David Walker, is a former comptroller general of the United States, former head of the Government Accountability Office (GAO), and a current Main Street Economics advisory board member.

…………………………………….

Washington’s Fiscal Mess Is Irresponsible, Unethical, Immoral: Former US Comptroller General

ZeroHedge, Apr 27, 2024 | Authored by Andrew Moran via The Epoch Times,

Walker interview with the Epoch Times – Excerpts:

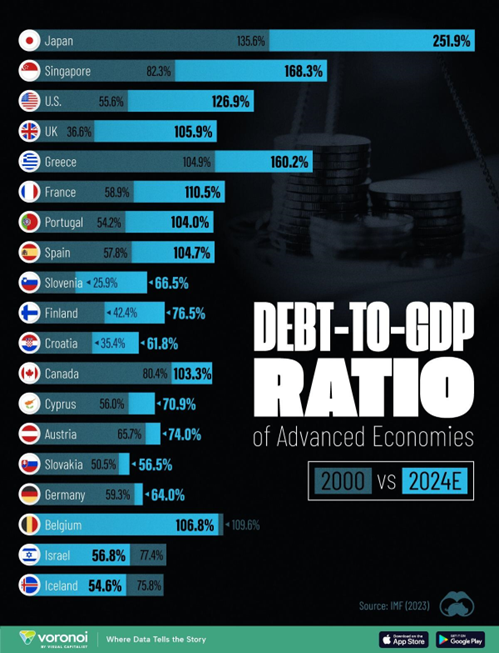

In 2007, the U.S. national debt was below $10 trillion, and the budget deficit was about $160 billion. Federal spending was about $3 trillion, and interest payments were approximately $400 billion... Then the numbers spiraled out of control.

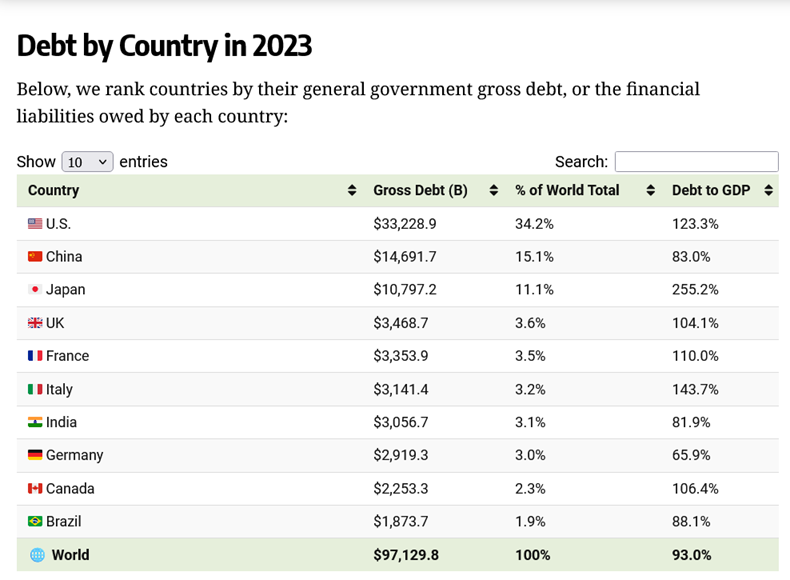

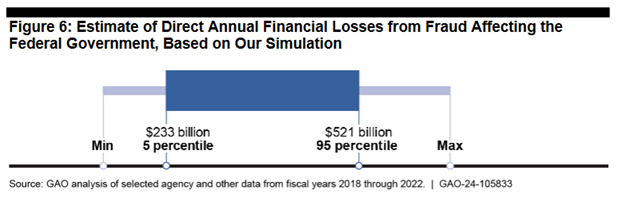

Washington’s fiscal situation has drastically changed… total debt has surpassed $34 trillion, the annual budget shortfall exceeds $1 trillion, and interest costs have topped $1 trillion…

According to the Congressional Budget Office’s long-term outlooks, the national debt will eye $50 trillion by 2034, fueled by around $17 trillion in cumulative deficits. As a percentage of GDP, debt held by the public and the deficit will reach 166 percent and 8.5 percent by 2054, respectively, the CBO forecasts.

“Washington has become addicted to spending, deficits, and debt, and they’re charging the credit card and planning to send the bill to younger and future generations of Americans,” Mr. Walker told The Epoch Times.

“That’s irresponsible. It’s unethical, and it’s immoral, and it needs to stop.”

“Only God knows when the tipping point is going to occur, and God’s not telling us,” he said.…

Republicans and Democrats

President Joe Biden… has added close to $7 trillion to the national debt since taking office in 2021.

While Republicans have griped over the current administration’s spending endeavors, experts assert that the GOP has also contributed trillions of dollars to the debt pile. One of the GOP-led expansionist initiatives was Medicare Part D under former President George W. Bush…

This program, which was designed to utilize private health care plans to offer drug coverage to Medicare beneficiaries, added $8 trillion in new unfunded obligations. Mr. Walker accepted that “the politicians were totally out of touch with fiscal reality,” considering that Medicare was already underfunded by $19 trillion.…

Put simply, both parties have been fiscally irresponsible, and now the bills are coming due.

“The federal debt is on an unsustainable course, and lawmakers have been unable or unwilling to correct it,” the organization stated.

Whether the United States can improve its fiscal trajectories remains to be seen.

____________________________

Mr. Walker’s recommendation of a Congressional “fiscal commission” to get America’s government debt and unfunded liabilities crisis back under control would end up being nothing more than a political cat fight – with no meaningful accomplishments.

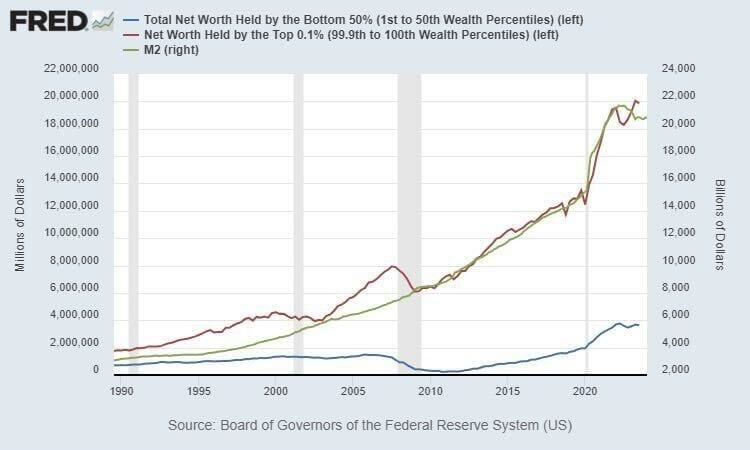

Furthermore, it would do nothing to eliminate household debt, consumer debt, student loan debt – and restore financial security for millions of America’s hard-working, tax-paying U.S. citizens.

It will take something far more powerful and far more creative than another ‘government commission’ to solve this crisis – and here it is:

The Leviticus 25 Plan is a dynamic economic initiative providing direct liquidity benefits for American families, while at the same time scaling back the role of government in managing and controlling the affairs of citizens. It is a comprehensive plan with long-term economic and social benefits for citizens and government.

The inspiration for this plan is based upon Biblical principles set forth in the Book of Leviticus, principles tendering direct economic liberties to the people.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2025 (13210 downloads )