doesn’t include the $4.4 billion cost in setting up state exchanges along with billions of dollars in additional costs for insurer subsidies, healthcare navigators, advertising, and on and on.

Costs are rising, enrollment is shrinking, and according to the CBO, it is costing a lot of Americans their jobs: Obama care’s cost per beneficiary explodes with shrinking enrollment NCPA January 28, 2016

There is a better way.

Decentralized health care is the solution, with U.S. citizens allocating health care resources in accordance with their own needs and desires:

The Leviticus 25 Plan 2017 – $75,000 per U.S. citizen The Leviticus 25 Plan 2017 (1536)