The Degenerative Disaster Of Medicare

ZeroHedge, Jul 07, 2024 | Via SchiffGold.com, – Excerpts:

In 2023, the U.S. spent 1.04 trillion dollars on Medicare, which is over $3,000 per citizen. For an inefficient, problem-ridden program, that number is difficult for Americans to stomach.

Medicare is a health insurance program for seniors and specific disabled individuals. It has provided coverage for millions since it originated in 1965. However, the benefits it offers are far outweighed by its inefficiency and inadequacy, which cost trillions.

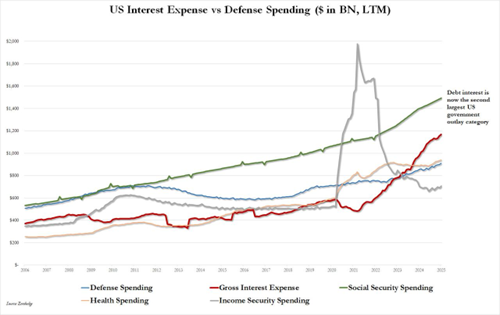

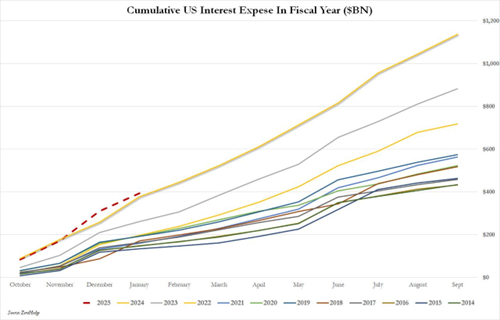

Medicare spending has grown exponentially since its creation under Lyndon B. Johnson. As of 2023, Medicare expenditures comprised 17% of the federal budget. The Congressional Budget Office projects Medicare’s spending will rise to $1.6 trillion by 2032. The Medicare Hospital Insurance Trust Fund, which finances a large percentage of Medicare, is set to be depleted by 2028. This threat of insolvency has the potential to leave millions of seniors without adequate coverage.

The causes of these burgeoning costs have a common thread: government inefficiency. Medicare’s fee-for-service model incentivizes quantity over quality—the program awards medical professionals for unnecessary procedures and artificially inflated costs. The American Medical Association approximates that 25% of Medicare spending, about $250 billion annually, is wasted on overtreatment, care administration inefficiencies, and excessive managerial costs.

Much of these administrative costs are due to the difficulty of complying with Medicare. A 2016 study showed that physicians spend an average of 785 hours per physician per year on Medicare regulatory compliance, costing an annual total of $15.4 billion.

These administrative complexities are due to the program’s intricate rules and regulations which often need to be clarified for both beneficiaries and healthcare providers. This often results in significant delays in care and excessive unnecessary costs. Medicare’s bureaucracy creates numerous obstacles for both physicians and patients which prevent seniors from getting the adequate care that they need.

This inefficiency is also passed on to seniors in the form of taxes and fees. Despite the common belief that Medicare is “free,” it comes with numerous hidden costs. The 2021 standard monthly premium for Medicare Part B was $148.50, with recipients with higher incomes paying up to $504.90 every month. Since 2000, these premiums have increased by 226%, far outpacing inflation. Additionally, the Medicare payroll tax is set at 2.9%, with those earning over $200,000 facing an additional 0.9% tax.

The aging of the U.S. population is putting unprecedented strain on Medicare. As the baby boomer generation continues to reach retirement age, the number of Medicare beneficiaries is growing faster than the working-age population that supports the program through payroll taxes. In 2022, there were 65.0 million Medicare beneficiaries, with 57.1 million aged 65 and older. This number is projected to increase substantially in the coming years.

The Medicare Trustees Report projects that Medicare spending will grow from 3.8% of GDP in 2023 to approximately 6% by 2047. This rate of increase is unsustainable, and the increasing ratio of beneficiaries to workers means that either taxes must increase significantly, benefits must be cut, or both.

In addition, Medicare’s current structure limits beneficiary choice and stifles innovation in healthcare delivery. Telemedicine has shown promise in reducing healthcare costs, especially chronic disease management. However, Medicare hasn’t embraced these innovations due to stifling regulatory constraints. A market-based approach would allow for greater experimentation and adoption of cost-effective healthcare solutions, driving innovation and improving care quality for seniors.

The current trajectory of Medicare spending is unsustainable and threatens the fiscal stability of the United States. With projected expenditures reaching $1.04 trillion in 2023, the system requires bold action from Americans and politicians who want to preserve the country’s future.

Healthcare systems will continue to fail as long as the government continues to heavily interfere. A reformed system should prioritize consumer choice, encourage provider competition, and reward innovation in healthcare delivery. This approach would utilize market forces to drive down costs and improve quality while ensuring seniors have access to comprehensive health coverage.

The time for incremental changes has passed. Medicare has cost tens of trillions and is not adequately serving seniors’ needs. Only through bold, market-oriented reforms can we hope to achieve an efficient healthcare solution that benefits both seniors and the rest of the American people.

________________________________________

The Leviticus 25 Plan provides for a $30,000 direct deposit into the Medical Savings Accounts of all qualifying or provisionally qualifying U.S. citizens – to be used for primary health care services and insurance.

This liquidity extension will flow through a Federal Reserve / U.S. Treasury Department Citizens Credit Facility directly to qualifying and provisionally qualifying U.S. citizens electing to participate.

Each participating citizen also enrolled in Medicare, Medicaid, VA Health Care, FEHB and TRICARE will then have a $6,000 annual deductible for primary care services related to those programs for five years.

This will allow participating citizens to allocate health care resources directly and efficiently, eliminating “administrative complexities” related to “intricate rules and regulations.” It will eliminate massive administrative costs for health care facilities and providers.

For Medicare patients, as well as Medicaid, VA, FEHB, TRICARE, the $30,000 deposit will be “tax free.”

The Leviticus 25 Plan will also be a ‘bail-out’ colossus for the Medicare Trust Fund, in that citizens will be paying directly, with cash, for primary health care services – for which there will be no ‘billing and claims filing’ by middle-men.

Imagine the impact if 80% of Medicare Part D’s 1.4 billion prescription events per year were to be paid for in cash.

The Leviticus 25 Plan will clean up Medicare, Medicaid, VA Health Care, FEHB and TRICARE.

And it will bail out Medicare the right way – through the hands of millions of U.S. citizens.

The Leviticus 25 Plan – An Economic Acceleration Plan for America

$90,000 per U.S. citizen – Leviticus 25 Plan 2026 (25669 downloads )